Risk management is one of the most important concepts in day trading. It refers to a situation where you attempt to maximize profits while reducing risks.

It is a topic that we have covered before and highlighted some strategies like position sizing, leverage management, and the need to have a stop-loss. Today, we want to talk about one of these strategies, position sizing.

Position sizing is an important concept for both day traders and long-term investors. As the name suggests, it refers to the size of the trades that you initiate and is a vital concept because it can determine your profits and losses and how long you will last as a trader.

Table of Contents

What is position sizing?

Position sizing is a method or technique of determing to how big or small your trades are. It is an important concept because the size of your trades will have an impact on how much money you can make when things go right or how much you can lose when things go south.

Ideally, when you open a large trade, it increases the profit potential that you can make (but also the losses).

For example, assume that two people have a trading account with $10,000 each. Also, assume that a stock is trading at $10 and trader A buys 100 shares at $1,000. The next trader decides to buy 1,000 shares at $10,000.

In this case, if the stock rises to $11, the first trader’s profit will be just $100. That’s a very small sum considering that the next trader’s profit will be $1,000.

However, if the stock whipsaws and drops to $6, the first trader will lose just $400 while the other trader will lose $4,000. Therefore, the second trader can be described as a high-risk and high-reward trader.

While this trader will make more money when his trades go right, he will also expose himself to more risks if the trades don’t work out.

Therefore, traders are always considering measures to find a balance between opening large and small trades.

Position sizing in stocks trading

Position sizing plays an essential role in determining the success of trades in the financial market. There are two main ways of approaching this in stocks. For one, there are stocks that trade for less than $1 and there are others that go for more than $220,000.

Small Trades

Most traders can easily afford to buy a stock that goes for less than $5 but few of them can afford a stock going for more than $200,000.

Therefore, most small traders focus on trading the stocks going for less amount of money. Furthermore, with a $1,000 account, you can buy more shares and benefit if it rises.

Fractional Shares

Recently though, many online brokers have started offering fractional shares to their customers. This is a situation where the company allows you to buy a portion of a stock.

In the example above, if you have $1,000, you can comfortably buy 0.0045 shares of a company.

Position size in forex trading

As mentioned, position sizing is an equally important concept in the forex market because it can make or break a day trader’s career.

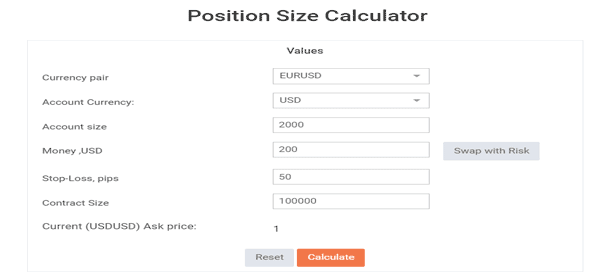

Unlike in stocks, forex position sizing is a bit complicated because of how it works. Forex brokers accept volume in form of lot sizes. Typically, lot sizes start at 0.01 and moves upwards.

For example, if you have a $5,000 account, you should first look at the percentage you want to risk. If you are risking 1%, it means that the maximum loss you want to risk is $50. You should then divide this amount by the stop in order to find the value per pip.

Related » Stop Order VS Stop Limit Order

In this case, divide $50 and 200 pips and receive $0.25 per pip. In the final stage, you should multiply the value per pip a known unit/pip value ratio. If we use 10k unit for a mini lot, the value will be 2,500 units of the currency.

Since this is a relatively long process, many traders use a free pip calculator that is provided by several platforms like Investing and MyFxBook, as shown below.

How to position size well

Traders approach position sizing differently. Still, one of the best approaches to position your size well is on considering the risk and reward ratio. In other words, you need to estimate the amount of risk you are prepared to take for a specific return.

Risk reward + stop loss

There are a number of approaches to this. For example, you can simply come up with a rule that states that you will not expose your account to a specific amount of risk. In most cases, many beginner traders use a risk-reward ratio of about 2%.

