Simply put, a stock catalyst is any information that triggers the dramatic movement of a company’s shares. At times, the catalyst may be news that directly affect the firm.

For instance, a company’s earnings release is likely to result in the downward or upward movement of its share price.

At the same time, information from the external environment can cause the price of a stock to shift significantly. The enactment of a legislation is one such aspect.

In this article, the focus will be on examples of stock catalysts and how to identify such elements.

Table of Contents

What to look for in a stock catalyst?

The key to successful trading is having an efficient trading strategy. Stock catalysts are all influential but not equal. Besides, it is crucial to identify the catalysts that will work well with your trading strategy.

To do so, ensure that you look for two important aspects in a stock catalyst: volume and volatility.

Stock Catalyst: Volume

Volume is the number of shares purchased or sold within a specific time frame. As a trader, you don’t want to buy a share that no one is interested in purchasing it back from you.

When looking at a stock catalyst, ensure that it has the momentum to create a trend. A significant increase in volume may be proof that the catalyst will form a trend that can be in your favor.

It is important to note that a notable movement in the price of a share does not necessarily mean that there is ample volume. You may end up purchasing a stock that does not have a lot of traders who are interested in it; an aspect that will result in a hefty loss.

As such, do not consider a stock catalyst if it does not yield a significant volume.

Stock Catalyst: Volatility

Volatility is yet another aspect that you should look for in a stock catalyst. It measures how fast the stock’s price shifts within a specific period of time. A drastic price swing, resulting from a major stock catalyst, usually equates to heightened volatility.

Such a situation creates a good opportunity for a keen trader. However, if the intensity of the price movement is not sufficient based on your trading strategy, evaluate the feasibility of entering the trade.

Hard vs. soft catalyst

Broadly, there are two main types of catalysts in the stock market: hard and soft. A hard catalyst is one that effects a company directly. This can be a company’s earnings, management change, new Federal investigation, and a merger or acquisition.

The chart below shows that IBM shares popped after the company published strong earnings.

A soft catalyst, on the other hand, is one that is not directly associated with a company but one that causes it to move. A good example of this is what happened during the 911 terrorist attack. Shares dropped sharply after the attack even though most companies were not affected directly.

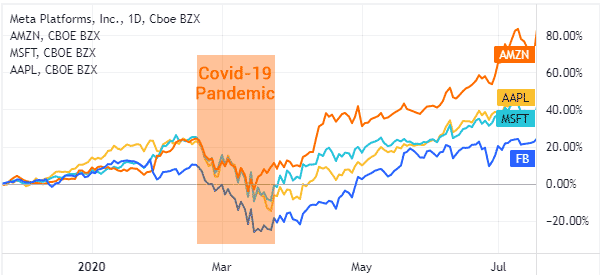

Another good example was the Covid-19 pandemic, which caused many stocks to decline even though they were not affected directly.

Examples of stock catalysts

Let’s take a look at real examples of stock catalysts and how they have affected the price of different shares.

Government regulations

One of the measures that governments across the globe enacted to curb the coronavirus pandemic was the ‘stay at home’ directive. This was a good soft catalyst for a stock like Zoom Video Communications Inc, whose stock price has increased by 569% this year.

Earnings report

The movement of Deere’s stock price is an example of how an earnings report (Q3’20 earnings on August) can be a notable hard catalyst. Its earnings per share (EPS) was $2.57 compared to the estimated $1.30. subsequently, its share price has increased by about 16.2%.

Moves by investors

A trader would want to follow big money. This is based on the notion that market moves by an influential trader results from comprehensive and smart analyses.

For instance, if Warren Buffet purchases the shares of a particular company, there is a likelihood that its price will increase as more people seek to purchase the firm’s shares.

As a trader, you should be careful with this hard stock catalyst. You can’t tell when the investor will sell his shares; a scenario that could cause you to incur huge losses.

Other examples of stock catalysts include M&A, analysts call, and natural disasters like hurricanes.

How to spot a stock catalyst

There are various ways that you can identify a stock catalyst.

Watchlist

A stock watchlist is a set of securities that a trader monitors to identify feasible trading opportunities. By analyzing the price movements of the shares you are interested in, one is able to spot a prospect to engage in a profitable trade. Most trading platforms enable a trader to create a stock watchlist.

Our TraderTV partners also produce a very useful watchlist twice a day.

Social media

Twitter has become an important social media platform to traders. Companies, government officials, and fellow traders tend to use Twitter to post information that can directly or indirectly affect a particular stock.

As such, it is a good way to identify a catalyst.

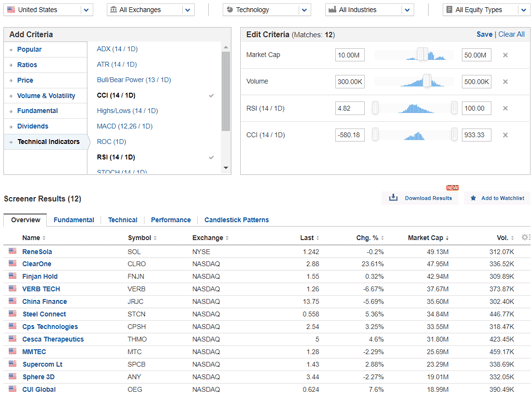

Stock screener

This is a trading tool that allows traders to conduct their analysis and filter shares based on crucial parameters like a company’s market capitalization, dividend yield, share price, volume, and volatility. Some stock screeners are free.

A catalyst calendar

A catalyst calendar is a tool that provides a schedule for upcoming events. It is usually a combination of popular calendars that move assets. Some of the top calendars that are in the catalyst calendar are:

- Earnings calendar – This one shows the companies that are about to publish their quarterly, half-year, or annual results.

- Economic calendar – It shows a list of economic events from the US and around the world. The most important events are interest rate decisions, jobs, and inflation.

- Dividend calendar – This calendar provides a schedule of companies that are about to pay their dividends.

- News – It also includes news that will have an impact on one or more stocks.

The chart below shows what a catalyst calendar looks like.

Importance of understanding stock catalysts

- You are able to spot a trend at its initial stage: one of the benefits of identifying a stock catalyst is that you are able to recognize a price movement early enough to benefit from the price action.

- Helps in establishing a trading strategy: You should never decide on whether to enter or exit a trade solely on the basis of a stock catalyst. However, combining it with technical analysis and the details on a company’s chart will help you decide on when and how to trade.

- Creates a feasible trading opportunity: depending on the aforementioned factors of volatility and volume, a stock catalyst can create a good opportunity for you to get into a trade profitably.

Final Thoughts

It is not advisable to make a trading decision based solely on a stock catalyst. However, it helps in identifying a feasible opportunity to get into a trade. Ensure that you consider the stock price’s volatility and volume before choosing to follow the catalyst.

External useful Resources

- How to Spot Stock Catalysts – TymothySykes

- Catalyst Calendar – Catacal.com