Silver is one of the four precious metals you can trade in the financial market. The other three are gold, palladium, and platinum.

This metal is often called the poor man’s gold. Reason for this is simple. They are both precious metals which are mined from deep areas of the earth’s crust. They are also used in the manufacture of jewelry and other precious coins. Again, they are all found deep inside the earth’s crust, which makes them expensive to mine.

But, the difference comes in pricing. While an ounce of gold sells for more than $1,500 or more, an ounce of silver sells for $21.

Table of Contents

Silver vs gold

The difference for this is simple. While silver is an industrial metal, gold is like insurance. People and governments buy it as a store of value. They imagine that they will be safe owning gold if the world comes to an end.

As a result, gold tends to have a negative correlation with the dollar. When the dollar gains, gold tends to fall as well. Only a tiny percentage of physical gold goes to the manufacture of jewelry, medals, and ornaments.

On the other hand, silver is an industrial metal with a lot of uses. It is used in the manufacture of utensils, silverware, coins, and even in the vehicle industry. Only a small percentage of people buy silver for its store of value characteristics.

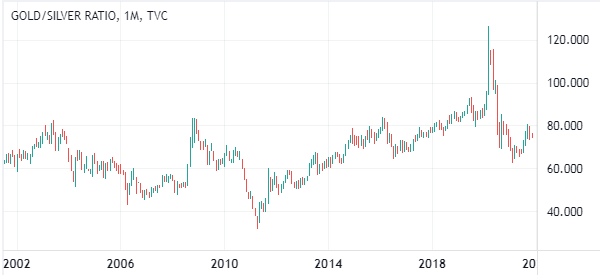

One of the most common indicators of the valuation of silver is the gold-to-silver ratio which reflects the amount of silver that can buy one ounce of gold. Historically, the ratio has averaged about 15 to 1 in the long term and 40 to 1 in the near-term.

The historic defeat of silver

An interesting story is told about a rich man in Texas called William Hunt. In the 70s, he was among the richest people on earth. He owned large pieces of land with huge oil deposits.

After his death, he left his estate to his two sons. After studying the surge in the gold market, the brothers decided to invest in silver. They believed that silver would one day reach the price of gold, so They spent their entire capital buying physical silver and silver futures. They also borrowed heavily to finance their silver shopping.

On their own, they managed to get the price of silver to more than $50. Then, in the late 70s, the commodities and futures commission (CFTC) announced that no individual would be allowed to own more than 3 million ounces of silver. This led to a collapse in the price of silver. Financiers came calling and the two brothers filed for bankruptcy.

What moves silver prices?

There are several catalysts that affect silver prices. As mentioned, silver is both a precious metal and an industrial one. As a precious metal, silver tends to be affected by the overall monetary policy of the United States. In this, the metal reacts to the periodic data like on employment, inflation, GDP, and retail sales.

These numbers always point to the actions by the Federal Reserve. In theory, strong numbers tend to mean that the Fed will tighten monetary policy, which will push the US dollar higher. Silver tends to have a small inverse relationship with the US dollar.

However, at times, the performance of inflation can attract more people to trade silver. For example, when inflation rises, it means that people will move to silver since it is also seen as a hedge against inflation.

Second, it reacts to the global economic numbers, especially in China. Silver rises when the economy is doing well because this implies higher demand. It then retreats when the global economy is struggling.

Third, geopolitical issues have a mild impact on silver. For example, geopolitical issues in countries like Mexico, China, Peru, and Russia have an impact.

Further, it reacts to trends in key industries like clean energy and semiconductor, where it is used widely. In addition, supply and demand dynamics can affect prices. For example, silver prices jumped during the Covid pandemic as more mining companies reduced supplies.

How to trade silver

Types of silver assets

Before we look at how you can trade silver, let us look at the various ways in which you can do it.

- Physical metal – This is where you buy and sell physical silver. This is not an ideal method for most people since it is ineffective and cost unfriendly. Like other industrial metals, silver trading is mostly done by large companies like Glencore and Fresnillo. Most of these traders provide a direct link between miners and consumers. As an independent trader, buying and selling metals can be an extremely difficult and time-consuming process. Therefore, we recommend that you focus on the digital approaches described below.

