In order to succeed as a day trader, people need to choose a good trading strategy, but this isn’t always enough to make things run smoothly.

Trading can be difficult for people because they allow their emotions to keep them from pulling the trigger on a trade. This may be the reason that you are finding it hard to be the lucky day trader that you wish to be.

One emotion that can keep you from being a successful day trader is fear. If you can complete your trades with good judgment, there is a chance that you will do very well.

In order to help you overcome your fears, we need to know what makes it hard for you to pull the trigger. After you learn what your weaknesses are, you will be able to find the talent within you that can turn you into a great day trader.

There are also a few tips and tools that can help you identify the best times to enter (and exit) the markets safely.

Table of Contents

How to enter a trade

Entering a trade is relatively easy. First, you can always enter two types of trades in the market. You can buy an asset and hope that its price will rise or short it hoping that the price will fall.

Second, after doing your research, you should select the volume of the asset. This simply means the number of the asset that you want to buy or short. Finally, use the buy and sell options provided by the broker to enter the trade.

When to enter a trade?

A common question among day traders is when you should enter a trade, whether you are buying or shorting a stock, currency, commodity, or ETF. You should only enter a trade when you have done the following:

- Researched the asset using price action, technical, and fundamental strategies.

- When the price is right. Avoid buying high and shorting low.

- When you understand the factors that affect the asset’s price.

- When you are psychologically ready.

Let’s go into a deeper analysis of them.

Do your research

First, do your research about an asset. In this case, you should focus on technical and fundamental analysis. Technical analysis is where you look at a chart and find unique patterns. These patterns can either be continuation or reversal.

Some of the most popular chart patterns to consider are triangles, rectangles, head and shoulders, cup and handle, wedges, and bullish and bearish pennants.

Technical analysis also involves using indicators like moving averages, Relative Strength Index (RSI), MACD, and Stochastic Oscillator. Also, it involves other forms of analysis like Elliot Wave and the Wyckoff Method.

Taken together, you can place a trade when the 50-period and 25-period Exponential Moving Averages (EMA) make a crossover. You can also place a bullish trade when the ascending triangle is nearing its confluence level.

Second, fundamental analysis is a process that looks at the news, economic data, earnings, and other details that could influence an asset price.

Some of the top economic data that have an impact on an asset are inflation, non-farm payrolls (NFP), and industrial production. Corporate earnings and other events like mergers and acquisitions (M&A) have an impact on stocks.

Identify support and resistance levels

The other key part is where you should identify support and resistance levels of an asset. A support is a price where an asset struggles to move below while a resistance is where it fails to move above.

In most cases, a move above the resistance is a confirmation of a bullish breakout while a move below the support confirms a bearish breakout.

Fortunately, most charting platforms have tools that help you to draw the support and resistance levels. Some of the other popular tools that will help you on this are the Fibonacci Retracement, Gann Squares and the Andrews Pitchfork.

Have a checklist for confirmation signals

Taken together, you should ensure that you should have a clear checklist that you use to confirm your bullish or bearish signals. A checklist should have a few things that need to happen before you enter a trade.

A good checklist can involve the following:

- Type of asset – For example, in forex, you can focus only on majors like the EUR/USD and GBP/USD. In stocks, companies must have certain qualities in terms of sectors and market cap.

- Technicals – For example, a bullish position should only happen when an asset crosses the VWAP indicator.

- Fundamentals – There must be a fundamental trigger for the stock, crypto, or currency pair.

- Risk management – Have a good strategy of managing your risks when you execute a trade.

- Trading journal – This checklist should match with your trading journal, which is a document that guides your trading.

To succeed in trading, you need to have confirmation signals that must be there when you execute a trade.

Well, now let’s move on to some crucial questions that every trader asks themselves before starting a trade. They may seem like lengthy procedures, but once learned these become automatic and immediate.

What might you worry about before opening a trade?

Do you pause when it is time to pull the trigger?

Before you make a trade, you do a lot of research (as we stated above). You know what your entry positions are and what your stop levels will be. Even so, you can only look at your screen when it’s time to act.

This is a problem because some day trading strategies do not allow you to pause. Those who do can lose their money, but those who don’t hesitate have the potential to profit.

You can fight this type of fear by executing the trade when your entry point hits. If you don’t believe that you can do this, you can place a limit order (like a trailing stop) and then move away from your computer.

Are you afraid that you are making the wrong decision?

The fear of making the wrong decision can keep you from making your trades because you are constantly thinking about winning and losing. Trading requires that you accept the idea that you are participating in an odds game where you need to have the upper hand.

If you are overly concerned about making the wrong decision, you may decide not to trade. But if your analysis was right, and the trades would be profitable, you might start to mull it over and lose focus for the following analysis.

Is an unsuccessful trade from the past holding you back?

Negative trades from the past can create a fear of trading because if you lose money, you will always remember it. These losses can cause you to be afraid to trade days, months and even years into the future.

You can fight negative emotions that are due to bad trades by accepting your losses. Then, you can accept responsibility for these failures. You will understand that each trade is different from the others and that you will never have two trades that will offer you the same experiences.

You aren’t going to be able to change in one day.

As you concentrate on one trade at a time, the trade that didn’t go well will become less important. You will understand that trading is an odds game and that it doesn’t matter if you lost once in the past.

This reality will not prevent you from earning profits in the future.

Related » Start again after a big loss

Do you worry about what is going on in the broader market?

