The Fear of Missing Out (FOMO) in trading or investing refers to the process of buying an asset like a stock simply because everyone is doing the same. It can also involve shorting an asset because people are shorting it.

FOMO has become a very popular trading strategy in the market today. While it can make you good money, FOMO is also a high-risk trading strategy.

In this article, we will look at what it is, what are the triggers, how it works and how to avoid it.

Table of Contents

What is FOMO in trading?

A good way of explaining the concept of fear of missing out is through an example.

In early 2021, we saw many cryptocurrencies extend the gains that existed in 2020. A closer look at the industry shows that some cryptocurrencies are solid platforms that solve some key challenges. However, many cryptocurrencies are products that don’t solve any challenge.

Yet, we saw many cryptocurrencies like Shiba Inu and Dogecoin become multibillion-dollar products. The two meme coins don’t solve a major challenge. Their popularity happened because of the concept of FOMO.

Related » How to day trade meme stocks

The situation exists in other industries as well.

For example, we also saw the price of lumber surge in 2021. This surge was because of the rising demand at a time when there were supply chain disruptions. However, as its price rose, most investors just bought the commodity for the fear of missing out.

FOMO is a concept that is deeply rooted in how humans are wired.

For example, most people are disappointed simply because they did not buy Bitcoin when it was trading at less than $1. In the past decade, the price has risen from less than zero to more than $60,000. Also, many people have been disappointed because they did not invest in Tesla.

Therefore, to avoid future regrets, many traders tend to buy things that are rising in value simply because they don’t want to be left out. This explains why the price of Shiba Inu rose sharply when it was launched.

FOMO vs disciplined trader

There are several differences between a trader with FOMO and those who are disciplined. They include:

- A disciplined trader does some research before entering a trade. A FOMO trader will typically buy something without doing any research. They will buy simply because the asset is rising.

- Disciplined traders usually have more peace of mind since they have an idea of how the trade will work out. FOMO traders are more anxious about all trades that they implement.

- Disciplined traders set realistic expectations while FOMO traders believe that the asset’s price will just keep rising.

There are other differences between FOMO and traders who have a trading plan. For example, they will typically use a trading journal and use stop like a stop-loss and a take profit.

FOMO and trading psychology

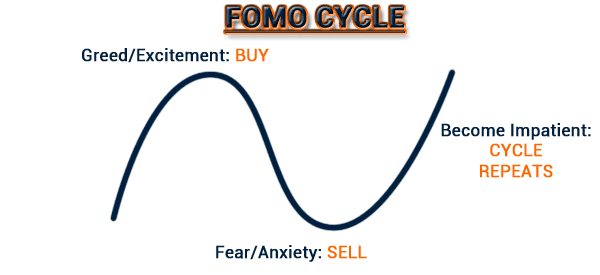

FOMO is a concept that is associated with trading psychology. Indeed, a close look at why FOMO happens shows that there are several emotional situations. These include:

- Fear – As the name states, fear manifests simply because participants are usually afraid of future regrets.

- Greed – There is usually greed in FOMO simply because the trader is buying without doing any research.

- Anxiety – There is anxiety in FOMO because buyers are anxious about being left behind by the rally.

- Jealousy – In many periods, FOMO traders tends to be jealous about the performance of their friends or other investors.

- Impatience – In many times, FOMO traders are usually impatient simply because they did not do a lot of research in the market.

The chart below shows the typical cycle that a FOMO trader goes through.

Causes of FOMO in trading

There are several key causes of FOMO in the financial market. They include:

- A long winning streak – At times, an investor will buy a financial asset simply because its price has been in a sustained period of strong gains (basically, following the trend). For example, many investors bought Tesla shares as its market capitalization soared to $1 trillion.

- Industry – At times, FOMO happens because of an industry. For example, many investors bought shares of EV companies like Lucid and Rivian because they believed that the firms could be like Tesla.

- News and analysts – FOMO can happen when there is major news about a company. For example, when a company receives a positive upgrade, traders can move ahead and buy the stock.

- Social media – At times, with many traders using social media to trade, these platforms could lead to buying. A good example of this happened in the so-called Wall Street Bets.

How to avoid FOMO in trading

There are several ways of avoiding the fear of missing out in the market. Let’s go over the easiest ones to implement, which are also the most effective.

Trading plan

A trading plan is a strategy that you have that will help you become a better trader. It is developed early in your trading journey and backtested to ensure that it works. With a good plan, it will be a relatively difficult thing for you to buy an asset that you have not researched well.

This can work very well with the Trading Journal. Start with a plan in mind, make a check (which happens to be the next point) and then note the actual entry/exit of the trade.

Trading checklist

A trading checklist refers to things that must be met for you to open a trade. For example, a checklist can have several things like moving averages, VWAP, and chart patterns like triangles and head and shoulders.

This point is important because between the planning phase, maybe made the night before, and the actual implementation, there is a time lag that could lead to substantial changes. Rechecking everything before opening your trade will avoid bad mistakes and unforeseen losses.

A trading journal

A trading journal is an important document that you can use to avoid FOMO in the market because it makes you become a more disciplined trader. For example, with a journal, you will only open trades when your criteria are met, thus avoiding blind trading.

Also, by recording in detail the reasons for entering a trade and the strategy adopted, we can identify any patterns in our mistakes to avoid making them again.

Trading routine

A trading routine refers to the process that you have developed to trade. For example, you can have a routine of waking up, doing fundamental analysis, and technical analysis before you open the trade. When you have such a strategy or routine, you will be at a good position to avoid FOMO.

Also the three processes described before, plan-checklist-journal can be an example of a routine, or better of a part of it.

Stops

As mentioned above, FOMO is not necessarily a bad thing. In fact, many traders have made a lot of money by just following the trend. What we recommend is that you should implement stops in the market.

A stop-loss will automatically stop a trade when it drops to a certain level. A take-profit, on the other hand, will stop a trade when it reaches a certain profit level.

Summary – FOMO trader or not?

FOMO is a trading approach that has made people a lot of money. At the same time, it has led to substantial losses to most people. This, as we have said many times, is due to the fact that opening a trade/going short is almost always done without first analyzing the asset.

In this article, we have looked at what FOMO is and some of its differences with trading with a trading plan. However, being related to psychology, it is not always easy to avoid getting carried away (if our trading style is based on analysis, of course).

That’s why we have also dealt with FOMO triggers and how to effectively avoid it. Or, at least, limit its effects.

External Useful Resources

- How to Deal with FOMO to Become a Better Trader – DailyFx