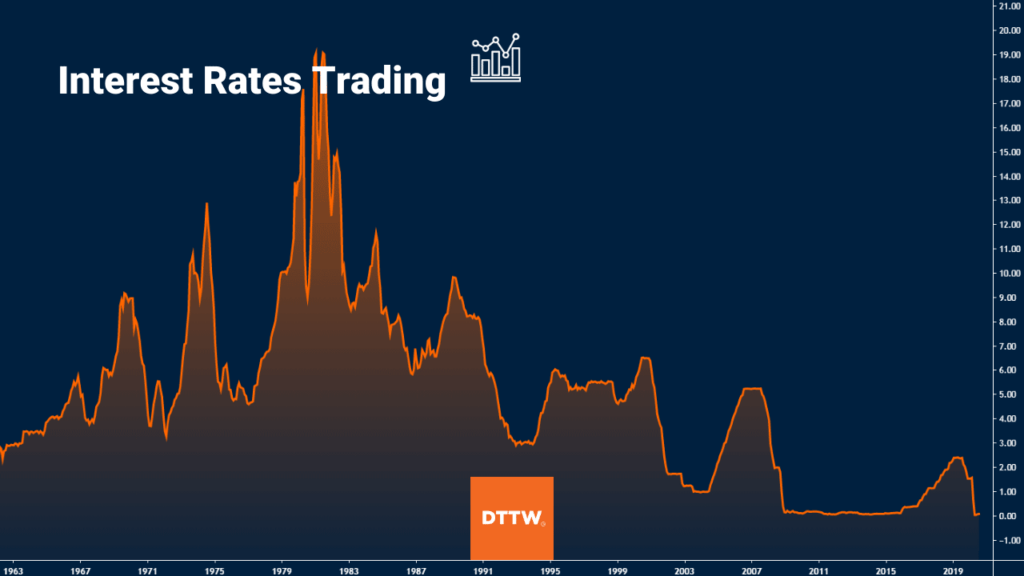

Interest rates are the most important part of the financial market. In most periods, higher interest rates usually lead to a weak performance in the industry.

For example, stocks and cryptocurrencies surged during the Covid-19 pandemic as the Fed slashed interest rates and launched quantitative easing (QE).

On the other hand, stocks and cryptocurrencies plunged in 2022 as the Fed raised interest rates by more than 400 basis points.

Interest rates also have an impact on other areas. For example, ordinary people are affected by higher mortgage rates and cost of borrowing.

In this article, we will look at everything you need to know about interest rates and the role of the central banks.

Table of Contents

Interest Rates & Central Banks

For starters, an interest rate is an amount of money that you pay on top of the principal that you have borrowed in a bank or any other financial institution. The rate is always in form of a percentage. In most cases, the rate is usually noted on an annual basis, which is known as the annual percentage rate (APR).

Central banks are given the mandate to set interest rates of the economy. Because of how delicate these issues are, most countries have separated central banks from politics. And, some countries like Turkey, Argentina, and Zimbabwe have learnt the hard way about infusing politics with this kind of decisions.

Most important central banks

All central banks are important in their countries because they are responsible for their monetary policy. However, in the financial market, there are just a few central banks that mean a lot to investors and traders, including:

- Federal Reserve – It is the most important central bank in the world because of the size of the American economy. The US dollar is also the reserve currency of the world.

- European Central Bank (ECB) – The EU is the second-biggest economy in the world while the euro is the second reserve currency. This makes ECB’s activities important.

- Bank of England (BoE) – While the UK’s relevancy is waning, the BoE is one of the most followed central banks in the world. This happens because London is still the financial capital of the world.

- PBOC – The People’s Bank of China is followed closely because of the role of China as the second-biggest economy in the world.

- Bank of Japan – This is the third-most important central bank in the world because of the role of Japan in the global economy.

Other important central banks are the Swiss National Bank, Reserve Bank of Australia (RBA), and Turkish central bank.

How Central Banks set interest rates

Most central banks, like the Federal Reserve, European Central Bank, and Reserve Bank of Australia have special monetary policy committees that meet every month to deliberate on the economy and set interest rates.

In most countries, the meeting usually happens in a span of two days. In these meetings, the committee usually looks at the state of the economy and adjusts rates accordingly.

The rule of the thumb is that a central bank will slash interest rates when the economy is struggling and raise rates when things are going on well.

How Monetary Policy Works

The idea behind this monetary policy is simple. If the economy is going through a tough time, low interest rates will spur spending by removing the incentive for savers. It also makes it affordable for people to pay their mortgages and even borrow money.

Central banks raise rates to normalise the economy. The idea is that if rates stay at relatively lower levels for a long time, it will lead to bubbles, which will ultimately burst. Therefore, they raise rates to normalise the economy.

How to Trade Interest Rates

There are several ways of trading interest rates in the financial market. Sophisticated traders have tools that enable them to trade these rates directly. A good example of such an asset is the rate swaps, which trade in the over the counter (OTC).

It is usually an agreement between two parties to exchange one stream of payments for a different stream over a long period of time. Another popular way of trading interest rates is through the London Interbank Offered Rate (LIBOR).

Conventional Assets

Another way is to trade the conventional assets like currencies and stocks. Ideally, stocks tend to perform well when interest rates are low. That is because, when rates are low, people move from the lower-yielding cash to other assets like stocks.

A good example of this is what happened during the coronavirus pandemic, when stocks rallied after the Federal Reserve slashed its rates.

Talking about currencies, instead, borrowing a low-yielding currency and investing in high-yield currencies is very important for carry trading strategies.

Metals & Currencies

Other popular assets that are tied to interest rates are precious metals like gold and silver and currencies. For example, precious metals tend to rise when rates are low while the value of a local currency drops in the same situation.

› Why You Need Some Gold In Your Portfolio

Futures contracts

Another way to trade interest rate decisions is futures contracts across multiple asset classes. A futures contract is where you enter a deal to buy or sell an asset at a future date and at a certain price. Unlike an options contract, in futures, holders have an obligation to buy the asset.

Some of the top futures contracts to trade are index futures like the Dow Jones and the Nasdaq 100 index. You can also trade individual stock futures products.

Bonds

The bond market is more exposed to interest rates than stocks because bonds are debt. Therefore, if interest rates rise, it means that a country or a government will need to adjust their policies to meet the new rates.

Therefore, higher interest rates lead to better returns for bondholders. For example, American bond yields remained at almost zero when the Fed left interest rates between 0% and 0.25%.

Effects of interest rates in day trading

There are several effects of interest rates in day trading. The core of this is simple. High-interest rates leads to more tighter monetary conditions, which affects assets like stocks and cryptocurrencies. At times, a high-interest rate environment leads to less trading as the performance of stocks worsens.

Low rates, on the other hand, as we saw during the Covid-19 pandemic, usually leads to more inflows among traders. As such, it is usually a good time for trend traders since assets tend to rise.

Also, higher rates usually have an impact on corporate earnings. Profits of many companies usually thin during these periods since firms have to pay more in interest rates.

Related » Tips to successfully trade exchange rates

Final thoughts

There are several things you need to know when trading interest rates. First, you need to know when a central bank will deliver its interest rate decision. You can easily get this information in the economic calendar.

Second, you need to understand the previous statements by the central bank’s officials. This will help you know what to expect from the rate meeting.

Finally, you need to prepare for the volatility that comes with interest rate decisions.

External Useful Resources

- Why These rates matter to forex traders – Babypips

- Mortgage Rates – Today’s Rates from Bank of America