The Stochastic Relative Strength Index (RSI), commonly known as StochRSI, is a technical indicator that was developed by Tushar Chande and Stanley Kroll. It is a relatively popular indicator that combines the concepts of the Stochastic Oscillator and the RSI.

In this article, we will look at what the Stochastic RSI is and how to use it in the market.

Table of Contents

What is the Stochastic RSI?

The Stochastic RSI is a technical indicator that traders use to find overbought and oversold levels. It achieves this by measuring the level of the RSI relative to its high-low range in a certain period of time. The indicator applies the Stochastic formula rather than price values. As such, it is one of the few indicators of an indicator instead of a price.

The Stochastic RSI ranges between zero and 100. Therefore, in this case, the overbought zone is usually at 80 while the oversold level is at 20. In contrast, the overbought and oversold levels of the ordinary Stochastic oscillator are at 70 and 30.

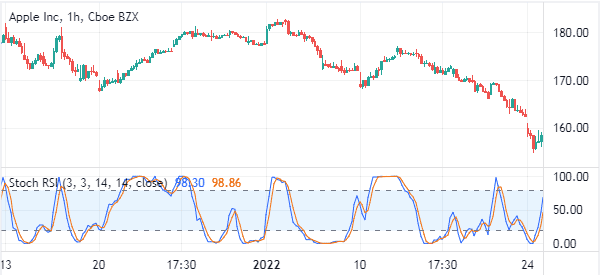

The chart below shows the Stochastic RSI applied on the Apple stock.

How Stochastic RSI is calculated

The calculation of the Stochastic RSI is relatively long and could be a bit complicated especially for new traders.

However, like most technical indicators, there is usually no need for traders to know how to calculate an indicator simply because they are usually provided for free by most charting platforms like MetaTrader, NinjaTrader, Thinkorswim, or PPRo8.

The formula of the Stochastic RSI is shown below.

| StochasticRSI = (RSI – lowest low RSI0 / (Highest High RSI – Lowest Low RSI) |

For example, a 21-day StochasticRSI is equal to zero when the RSI is at its lowest level for 14 days. Similarly, the 21-day StochasticRSI is equal to 1 when the RSI is at its highest point in 21 days. Further, the 21-day StochasticRSI is equal to 0.5 when the RSI is in the middle of the 21-day high-low range.

Stochastic RSI settings

Like all indicators, it is always important to tweak the settings to meet your trading goal. For the StochasticRSI, you only need to change a few points.

First, you can change the color of K and D. in the chart shown above K is shown in blue while D is shown in D. Therefore, you can change the colors to match your trading preference.

Second, you can change the levels of the upper and lower band. While the default levels are at 80 and 20, you can tweak them to meet your criteria. For example, you can set the overbought level to be at 70 and the oversold level to be at 30.

Third, you can change the length of K and D. the default values of the two are at 3 and 3. Fourth, you could change the length of the Relative Strength Index (RSI). The default value of this is at 14 but you can change it to something like 14.

Finally, you can change the RSI source. This means that you can select the data that the RSI will use. In most cases, traders use closing prices.

What are K and D in this tool?

A common question is what the %K and %D are in the Stochastic oscillator. %K it’s used to define a price range compares the lowest low and the highest high of a given period, and it is calculated as follows:

ƒ %k = (current close – lowest low) / (highest high – lowest low) x 100

On the other hand, %D, the moving average of %K, is calculated as follows;

ƒ %D = 3-day SMA of %K.

How to use Stochastic RSI in day trading

There are several strategies that traders use when using the Stochastic RSI indicator. First, the most common one is to find out whether an asset is in the overbought or oversold zone.

The idea is to short an asset when the Stochastic RSI moves above the overbought level and buy it when it moves to the oversold level.

However, in our experience, We have found this approach to be a bit difficult. For example, as shown below the Apple stock price continued rising even when the indicator moved to the overbought level.

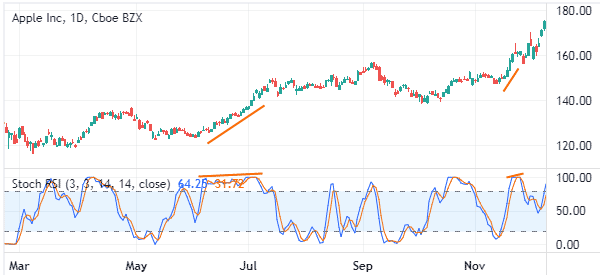

The second strategy is to use the Stochastic RSI to find divergences. A divergent situation happens when the price of an asset rises while the oscillator is in a bearish trend.

For example, when the asset is rising and the Stochastic oscillator is falling, it could be a sign that the bullish trend is waning.

The final strategy is that of using the oscillator to confirm what other trend indicators are showing. In most cases, people use the indicator in combination with the likes of trend indicators like moving average and Bollinger Bands.

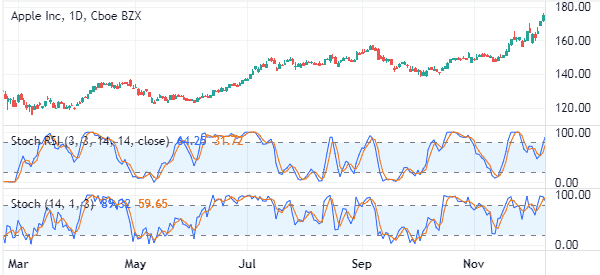

Stochastic vs Stochastic RSI

The Stochastic and Stochastic RSI are two different indicators but they have a closer resemblance. Besides, the latter is derived from the former indicator. The chart below shows the two indicators applied in the Apple chart.

While different, the two indicators are used in a similar way. However, in our experience, We have found that the Stochastic oscillator is better. You can use it well in trend following and to find overbought and oversold levels as shown above.

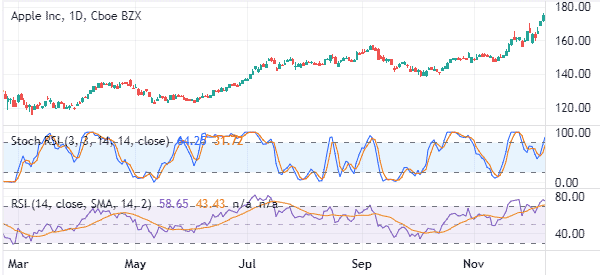

Stochastic RSI vs RSI

The two indicators don’t look alike. Besides, the RSI has only one line. They are also different because at its core, the Stochastic RSI is a stochastic oscillator. The RSI, on the other hand, is an indicator that measures the strength of an asset’s movement.

In our experience, We have found that the RSI is a better one to use than the Stochastic oscillator. The chart below shows the RSI in the same chart with the RSI.

Summary

In this article, we have looked at how the Stochastic RSI works and identified how to combine it with other indicators.

This tool is not a popular indicator in the market (at least not as much as the two that compose it, the stochastic oscillator and the RSI), but it’s quite useful to find overbought and oversold levels.

It’s worth giving it a chance, at least when you develop a new strategy in the demo mode.

External useful resources

- 5 Key Differences between the Stochastic RSI and Stochastic – TradingSim