- CFDs – A CFD is an asset that tracks the price of a real asset. These products are offered by most online brokerages. As the name suggests, a CFD is simply a contract between a person and an exchange. With it, you place a bet that the price will either rise or fall over time. You place a sell order if you expect the price to fall and a buy order when you expect it to rise. CFD assets are not allowed in the United States because they are against securities law in the country. They are nonetheless available in most countries.

- ETFs – There are several ETFs that track silver directly while others track silver mining companies. An ETF stands for an exchange traded fund, meaning that it can be bought and sold like a stock. Unlike stocks, ETF providers make money by charging an expense ratio, which is often less than 1%. Some of the top silver ETFs are WisdomTree Physical Silver ETF, Invesco Physical Silver, and iShares Physical Silver,

- Futures – You can trade silver futures and options if your broker provides them. Futures and options are financial derivatives that allow a person to buy or short a financial asset at a certain price at a particular time. A call option gives one a right to buy while a put gives one a right to sell it. The difference between futures and options is rights and obligations. In an option trade, one is given the right but not an obligation to buy while in futures, one has to complete the trade. Many brokers in the United States provide silver futures and options. The most popular of these ones are Robinhood, Schwab, and TastyTrade.

Anyone who has tried to trade silver knows how difficult it is. While silver and gold are related, their movements are not influenced in the same way. In fact, they are almost negatively correlated.

This is because a strong economy tends to require more silver. On the other hand, a strong economy tends to be disadvantageous to gold.

Technical analysis

Therefore, to trade silver successfully, you first need to understand this foundation. Then, you need to understand clearly how to perform technical analysis. As you will realize, silver tends to have major movements within a short period and then stall.

Some of the technical indicators you can use to trade silver are moving averages, Relative Strength Index, and the MACD.

Demand and supply

To become a good silver trader, it is also important for you to understand the demand and supply dynamics. Most of the world’s silver is mined in countries like Mexico, China, Peru, and Australia. The biggest mining companies are Fresnillo, Glencore, Goldcorp, and Pan American Silver Corp.

On the other hand, the biggest demand for the metal is in companies like China, Japan, India, United Kingdom, US, Canada, and Germany among others.

As the middle class has risen around the world, the amount of silver demand and supply has risen (from 20K metric tons in 2005 to a high of 27K in 2018). The demand too has continued to rise, fueled by the fabrication industry, the jewelry industry, and the photovoltaic industry. However, the price will depend on the Fed’s monetary policy outlook.

Strategies to day trade silver

Like other financial assets, there are several strategies that you can use to trade silver. First, you can use the scalping approach, which involves buying and selling the metal within a few minutes. The goal is to generate small profits several times per day.

Second, there is the trend-following strategy, which involves buying into an existing trend. As a trend-follower, you should identify an existing trend and place a trade in that direction. If silver is rising, you place a buy trade and vice versa and wait for it to reverse.

Third, there is a strategy known as a reversal, where your goal is to predict when an existing trend is about to end. Some of the top reversal trading strategies are using chart patterns like double-top and rising wedges, using candlestick patterns like doji and hammer, and using indicators like moving averages.

Further, you can use news trading, where you react to important news and economic data. Some of the most notable economic numbers to have in mind are non-farm payrolls (NFP) and inflation.

Pros and cons of silver

There are several advantages of trading silver. First, silver is offered by most companies in the United States and globally. Second, it is a highly liquid metal, which makes it easy to enter and exit trades.

Third, silver has a close relationship with gold, one of the most popular metals in the world. Finally, it has numerous catalysts, especially in the monetary policy side.

The top cons of silver trading are its elevated volatility and the use of leverage and margin. The latter two can lead to substantial losses when silver prices show significant volatility.

Summary: How difficult is it to trade silver?

Let us be clear, We do not recommend any new trader to focus on silver. For experienced traders, We recommend that you take time to come up with a good trading strategy.

This strategy should be different from what you normally use to trade currencies and stocks. Make sure you understand the different supply chains and the demand.

External Useful Resources

- For further information click on IG