Technical analysis is the process of using tools that have been developed using mathematical calculations to forecast the direction of an asset. There are hundreds of technical indicators that are found in most trading platforms like the MT4, PPro8, and TradingView.

These indicators are divided into leading and lagging indicators. Lagging indicators are the likes of moving averages and the Parabolic SAR while leading indicators are the likes of the Relative Strength Index (RSI) and MACD.

In this article, we will look at the Relative Vigor Index (RVI), and how you can use it to look for trends in the financial market.

Table of Contents

What is the Relative Vigor Index?

The Relative Vigor Index (RVI) is a technical indicator that is categorized as an oscillator in most trading platforms. The indicator appears as three lines:

- The neutral level (dotted horizontal line)

- Relative Vigor Index (RVI) line

- The signal line.

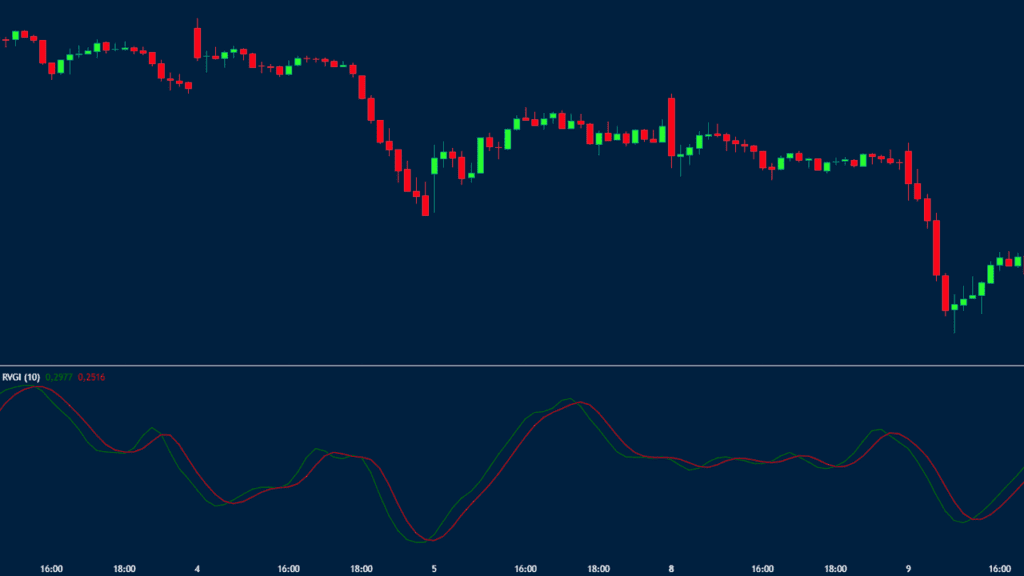

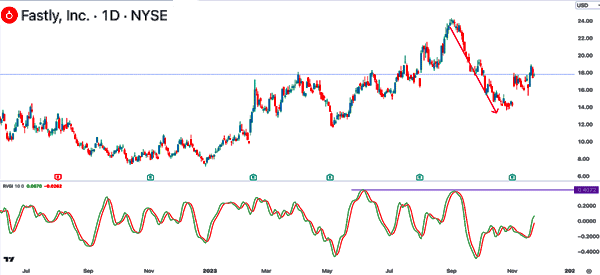

Some popular trading platforms like TradingView show the indicator as two lines. It has a red and green line. The green line is the RVI line while the red line is the signal. Still, you can add the neutral line using the horizontal line. The chart below shows the RVI on the EUR/USD chart.

Traders use the indicator to identify when the price of an asset is oversold or overbought. Overbought levels are used to signal opportunities to short or sell while oversold levels are used to signal opportunities to buy.

As with all indicators with such lines, there are two main sections that traders watch. There is when the two lines cross the neutral line. The other period is when the RVI and signal lines cross one another.

Related » How to master Technical Analysis

What does the Relative Vigor Index tell you?

The Relative Vigor Index, as mentioned, compares an asset’s closing price to a recent price range. If the figure is higher, it means that the trend is significantly strong, meaning that it makes sense to buy the asset. A smaller figure means that the market is calm and moving sideways.

In this case, because of its appearance, the RVI is interpreted in the same way as other oscillators like the MACD, Relative Strength Index (RSI) and the Stochastics are. When it is rising, it is a sign that one should place a buy trade, and hold. Similarly, if it is falling, it is a sign that the momentum is fading.

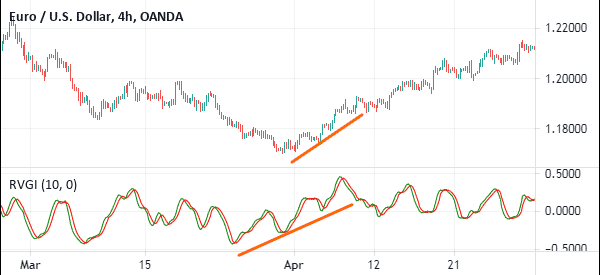

However, in some instances, the indicator can be a sign of divergence. This happens when it is in an uptrend while the price is falling. A good example of this is shown in the chart below.

