You get into the trading floor, say 8:30am EST. The buzz and the energy starts to rise as the traders come in to work. You spend an hour relaxing, reading articles, watching the news, looking at stock quotes and stock charts.

You check to if there is anything exciting happening with your handful of “go to” stocks. You look at what stocks are in-play today and see if you might see an opportunity to trade them.

And then bang! The opening bell rings at 9:30am EST and you are off into a world of excitement.

What does all this mean?

Preparation is one of the most important things that any day trader should always do. This involves how you start your trading day and the routine that you have on a daily basis.

Research shows that people who are more prepared and those who have a morning routine are more successful than those who don’t have it. So, in this article, we will look at some of the top things that professional traders do every morning.

Table of Contents

The watchlist

A watchlist is an important tool that most professional traders use every morning before they start executing their trades.

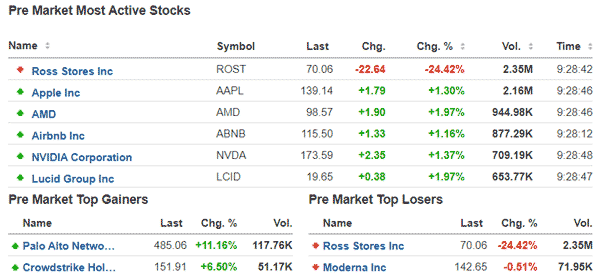

As we have written before, a watchlist is a tool that highlights some of the top movers in the pre-market session of the market. In addition to showing the list of these top movers, the watchlist provides the reasons for these price actions.

The figure below shows the most active stocks in the premarket. It also shows the top pre-market gainers and losers.

While this list is good, it does not provide the reasons why these stocks are performing like that. But it can always show you some of the top names to trade during the day.

In most cases, the top movers and most active stocks will be more profitable when you are trading. Therefore, you should always check out this watchlist before you start your trading day.

Read the news

Most pro traders have a good understanding of the role of news in the market. They know that news can have an impact on all assets like stocks, cryptocurrencies, and commodities.

Therefore, most traders start their trading days by looking at what happened in the overnight sessions. In this case, in the US, they will read news that happened during the European and Asian sessions. In Asia, traders will typically start by looking at what happened during the American session.

Fortunately, there are many sources of these news events. If you are lucky to have sophisticated tools like the Bloomberg Terminal and Refinitiv Eikon, they can be valuable resources. However, these platforms are extremely expensive.

Some of the most important platforms to use to get this information are Wall Street Journal (WSJ), Bloomberg, Investing.com, and Financial Times. Some of these platforms are now using a premium model where you have to pay for them. These costs are usually highly worth it. You can also watch financial television like Bloomberg and CNBC.

Alternatively, you can use these news sources totally free of charge.

Calendars

The next key important thing to watch are calendars. There are several types of these calendars”

- Economic calendar – This is a calendar that shows the economic data from around the world. Examples of these events are jobs numbers, inflation, and interest rates.

- Earnings calendar – An earnings calendar shows the key companies that will publish their quarterly results.

- Dividends calendar – This calendar shows the top companies that will pay out dividends during the day.

- IPO calendar – The calendar shows the number of companies that are set to go public during the day.

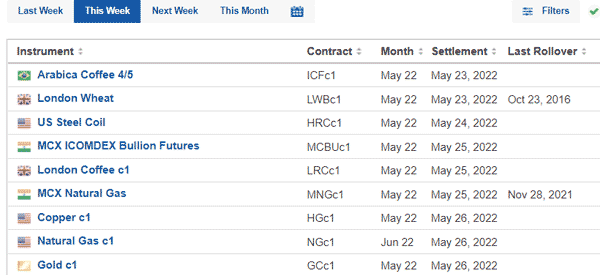

- Expiry – This is a calendar that shows the expiry of options. The chart below shows how this calendar looks like.

Trading journal and plan creation

The next key thing that many pros do in the morning is the creation of their trading journal and plan for the day.

A journal is a piece of paper or soft copy document that lists some of the most important things that you can do in the market. It includes things like the trades you are anticipating, the profit targets for the day, and the reasons why you will execute them. Also, you can review your previous day’s journal.

In line with this, you should work to create your trading plan. This plan can involve several things such as the assets to focus on for the day. For example, you can decide on whether to trade stocks, forex, and cryptocurrencies. You can also decide on the strategy you want to use for the day.

Other parts of trading routines

There are other important parts of a trading routine that professional traders use. First, they focus on their bodies and their health. This involves taking time to do exercise and take a good breakfast. Ideally, the state of your health will play an important role in determining how successful you are.

Second, ensure that your trading office is arranged well and that everything is in order. Again, you will be more successful if your office is in order.

Related » How to Setup Your Day Trading Desk (and Room)

Finally, if you are part of a team, you should hold your meeting with the team. This morning meeting will be useful in comparing notes about the market.

Summary

Professional traders rarely start their trading day by just going to the market. Instead, you should take a systematic approach to ensure that you are well-prepared to ensure that your day is successful.

External useful resources

- What is the day-to-day routine of a professional trader? – Quora