For istance, if you have a $10,000 account, it means that you will set a stop-loss where the maximum amount of loss that you can make is $200. For starters, a stop-loss is a tool that stops a trade automatically when it reaches a certain loss level.

Therefore, in this case, if you open a trade, you will need to ensure that the maximum loss you can make is about $200.

Your performance

Still, there is a better way to calculate the risk-reward ratio. Most advanced traders use their trading journals to identify their win and loss ratio in a given period.

For example, assume that you open 30 trades in a month. Of these trades, 25 of them are winning trades. This means that you win about 83% of the time.

You can then compile this data for a few months and see whether the answer is the same or nearly the same. Therefore, if the answer is say, 83%, you can easily use it as part of your risk and reward ratio. You don’t need to suceed 100%.

Tip for beginners

Many beginners start with a small risk-to-reward ratio and then increase it as they gain more experience in the market.

In other words, any time you open a trade, ask yourself what the maximum loss is that you are comfortable making and then place a stop-loss there.

Other risk management strategies

There are other risk management strategies to consider when trading. First of all, you should consider your leverage. Leverage refers to a loan that your broker extends to you in order to maximize your profits. In most cases, a high leverage will lead to more profits.

But it will also expose you to more losses if your trade goes south. Therefore, we recommend that you start your trading journey with a small amount of leverage and then increase it as you gain more experience.

Second, as mentioned above, you should always protect your trades using a stop-loss or a take-profit. These two tools will stop your trades automatically when they test key levels. You should always add these tools in all trades that you enter.

Third, you should always ensure that you exit all your active trades before the end of the day if you are a day trader. This is important because of the risks associated with gapping when the market opens.

How to decide position sizing

Obviously, this cannot be left to chance or done without first making some considerations. Good feelings are important for every trader, but as always this should not put your trading account at risk.

There are several methods and techniques to calculate your position sizing. This is because there are several factors you need to consider when sizing your trades.

Level of Experience

First, you need to consider your level of experience. Many new traders should start by pricing their trades modestly early in their careers.

This will help ensure that they are able to test their strategies while risking the least amount of their money. As your experience and knowledge of the markets grows, you can increase your exposure.

The size of the account

Second, the size of the account. If you have a $10,000 account, you should open smaller trades than a person with a $1,000,000 account.

The logic behind this is relatively simple. For one, if your trade makes a big loss, it will be easier to pare back the losses when you have a big account than a smaller account.

Trading confidence

Third, the confidence of the trade should also play a role. At times, you are almost sure how a stock will trade.

For example, if a company releases strong earnings and boosts its guidance, you are almost certain that the stock will jump. In such a case, you can open a relatively big trade.

However, such big trades should have a modest tight stop loss to ensure that you can capture the profit easily. The market volatility should help you in position sizing. In periods of high volatility, you should open modestly small trades to take advantage of the period without risking a lot of money.

Risk-reward ratio

Most importantly, you should always consider your risk-reward ratio when setting your position size. For example, if your goal is to risk a maximum of 5% per trade and you have a $20,000 account, you should ensure that your stop loss is at $1,000 for every trade you initiate.

The risk of aggressive position sizes

Many new day traders lose a lot of money because of two main reasons. They start their accounts with a big leverage and then use large position sizes. Their goal is to make a lot of money within a short period.

For sure, if trades go their way, they will make more money than people who have a small leverage and small trade sizes.

However, in the financial market, things don’t always go right. Even the most perfect traders lose money every week. As such, when that happens, there is usually a possibility that the losing trades will be substantial.

Therefore, we recommend that you use a small amount of leverage, especially when you are starting your career journey.

Final thoughts

Position sizing is an important concept in the financial market. While larger trades can help you make more money, smaller trades are usually safer. As a trader, you should always calculate the sizes of your trades well before you open a trade.

We have also looked at other strategies to protect your risks in the market. These include having a stop-loss and a take-profit and always closing your trades before you end your day.

External Useful Resources

- Money Management & Position Sizing: The Key to Profitability – Patternswizard

- Position Sizing Strategy for Long-Term Success – Old School Value