Market noise is an important concept that you need to understand as a trader. It refers to key events in the market that often distorts the accurate picture of an asset.

For example, a stock that goes parabolic without any underlying reason can be said to be a victim of market noise. And trading a stock without knowing why it moves is not a wise idea.

In this article, we will look at some of the top strategies to remove market noise when trading and make your analysis even more effective.

Table of Contents

What is market noise?

Market noise is a situation in the financial market that is often characterized by high volatility. It can happen across all financial assets like stocks, cryptocurrencies, forex, and indices. In most cases, the situation usually makes it extremely difficult to analyze a financial asset and find entry and exit positions.

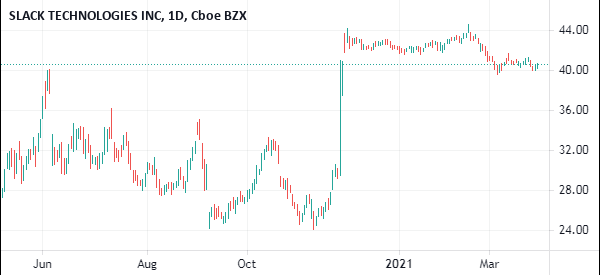

A good example of market noise is shown in the chart below. In the first chart, we see that Docusign stock price has several gaps that make it difficult to know when to enter and exit a trade.

In the second chart below, we see that the noise has been removed by using a different type of chart. With this new chart, it is easy to identify where you can buy and short the stock. You also get a good understanding of what is going on in the market.

How to spot market noise

A common challenge among many traders is how to spot market noise. Still, there are several simple ways to identify this noise in the market.

Premarket movers

First, you can spot market size by looking at premarket top movers. This is a list of companies whose shares are making substantial moves before the market opens. Some websites like Investing.com, WeBull, and MarketChameleon have free tools that show you top movers.

After identifying top movers, you can then try to understand the reasons why they are moving. A simple Google search of the stock name could give you answers to this. Alternatively, you can use a market watchlist to get this information.

In most cases, stocks move sharply before the market opens due to news such as earnings and management changes. As such, you can filter this noise by understanding whether this news will have a major impact in the long term.

Related » How to Get the Most Out of Your Daily Stock Watchlist

Check the overall performance

Second, you can identify market noise by looking at the overall performance of a financial asset. A good way to look at it is to use an indicator like moving averages and see whether an asset is trading substantially higher or below the price.

If a stock is trading at $20 while the 50-day moving average is at $10, it could be a sign of noise.

How to filter noise in the market

Therefore, a common question is how to filter noise from a financial asset. To be fair, at times, it is relatively difficult to differentiate real market action and noise.

Still, there are several strategies you can use to reduce noise in the market.

Multi-timeframe analysis

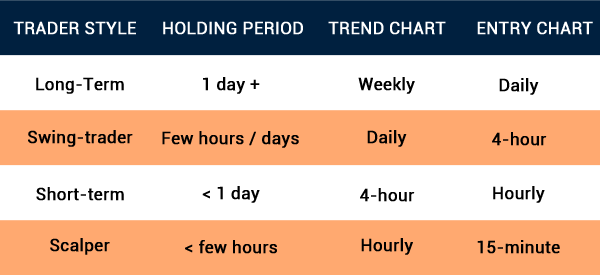

One of the easiest ways to filter noise in the market is to use a multi-timeframe analysis. This is a trading strategy that involves looking at multiple charts before making a decision.

For example, if you are a 1-minute chart trader, you can start your analysis by looking at a 15-minute chart followed by a five-minute chart.

Similarly, if you focus on a 30-minute chart, you can start your analysis on a four-hour chart followed by a hourly chart.

Related » The Rule of Three in Multi-Timeframe Analysis

The benefit of doing this is that you will have a good understanding of the underlying trend before making a trade entry.

Use different charts

In most cases, traders and investors focus on candlestick charts. It is the best chart used for analysis because it has the key points that are useful in analysis. These are Open, High, Low, and Close.

However, at times, candlesticks can have some noise.

Therefore, there are other types of charts that can help you to remove this noise. Some of the popular charts that can help you with that are line, renko, kagi, and heikin ashi.

Chart patterns like renko and kagi are not commonly used although they have features to reduce this noise since they focus on an asset’s price and not time.

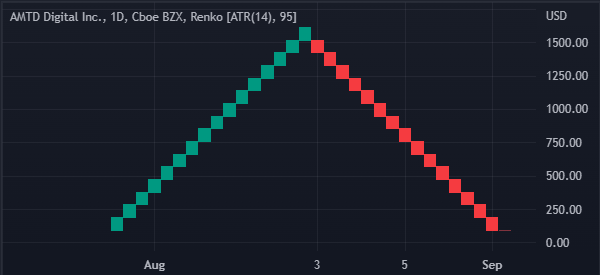

A good example of this is shown in the two charts below. The first chart shows that AMTD shares have had some noise in the past few weeks.

Now, if we change the chart from a candlestick to another one like Renko, we see that the overall trend is well-defined.

Focus on trends

Another approach to remove market noise is to focus on trends in the market. This is a trend that is known as trend-following, where you focus on existing trend and follow it until signs of a reversal emerges.

For example, if the stock is generally rising, you can filter the noise and continue buying and holding the asset.

Related » Anchored VWAP remove previous market noise!

Strategies to trade in a noisey environment

So, which are some of the top strategies to trade in a period of significant market noise? First, as shown above, you can use a trend-following approach to trade when there is significant market noise. This is where you use other popular chart patterns like Kagi and heikin ashi to identify the exact trend and then follow it.

Second, you can use chart patterns like triangles, head and shoulders, and wedges to execute trades. In this, you should identify these patterns and then execute trades as necessary.

For example, a head and shoulders pattern is usually followed by a bearish breakout while an ascending triangle pattern is followed by a bullish breakout.

Third, you can scalp in a period of high volatility. This is where you focus on buying and selling financial assets and then exiting after a short period. With scalping, you can make money in all market conditions.

Summary

In this article, we have looked at what market noise is and how you can identify it in the market. This noise can’t ruin your trading account, but it can certainly make your analysis less performant – and therefore less profitable.

Fortunately, as we have seen, there are several methods to remove it. We have also looked at some of the top strategies to use when trading in that market condition.