How to calculate the RVI

The process of calculating the relative vigor index is relatively complex compared to other indicators. This should not scare you because you are not required to do the calculations yourself. Instead, it is recommended that you know the meaning of the indicator and how to use it when trading.

As with most indicators, the RVI was created with the commodities market in mind. Still, it can be used well in the other markets such as forex, stocks, and indices.

The first step for calculating the RVI is to identify the period to examine. The default period in most platforms is usually 10. Still, you can tweak this period to suit your trading strategy.

After this, you need to identify the Open, High, Low, and Close values for the current bar. Then, identify the same levels for the lookback period.

You should then calculate the simple moving averages for the numerator and denominator for the period. Finally, divide the numerator from the denominator. As you may have noted, this is a process similar to how the stochastics oscillator is calculated.

Best setting

There are not many settings for the RVI indicator. All you need to do is to enter the period and change the colors. The default period in most platforms is 10 while the default colors are red and green. You can change the period to suit your trading strategy.

How to Use the Relative Vigor Index (RVI)

Finding the open and closing prices for currencies is usually relatively difficult because the forex market is usually open 24 hours for five days. Getting the data for stocks is easy because there are actual opening and closing prices every day.

By the way, the first step is to look at a chart visually and see how it is trending. You should use the RVI when the market is trending, this will help you get the real signal.

After applying the RVI, you need to look closely at when the two lines intersect. This is where the signal is used.

As shown on the chart above, something happens when the RVI and signal line of the RVI indicator make a crossover. The red arrows show how the pair moves upwards when the two indicators cross over. The blue lines, instead, show how the price moves lower when the two lines make a crossover.

As you can see, not all crossovers lead to reversals. This is why you need to be very careful and use the indicator well and in combination with other indicators.

Using the RVI in trend following

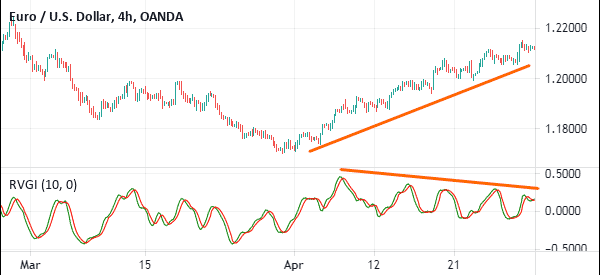

In addition to looking at the crossovers, you can use the Relative Vigor Index (RVI) using the trend following strategy. This is a strategy where you look at an existing trend and follow it.

You can use it this way. When there is a bullish trend, continue holding the asset as long as the two lines are rising and vice versa. On the other hand, if the price is falling, continue shorting the asset as long as the two lines are declining. A good example of this is shown below.

However, the main disadvantage of this strategy is that at times, the price will be rising while the indicator is either falling or moving sideways.

Using RVI to trade divergences

Another relatively simple way of using the RVI indicator is to trade divergences. This refers to a situation where the price of an asset is rising while that of the indicator is falling.

When a divergence appears, it can be a sign that the bullish or bearish trend is about to end. However, the main challenge for this is that divergences take a substantial amount of time to form. As such, it is not ideal for day traders or scalpers. An example of this is shown in the chart below.

Trading the RVI crossover

The Relative Vigor Index (RVI) has a close similarity with the MACD in that it has two lines. In the RVI, the first line, often in green, is known as the RVGI line while the other one is the signal line.

Therefore, one way to find a trading signal is to find the crossover of the two lines. A buy signal happens when the two lines make a crossover at a lower level when pointing upwards.

Similarly, a sell signal emerges when they make a crossover when pointing downwards, as shown below.

RVI double-bottom

The other approach, albeit not popular, is when the indicator forms a double-bottom or a double-top pattern. In technical analysis, these patterns are usually signs of reversals.

To do that, you first need to draw the lines where the double-top or bottom has formed and then predict the next move. A good example of this is shown below.

In it, we see that the RVI indicator has formed a double-top pattern, which was followed by a sharp drop in the stock price.

Overbought and oversold

Further, like other oscillators, it is possible to use it to find overbought and oversold levels. An overbought point is where an asset price gets very extreme in the upside. An oversold level is where it crashes so much.

In most cases, traders buy assets when the price is at an oversold level and short when it is at an overbought point. A good example of this is in the chart below.

Pros and cons of the RVI indicator

There are several benefits and cons of using the Relative Vigor Index (RVI). As shown above, there are several ways of using it to trade. You can use it to trade crossovers, trade double-tops and bottoms, and divergences. The other benefits are that it is easy to use in trending markets.

On the other hand, the indicator does not work well in ranging markets. It also provides false signals regularly,

Final thoughts

The Relative Vigor Index (RVI) is a technical indicator that can be used to trade all types of assets like currencies and commodities. However, the indicator has some limitations such as sending the wrong signals and being relatively difficult to calculate.

Therefore, you should do your best to find out the best period to use, including combining it with other indicators like the RSI and MACD.

External Useful Resources

- Price Relative / Relative Strength – Stock Charts