Risk management is at the core of forex, commodities, and shares trading. We have covered several risk management strategies before. However, at times, traders decide to go all in on a trade, in what is known as a YOLO trade.

In this report, we will look at what YOLO trading is and how you can use it efficiently.

Table of Contents

What is a YOLO trade?

YOLO stands for You Only Live Once. In trading, a YOLO trade is where you go all in hoping to make a substantial return. For example, you can see a share price rising in high volume in premarket trading and then decide to buy it as soon as the market opens.

The goal of doing this is to make easy money as the momentum remains.

Example of a YOLO in Hertz stock

A good example of this is what happened with Hertz stock lately. Months ago, Hertz, the then-globally went bankrupt. A few weeks later, the stock jumped to a high of $6.2192.

However, with the company being bankrupt, and with the pandemic going on, the odds of the company bouncing back were almost zero. Therefore, in this case, a YOLO trader would have shorted the stock and gained 82%.

When to use a YOLO trade

There are several situations when this kind of trades are possible. Examples of such situations are mergers and acquisitions (M&As) and Initial Public Offerings (IPOs).

Mergers and acquisitions

When a M&A deal is announced, the initial response is for the stock price of the company being acquired to rise and for the acquirer to drop. Therefore, a YOLO trade can be about buying the company being acquired instantly and exiting with a profit.

A good example of this situation is what happened with Tiffany, the American luxury jewellery store.

In 2019, LVMH announced that it would buy the firm for about $16 billion. That news pushed Tiffany’s stock to pop, which was a good opportunity. However, this year, battered by the Covid pandemic, LVMH announced that it would abandon the deal, pushing LVMH higher.

And, a few months ago, after the two sued each other, LVMH decided to buy the firm with different terms. That pushed the stock higher, leading to an ideal YOLO trade that has returned more than 20%.

Initial public offering (IPO)

In recent months, tech IPOs have been the real deal. We have seen IPOs of companies like Snowflake, Asana, and Unity Software hit the market. As a result, shares of these companies tend to do very well on the first few days they go public.

Therefore, a good YOLO trade is where you buy the stock the same day it goes public and then exit before sellers start coming in. The chart below shows how Snowflake’s stock popped on its first day as a public company.

› How day traders take advantage of ipo stocks

Earnings & major events

Finally, YOLO trades situations can come up after a company releases its earnings or after a major event such as the end of a political campaign.

Historically, stocks usually react wildly after a company publishes earnings. In some cases, a stock can crash after a company publishes weak earnings and vice versa.

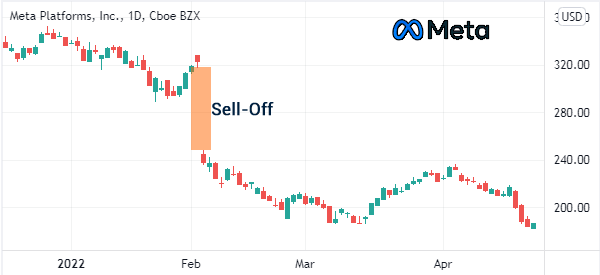

For example, as shown below, Meta shares crashed hard after the company published weak results. This can be a good YOLO trade.

There are other major events that can lead to major volatility in a stock. For example, a stock can become more volatile after a company announces a new product or when a beloved executive leaves the firm.

How to mitigate risks in YOLO trading

As mentioned, YOLO trades can be a highly risky trading strategy. Therefore, it requires using several strategies to mitigate risks. Some of these approaches to reduce risks are:

- Not leaving trades open overnight – YOLO companies tend to have a lot of volatility. Therefore, you should always ensure that your trades are closed before the you end your trading day.

- Position sizing – You should ensure that all your trades are relatively small so that you can avoid putting your account at risk.

- Stop-loss and take-profit – You should always protect your trades with a take-profit and a stop-loss to prevent substantial losses.

- Focus on long trades – It is possible to make money shorting stocks in YOLO trading. However, the risks of shorting outweigh those of going long. Short trades have an infinite loss potential.

Pros and cons of YOLO trading

There are several benefits of using the YOLO trading strategy. Let’s start with pros:

- High profitable – YOLO trades can be highly profitable trading strategy when things are going your way.

- Fun – At times, YOLO trading can be a fun way to make money in the financial market.

- Interactive – YOLO trading can be highly interactive especially when you are part of an online community.

On the other, the strategy has some drawbacks, especially among inexperienced traders. Som of the top cons for the approach are:

- Huge losses – Since YOLO involves large trades, the amount of losses can be significantly higher than average.

- Over-trading risks – There are risks of overtrading when using the YOLO trading strategy. The more trades you open as a trader, the more risks you expose yourself to.

Final thoughts

YOLO trades been around for decades but their prominence have gotten popular recently. Unlike other trades, their goal is to make a good return, often in a short period of time.

However, by going all in, YOLO trades tend to be relatively risky (something familiar to poker players who have converted to day trading). Therefore, you should only implement them on your separate trading account, not the main account.

External useful resources

- Millennials: Forget YOLO Stocks. Buy These Instead – The Fool