Guide to Analyse and trade Newly Public Companies

The goal of most founders of companies is to one day take their companies public. A good example of this is Amazon, which went public about 20 years ago. Today, it is the third biggest company in the world with a market cap of more than $1 trillion. Jeff Bezos, its founder is now the richest person in the world with a net worth of more than $170 billion.

In this report, we will look at how to trade IPOs in the market.

Table of Contents

What is an IPO?

An Initial Public Offering (IPO) is a process when a company moves from private hands to become public. Most of the biggest companies that are traded today become public through this process.

In short, the IPO happens when holders of a private company sell their shares to outside investors. By selling their shares, the company gets cheap money and uses it to expand its operations.

The process: how companies go public

An IPO is a long process that involves several stakeholders like regulators, auditors, lawyers, and investment bankers among others.

Indeed, many large investment banks like Goldman Sachs and Morgan Stanley make a substantial amount of money in IPOs.

In recent years, the number of IPOs has reduced because of the pandemic. Some of the most popular recent IPO were Roblox, Coinbase and Robinhood.

At the same time, some companies like Nikola and Virgin Galactic have taken the route of Special Purpose Acquisition Vehicles (SPACS) to go public. By so doing, they avoid the long, expensive, and tedious process of an IPO.

Another way is the process where a private company buys another that is already public. This is known as reverse merger.

How to Trade an IPO

There are several things you need to know about how to trade an IPO.

The release

First, you need to know when a particular company is going public. For popular companies like Twitter and Facebook, the financial media tends to report a lot about them.

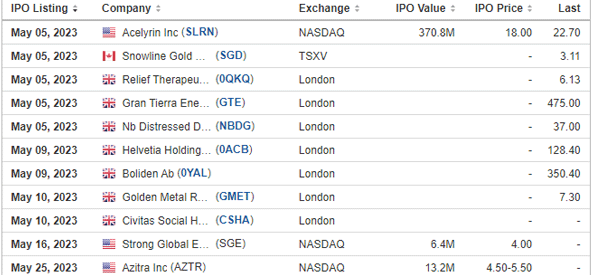

For unpopular stocks, there are several places where you can know when they are offering their IPOs. We sometimes use a popular platform called Webull. Below is a screenshot from its corporate actions page. Other popular platforms you can use to get this data are Investing.com and Nasdaq.

As seen above, the page lists the name of the company, the offering price, the amount of shares being offered, the offer amount, and the date of the listing.

Learn more about the company

Second, if it is a company you have never heard about, you can try to learn more about it. For example, you can Google this information.

Alternatively, for US firms, you can check the firm’s regulatory filings with the SEC. However, as a trader, you should not focus so much on the fundamentals of the company. Leave that to investors.

Check the Stock’s Volume

Third, you need to check out the volume that is being traded and the sector of the company. In recent years, the market has incredibly favoured companies in the financial technology industry.

For example, the valuation of a fintech company like Lemonade has gained by more than 70%. This is unlike other industries like oil and gas.

Volume is an important thing when trading IPOs because it shows you the amount of interest in the company. It is also important because of the little information that is available to you.

Because of the limited amount of data, there is no chart available for technical analysis.

IPO trading strategies

How to trade IPOs on the first day

There are numerous approaches of trading an IPO on the first day. Besides, there is no much available chart to help you with technical analysis. As you will realize, the stock will often have a lot of volatility when it goes public.

Since there are no rules about this, we recommend that you scalp the stock, where you buy and sell within a few minutes. And avoid holding a stock in the overnight market because of the volatility that comes in the second day.

Gray, Primary, and Secondary markets

There are three main methods of trading an IPO. First, you can trade the IPO in the gray market, where you simply predict whether a stock will open higher or lower. This option is not popular.

Second, you can use the primary market. This is a strategy where you are able to subscribe to an IPO before the company goes public. In this, you will be first in line during the IPO day. This approach is mostly common among wealthy investors.

Third, there is the secondary market, which is the most popular approach. It involves buying and selling a stock when the company goes public.

Several questions you should ask yourself before trading IPO stocks

Does the company make money?

If you want to go long such companies, you need to ask yourself this question. This is because if the company will realize its growth, it needs to be making money. If the company is not making money, then you should look at the user growth.

Investors love unprofitable startups that are adding their number of users. However, they love such companies if their customer acquisition costs are not high.

What is the economics of the business?

Ask yourself whether there is any signs of growth in the company and whether the company is paying a lot of money to acquire customers.

The company has any competitive advantage over its competitors?

When Snapchat came to the market, they did not anticipate what Facebook did. Since their product was not patented, Facebook incorporated its product into their products such as Whatsapp and Instagram.

Today, Instagram stories is more popular than Snap. Before Blue Apron became public, Amazon acquired Whole Foods in a bid to disrupt the groceries market.

What is its strategy to make money trading IPO stocks?

You should take time to read the S1 document all companies are required to file before becoming public. The S1 document will show you how the company makes money and its strategy going forward.

By carefully studying the document, and criticisms from critics, you will know whether to buy tor short a company after IPO.

What time do IPOs start trading?

A common question is when a company that is going public starts trading. The answer to this question is that the time is not fixed. If a company is going public today, there is a lot of work that the exchange and underwriters do before it starts trading.

In most cases, a company will tend to start trading during the regular session before the market closes. At times, the IPO can be postponed to the following day depending on a number of factors like technology outages.

Final thoughts

Trading IPOs is an interesting thing because it allows you to trade on the first day that the firm has gone public. However, because of the limited data that is available, you should be relatively cautious.

Indeed, we have seen many people lose money by either shorting or going long companies that have just gone public.

External Useful Resoureces

- How to Buy IPO Stock – TD Ameritrade