You are keeping your eye on a particular stock. This lets you know that the stock is a great setup. When it comes time to pull the trigger, you decide not to because you are worried that there will be a correction in the broader market.

In this situation, realize that the broader market can experience a correction and move in the opposite direction.

Although it’s a possibility that the markets will correct, you cannot let this stop you from trading. You have to accept the fact that there is a risk to day trading and do it anyway.

Correlation, and inversely related stocks, can be a solution to mitigate this problem.

Do you think that you can’t do it?

It can be hard to admit, but sometimes, you don’t think that you can trade.

Maybe you have lost confidence in your trading strategy. You might have started to believe that you can’t do anything. If you think this way while you are trading, you will fail.

The most important thing you have to learn from this article is that you need to think positively if you wish to be a successful trader.

If you don’t believe that you can win at day trading, a reason that you shouldn’t try will always come to mind.

Is it a good idea to accept every trade?

It depends on how much experience you have, but it’s possible to be in any one of the above-described situations. The remedy for each one of these circumstances is one thing: you have to become used to the idea that you are a day trader.

You must know that when you are trading, you are dealing with odds, and you need to have something that will tip the odds in your favor: your researches and analysis.

After you believe that the odds are with you, you will be able to place trades without worrying about whether they will be winners or losers.

A simple and practical tip to increase your confidence with the markets is to not jump into trading just anything. Of course, when there are profitable opportunities it is normal you want to follow the trend and maximize profits, but sometimes we get out of our competence and this can be risky.

If for example you have never traded currencies, making an entry position in EURUSD just because you spotted a trend may not be a good idea.

In the long run, you will have won more than you have lost, and this will make you a winner!

After you have begun to see the markets as an odds game, the worries that were described above will be distant memories. That’s because you will have learned that the variables are always changing.

You cannot possibly know how each one will influence your trades. This means that worrying and trying to predict the markets’ every move is a waste of your time.

Related » Risk Management Strategies for your trading account

When to exit a trade

In line with the above question, many day traders ask about when the right time is to exit a trade. You should exit a trade when:

- You have reached your profitability target.

- When it hits a stop loss or a take profit level.

- When the reasons why you entered a trade change.

If you are a day trader, you should exit a trade when the market is about to close. That’s because you don’t want to have the risks that happen overnight.

There are other things you need to do when you are exiting a trade in the stocks and forex market. First, you can exit a market when a trend starts to reverse.

For example, if you bought an asset during its uptrend, you can exit when the rally starts to fade. This happens when there is a new report on an asset or when trades start to take profits.

The other time to exit a trade is when you want to cut losses. In this, if your trade is not working, you should start paring back losses and then you can focus on other trades. In most cases, holding these losing trades can lead to substantial losses.

How to manage your holding period

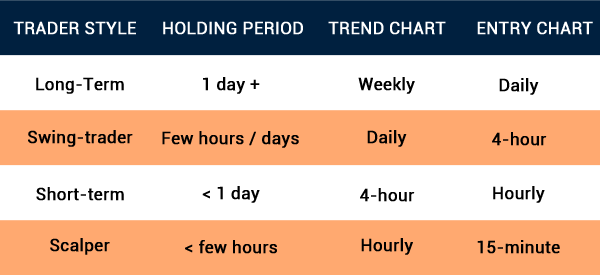

A holding period is a time when your trade is going on. This period will depend on a few things, especially your trading approach. If you are a scalper, the holding period will be less than 5 minutes.

On the other hand, if you are a regular day trader, then your holding period will be a few hours. Similarly, swing traders have a few days of holding pattern while position traders have a period of a few weeks or months.

There are a few things that can be done during the holding pattern. First, don’t constantly look at the charts when the trade is on. Doing so can lead to panics, which can see you close your trades or extend the stop-loss.

Second, you should set up alerts on key levels. Most platforms have an alert feature that sends a ping when an asset reaches a certain price. The alert can help you know whether to start or even stop a trade.

Third, while you should not keep looking at your open trades, you should track your trades regularly. Doing so will help you estimate your profit and loss.

Finally, you should ensure that you have better emotional balance when trading. In most cases, emotions can cause you to make some mistakes when you have a position open.

Tips for entering and exiting positions

These tips will help you when entering and exiting positions in the market. First, be patient and wait for key signals to emerge. At times, it can take a few hours before a clear entry sign comes out.

Second, if an asset is not adding up, move to another one. Besides, there are thousands of assets that you can trade on any given day.

Further, set your strategy based on your trading style and approach. Finally, you should also monitor the market sentiment before you enter a trade.

When it is better to avoid trading

In line with this, there are certain periods when staying away from the market is a better way of doing things compared to being active. Some of these periods are:

- Emotions are not okay – You should stay away from the market when you are not in a good emotional state. Evaluate yourself is critical, always.

- Economic or financial data – Depending on your trading strategy, it makes sense to stay away from the market when there is an impending economic or financial release because of the vast volatility that happens.

- Analysis not adding up – At times, your analysis may not be adding up to show a clear trading signal.

- Health – It is recommended that you stay away from the market when your health is not okay.

- After a big loss – It makes sense to avoid the market after you have made a big loss when trading. This could lead to an error of judgment.

Conclusion

Don’t worry. Trading was meant to be challenging, but it was also meant to be fun. It’s a time when you get to know important things about yourself.

If you can’t carry out your day trading strategies because you have any of the concerns listed here, feel free to take a break.

In the meantime, try our trading simulator so that you are not risking your money while you are learning what makes it difficult for you to make your trades.