Supply and demand is the most important concept in the financial market. In basic economics, it is well-known that supply and demand are what affect the prices of items. Ideally, when there is strong demand, the prices of an item will rise and when the demand fades, the price will retreat.

In financial markets the concept works the same way, going to influence the price of any asset. Each of these, however, has specific movers that you must necessarily know before you start trading. Let’s dive into them, together with other key steps.

Table of Contents

What is supply and demand?

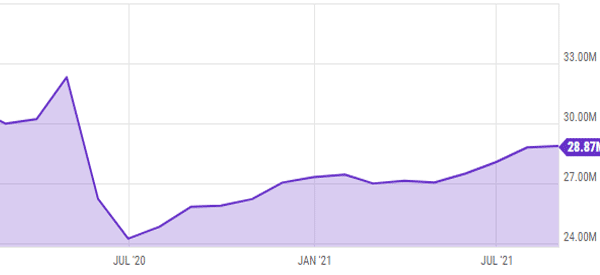

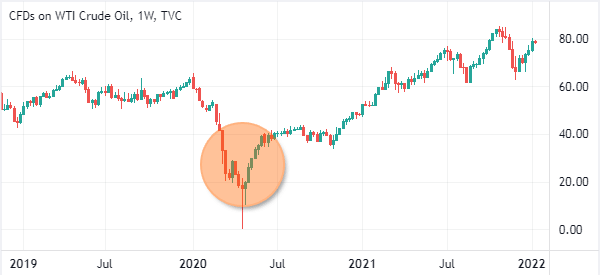

In economics, supply is defined a period when suppliers of an item decide to increase its quantity in the market. A good example of this is in the oil market. During the Covid-19 pandemic, OPEC and its allies decided to slash production, which helped to lift oil prices. In most cases, when supplies rise, the price of an item declines.

Demand, on the other hand, is a situation where people are ready and willing to buy a certain product. For example, in the early days of the pandemic, governments announced lockdowns in most countries. As a result, demand for oil declined, which pushed prices lower.

At some point, the price of crude oil moved to the negative zone.

Supply and demand affect all assets, including stocks, commodities, currencies, and even cryptocurrencies. For example, one reason why the Bitcoin price has done well over the years is that its supply is capped at 21 million coins.

Another example is the fact that the US dollar declined during the pandemic because the Federal Reserve printed about $120 billion every month through its quantitative easing (QE) policies.

» Related: How to do a supply chain analysis

How supply and demand affects assets

In theory, there are two main laws of demand and supply. First, the theory states that a higher price will attract low demand since few people will afford the item. Second, the higher the price, the higher the supply since sellers will want to take advantage of these prices.

In most cases, the latter point happens in the commodities market, which is widely known for its cyclical nature. When the price of a commodity rises, producers boost production in a bid to take advantage of the high prices. Again, when they boost production, they increase supplies, which leads to lower prices.

In stock market

In the stock market, the concept of supply and demand is important. There are two main ways how this becomes clear. First, when a company sells stock, it leads to more shares in the market, which then drags the price of the stock. Besides, when there are more outstanding shares, the earnings per share will tend to decline.

First, a company can decide to lower the amount of outstanding shares in the market through what is known as a buyback or repurchase. When this happens, it leads to a higher earnings-per-share, which in turn leads to a higher share price.

How to identify supply and demand

There are different ways to identify supply and demand in the financial market. From a fundamental side, it is easy to know whether the supply of an asset is rising or not.

For example, in commodities like crude oil, one can predict whether it is rising by using data from the Energy Information Administration (EIA), American Petroleum Institute (API), and OPEC. These organizations usually publish estimates of demand and supply every month.

Similarly, in agricultural commodities like corn and soybeans, you can use a monthly report by the government known as WASDE. WASDE stands for World Agricultural Supply and Demand Estimates. Most traders use this report to predict whether the demand and supply of a commodity will rise.

Another useful tool to use to estimate demand and supply of an asset is to use the Commitment of Traders (COT) report that is published by the Commodity and Futures Trading Commission (CFTC). This report usually shows the positioning of large hedge funds, speculators, and retail traders.

What are supply and demand zones?

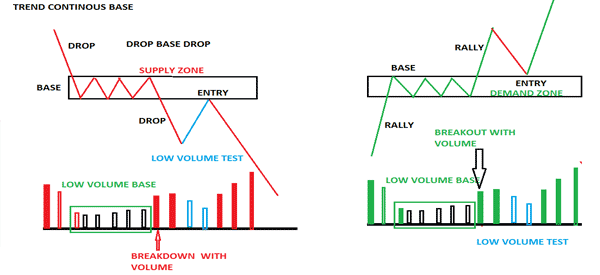

Market participants have identified a number of supply and demand zones. In a supply zone, it means that there is more supply coming in the market while in a demand zone, there are more people buying an item. Therefore, an asset price will typically rise when it moves to a demand zone and vice versa.

There are three main types of these zones. First, there is a trend continuous base, which is categorized into rally-base-rally (RBR) and down-bas-down (DBD).

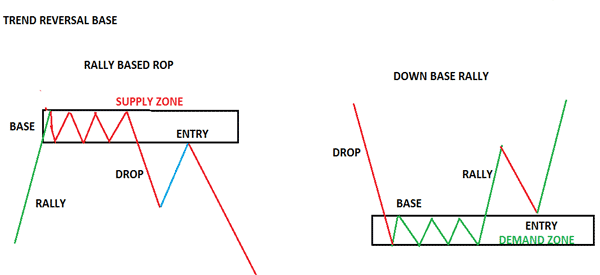

Second, there is a trend reversal base, which is categorized into rally-base-drop (RBD) and down-base-rally (DBR). Finally, there is a flip zone.

In a trend continuous base, the asset’s price will typically pause and then resume the original trend. If it was in a bullish trend, the asset will keep rising. Similarly, if it was in a bearish trend, the price will continue falling. The chart below shows how these patterns look like.

In a reversal base situation, the price will typically start a new bearish or bullish trend that is opposite of the original one. The chart below shows how this pattern looks like.

How to use these patterns

In theory, these patterns are relatively easy to identify and discuss. The challenge comes in applying them in the financial market. There are several concepts that can help you trade these patterns.

First, we recommend that you identify areas of break and retest. This is where a price moves above or below a key support and resistance level and then retests it. When it happens, there is a likelihood that it will move in the initial direction.

Second, you should avoid making guesswork by opening a market order. Instead, you should open a pending order, where you set a buy stop or a sell-stop depending on the chart pattern. These trades are usually safer than market orders.

Finally, you could use bracket orders. This is where you combine pending orders and then add stop loss and take-profits on the chart.

Final thoughts

In this article, we have looked at the concept of supply and demand and identified how it works. We have also looked at some of the most important concepts that you should use when trading the supply and demand zones.

External useful resources

- Demand and Supply Analysis of International Trade – Lumen Learning