There are many reasons why asset prices move. A stock price can move up when insiders in the company buy the stocks in the company or when the company announces better-than-expected financial results.

A currency pair could move up when the economic data from a country is better than traders are expecting while the price of a commodity could move up when the demand slows.

In all this, the need for news is very important. This is because investors who are the first to receive the news usually do well than those who receive it late. In the financial market, whether you make or lose money can depend on less than a second.

This is the main reason why most institutional investors are happy to pay $20,000 for the Bloomberg Terminal! Obviously not everyone can afford these fees, and that’s why the popularity of some free (or freeminum) platforms has grown over time.

Warning! You don’t have to use all of these sources of information together; 3/4 is enough. Keeping too much data, especially if different, can be a bottleneck in your analysis.

Table of Contents

How to choose the best free news source

There are a couple of things you need to focus on when selecting the best free news source when day trading. First, think about your trading style and the assets that you trade. In some cases, you might want to find websites that track your specific asset like crypto or commodity.

Second, know more about your trading style. If you are a scalper, you will often want a news source that is fast such as StockTwits or a squawk service. On the other hand, if you are an investor, you need a website that is more detailed.

Free vs paid news sources

A common question is whether free news sources are usually better for day traders. Unfortunately, the best news sources in finance like Bloomberg, Financial Times, and Wall Street Journal have all gone behind the paywall.

Still, there are many free websites that provide breaking news and additional tools for free. For example, a website like Investing.com has most things that you need to trade several asets like stocks.

Further, many trading apps like Webull provide up-to-date news streams that you can use to trade and invest. Most importantly, there are social media platforms like Twitter and Stocktwits that have extensive free information.

Top free financial news sources

Bloomberg

Bloomberg is the biggest business news source in the world. The company employs more than 3000 financial journalists from around the world. These journalists are there to break stories and share their perspectives on trade.

They report their content in the Bloomberg Terminal and on the Bloomberg television. While the terminal is unaffordable to many people, their websites, apps, and television is a good way to find news and opinions about the market.

Bloomberg introduced a paywall a few years ago that charges $34 per month. And unlike other websites with paywalls, this one is extremely difficult to crack.

Reuters

Reuters is the second biggest financial services provider in the world after Bloomberg. Reuters has a market cap of more than $30 billion. The company applies the same model like Bloomberg, with most of its revenues coming from the premium subscribers of Reuters Eikon.

The company has mobile apps and websites that are among the first to break news. Like Bloomberg, Reuters also introduced a paywall that goes for $35 per month.

CNBC

CNBC is a leading financial services company owned by Comcast. The company’s TV network is among the first to report breaking news on Wall Street companies. It is also one of the most-watched financial services television network (and provide some excellent podcast).

As a trader, you should have either CNBC or Bloomberg running.

These days, Twitter is the fastest news network in the world. People go there to share news and information on various topics. Journalists post the news there before they post in their networks.

Twitter is also an ideal place to find ‘hidden news stories.’ These are stories that are hard to discover, especially those from very local news sources.

For example, a major news story from a small country might not make it in big platforms like Bloomberg.

You can go to Twitter to find breaking news, identify trending assets, and even contribute to debate about various financial assets.

› Traders and Trading Accounts to Follow on Twitter

Like Twitter, Reddit is an important place to find hidden news stories. While it is known for its focus on weird stories, many investors use it to find quality news stories from a wide variety of news sources.

› How to Exploit Reddit in Day Trading

Stocktwits

Stocktwits is a financial service of Twitter. In it, investors from around the world share the content about finance and their projections. This is a good website to find a wide variety of crowdsourced materials.

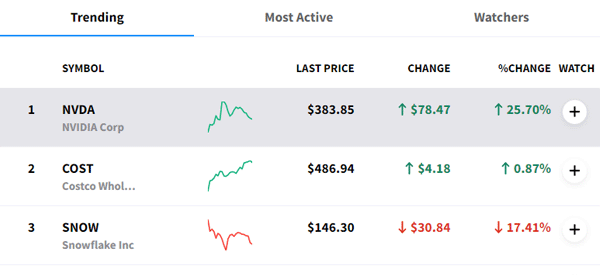

Stocktwits has several features. For example, you can find trending assets, market movers, and watchers. After identifying a stock, you can contribute to the conversation or find the reason why it is either falling or rising.

The chart below shows some of the top trending stocks at the time of writing this.

Watchlists

A watchlist is another viable source of financial news. A watchlist is a set of assets that a trader monitors for feasible trading opportunities.

A typical financial market has numerous entities. As a trader, not all the incoming news are in line with your area of interest. Besides, it is not possible to follow all the assets. To ensure that you don’t miss out on events that are influential to a particular security, it is important to create a watchlist.

You can choose to create a watchlist based on the companies’ size, industry, or type of financial instrument. Most brokers enable their clients to develop this trading tool. Besides, sites such as Webull and MarketWatch allow one to formulate an effective watchlist.

Subsequently, you will stay abreast with news that are bound to affect the direction of the asset’s prices.

YouTube videos

In the current digital world, YouTube has become a popular and credible news platform. As a trader, you will benefit from the up-to-date information presented by various professionals.

What’s more, the presenters often include fundamental analysis in the conversation. Some of the reliable YouTube channels to consider include Bloomberg Markets and Finance and CNBC Television’s Mad Money.

Besides, there are some live YouTube channels that avail the latest news to traders. The TraderTv live is one such platform.

Podcasts

Just like on YouTube, there are numerous professionals who avail recent news to traders. Some of the podcasts to consider include InvestTalk, Motley Fool, and Wake Up to Money. One of the benefits of using podcasts as a source of financial news is the inclusion of detailed analysis of the events.

Telegram

Telegram is becoming a popular source of news for traders. Bloomberg News is one of the entities that is effectively using this means of communication. When you subscribe to such a platform, you will be receiving one or several messages on a daily basis.

The crafted newsletter contains relevant stories as well as links to other news.