The US has thousands of publicly traded stocks. These companies come in different shape and form. In terms of categories, stocks are divided into some key segments like pharmaceutical, technology, finance, materials, utilities, and retail among others.

Companies can also be divided into their sizes. In this article, we will look at the top types of companies by size and how to select the ones to trade.

Some traders and investors prefer focusing on giant companies like Microsoft and Apple while others prefer trading small and penny stocks.

Table of Contents

Definition of the sizes

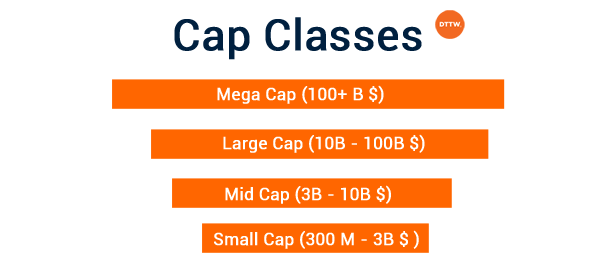

There is no generally accepted definition of what large-cap and small-cap companies are. In our case, we will define a large-cap company a market cap of more than $10 billion. Companies with a market cap of more than $100 billion are known as mega caps.

On the other hand, small-cap stocks are those that have a market cap of between $300 million and $3 billion. Companies that are between $3 billion and $10 billion are known as mid-cap stocks while those that have a value of below $300 million are known as penny stocks.

Still, you will often find different definitions of these classes.

Examples of large-cap stocks

There are many popular examples of large-cap stocks. Some of the best-known are:

- Etsy – This is an e-commerce company that helps people sell their hand-made products. It has a market cap of more than $25 billion.

- Crowdstrike – It is a cybersecurity company that is valued at more than $48.57 billion.

- Okta – Okta is a cloud company that also provides security-based solutions. It has a market cap of about $33 billion.

- General Electric – It is a giant industrial company that manufactures health products and jet engines. It is valued at more than $99 billion.

It is worth noting that companies move in and out of these classes every day. For example, if GE stock rises and pushes its market cap to more than $100 billion, it will be said to be a mega-cap stock. In fact, a few months ago, companies like Goldman Sachs and Square were large-cap stocks.

Examples of small-cap stocks

There are hundreds of small-cap stocks in the United States that you can trade in. Some of the best-known ones are:

- GoPro – GoPro is a maker of motion cameras and is valued at more than $1.2 billion.

- Dropbox – It offers cloud computing solutions to individuals and companies. It has a market cap of more than $9 billion.

- Box – It is similar to Dropbox and is valued at more than $2.85 billion.

- Smartsheet – It is a cloud computing company that offers collaboration and work management solutions. It is valued at more than $8 billion.

From time to time we host the CEOs of some small caps on Market Wisdom. If you are curious, take a look here!

Strategies for trading large-caps and small-caps

In general, there is no major difference between trading large-caps and small-caps companies. Furthermore, they all move due to similar reasons like earnings and news of the day.

The biggest difference between the two is that many share prices of large-cap stock companies tend to be expensive. That’s because they became large-caps by investors placing a higher bid for them.

For example, the stock price of Goldman Sachs has surged to $300 while that of Okta has risen to $252. That of Crowdstrike has risen to more than $220. This means that for a day trader with less than $3000 in his account, trading these companies will be less profitable.

Related » How to Trade Super Expensive Stocks

For example, in this case, the funds will buy just 10 shares of Goldman Sachs. Even if the company’s stock rises by 20%, the ultimate profit will be relatively small. Still, day traders are able to trade these stocks using leverage and fractional trading.

On the other hand, the share prices of small caps are usually relatively cheaper. For example, Dropbox, Box, and Smartsheet share prices are $22, $18, and $70, respectively.

Also, it is worth noting that there are many large-cap stocks whose share prices are relatively small. These companies compensate this by having many outstanding shares. For example, because of the previous dilution, shares of GE trade at $11. Similarly, shares of Sirius XM, a company valued at $33 billion are trading at $5.80.

How to day trade small and large-cap stocks

The process of day trading small and large-cap stocks is similar. That’s because these shares usually move because of similar reasons, including earnings, news, and industry. Therefore, here are several tips that will help you trade these companies well.

Use level 2 well

Level-2 is a tool provided by many online brokers, including Real Trading. The tool usually shows the movement of bid and ask prices of a stock.

Bid is the maximum price that a person is willing to pay while ask is the maximum price that a seller is willing to sell. The bid is usually on the left while the sell is on the right.

Level 2 is an important tool that will help you understand how other traders and investors are positioning themselves.

In fact, many traders ignore chart analysis and focus on reading these level 2 flows. For example, if you see a big bid price that is above the current price, it means that there are more buyers.

Use time and sales

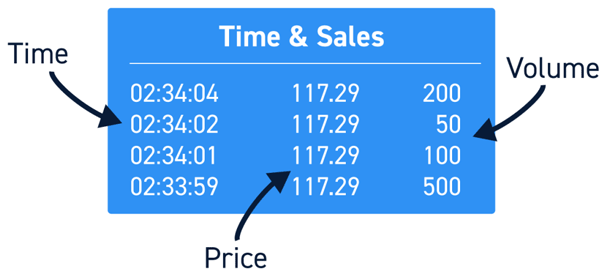

Also known as reading the tape, this refers to the process of using a tool that tells you the time, volume, and the price the order was executed at. This tool is also offered by many brokers and can help you know when to buy or sell.

The main difference between time and sales and level 2 is that the latter focuses on trades that are current open. Time and sales, on the other hand, looks at the trades that have already been executed. Therefore, traders prefer using the level 2 data than reading the tape.

Use a watchlist

A watchlist is a document that summarizes the top-performing shares and the reasons why this happened. At Real Trading, our team comes up with a stocks watchlist every day that you can subscribe to for free here. A watchlist will simplify how you trade and save you a lot of time.

Instead of spending one hour finding opportunities, you can use a watchlist and find them within minutes. You can also create your own watchlist using popular free platforms like Investing and TradingView.

Focus on premarket movers

The premarket session is an important period because most news events usually come out in the morning or in the extended hours.

Therefore, focusing on premarket movers will help you identify good trading opportunities. It will show you stocks that have news catalysts and those that have higher relative volume.

Use technical analysis and fundamental analysis

Last but not least, you should incorporate the concept of fundamental analysis when you are trading large and small-cap stocks. Fundamental analysis is the process of looking at news and other financial data to find the real value of an asset.

The most popular fundamental factors to consider in this type of analysis are

- earnings

- interest rates

- speeches by key people

- inflation

These news and events can have an impact on large and small cap stocks.

Technical analysis, on the other hand, focuses on chart analysis. It involves the use of technical indicators and conducting chart analysis. Some of the top chart analysis patterns to consider are triangle, head and shoulders, and rising and falling wedges.

So, which is better between large and small cap stocks? We believe that traders and investors can invest and trade and make money focusing on both small and large cap stocks. When investing, it is always recommended to have a diversified portfolio that is made up of small and large cap companies.

Summary: Which is better between large and small cap stocks?

Large-cap and small-cap stocks are two broad areas that are constantly changing. For one, for most stocks to become large-caps, they usually become small-caps first.

So, which is better between large and small cap stocks?

We believe that traders and investors can invest and trade and make money focusing on both small and large cap stocks. When investing, it is always recommended to have a diversified portfolio that is made up of small and large cap companies.

External Useful Resources

- Why market cap matters – Fidelity