A short squeeze is a situation where a heavily shorted company goes parabolic, leading to substantial losses among short-sellers. This situation happens when a stock that is often disliked by investors surges. The surge can happen when there is important news or when there is none.

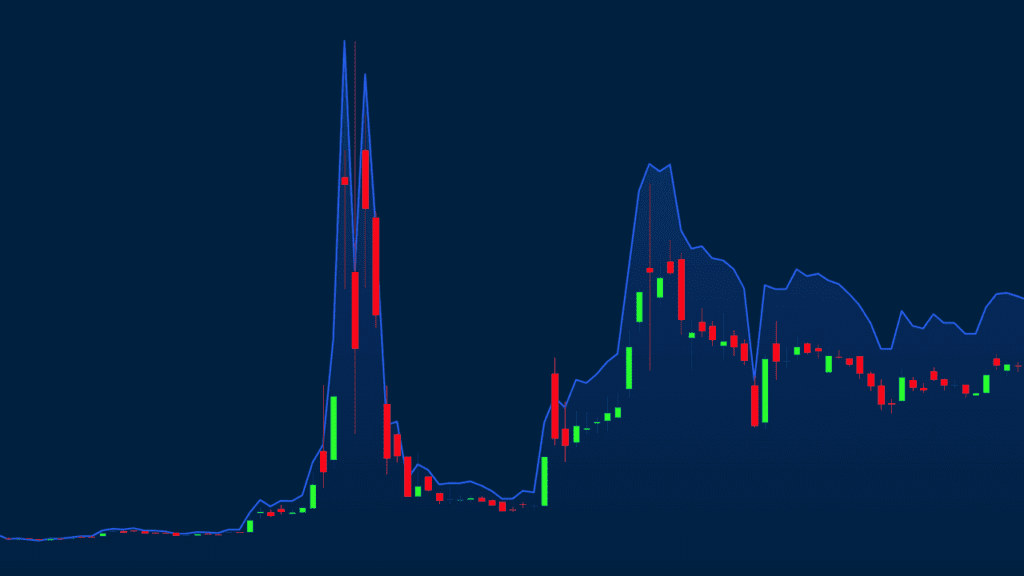

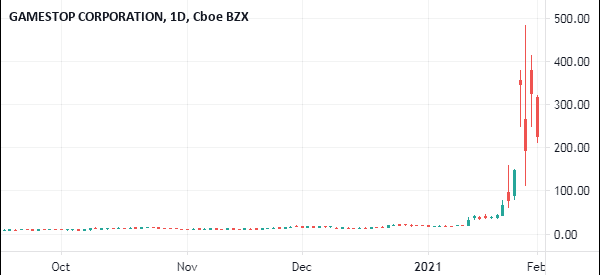

Short squeezes have been around for many years. However, they gained popularity in 2021 when heavily shorted companies like AMC, Blackberry, and Bed Bath and Beyond surged. As shown below, the GME shares jumped from $1 in January 2021 to a high of $121.

This short-squeeze led to substantial losses to people who had shorted the company. As We will explain below, shorting is risky because you can make infinite losses. When you are long a stock, the biggest loss you can make is losing your total deposits.

This article will extensively look at what a short squeeze is, what causes it, and how to avoid one.

Table of Contents

Difficulties of long term trading

In the 70s, Warren Buffet bought Coca-Cola shares. His was a long term bet that people will always buy coca-cola because of the moat the company had established.

True to his prediction, the company is one of the largest in the world today, and he has made billions of dollars from it. However, now coca-cola faces many challenges because of the health implications its products have on people.

20 years ago, Kodak was the largest imaging company in the world. Investors who had a 40 year prediction on the company has long failed as the company nears liquidation!

IBM was once the leader in computing. Today, the company is facing many challenges and its investors have lost billions.

These examples show that no one can tell the future of companies. The big Facebook and Google we see today might be a thing in the past years to come.

As a day trader, you can avoid these long term issues by looking at the short term details of an asset.

How to short a company

To explain what a short squeeze is, let us first look at how shorting a company is and how it works.

In the past, this was rather a complex transaction to do because you had to enter into an agreement with another investor. Today, you can short a company at the comfort of your trading platform.

Examples

Assume company A is trading at $10 per share. After conducting some analysis, you forecast that the company’s real value is $5 per share, so you decide to short it.

In this, you go to a trader B who owns 1000 shares of the company. The real value of these shares is $10,000 (1000 shares X share price). You enter into an agreement with him where you borrow his shares and sell them.

In reality, if the shares of the company hits $15 a share, you will be in a negative because you will need to pay the investor, $15,000.

After borrowing the shares, you sell them for $10,000 and hold the money. If the shares goes down to $5 which you had predicted, you can now buy them back and return the 1000 shares to the investor.

In reality, you will have made $5,000 in this transaction.

Related » How to Identify Short Covering as It Happens!

What is a short squeeze

A short squeeze refers to a situation where a stock you have placed a short bet on rises spectacularly. When it happens, many traders lose more money than what they have traded in initially.

There are two good examples of explaining what a short squeeze works.

First, a few years ago, Bill Ackman placed a short bet on Herbalife, a company that sells products through a multi-level approach. He accused the firm of being a pyramid scheme. After shorting the stock, Carl Icahn, his rival, entered a large buy position. At the end, Bill lost more than $1 billion.

Gamestop and AMC Squeeze

Second, early 2021, traders ganged up in social media (Reddit) and decided to buy shares in some of the then hated companies like GameStop and AMC Entertainment.

This led to these stock prices to jump by more than 400% within a short period. Many investors who had shorted these companies lost billions of dollars.

What do days to cover in short-selling mean?

One of the most common phrases in the short-selling industry is known as days to cover. It is a figure that you will often see in most financial trading platforms.

It is an index that defines the days that would be necessary to let short-sellers cover their positions. The index is calculated by dividing the current short interest with the average daily share volume.

What happens after a Short squeeze?

As a trader, if you buy a company A for $10 per share, the maximum loss you can make is 100% loss of your money. This is because a company’s shares can never be a negative.

However, if you go short a company, the maximum loss you can make is infinity. This is because a company’s shares can go up to any number.

This is a serious problem that a certain trader made times ago by shorting a biotech company known as KaloBios. After shorting the trade, the trader went for a meeting. After the meeting, he found that his account was $-300,000.

Related » Another key concept is the SSR (Short Sale Restriction)

Why short-squeezes happen

Short-squeezes happen when highly shorted companies suddenly rise, leading to substantial losses to people who were short. There are several reasons why these short squeezes happen in the market.

First, a short squeeze happens because of pumps and dumps. This is a situation where a person or a group of people gang up with the goal of pushing a stock higher. These situations are mostly common among small companies.

Second, they happen when there is major news about a company or a crypto. For example, a highly-shorted biotech company could pop up suddenly when it receives an FDA approval or important update.

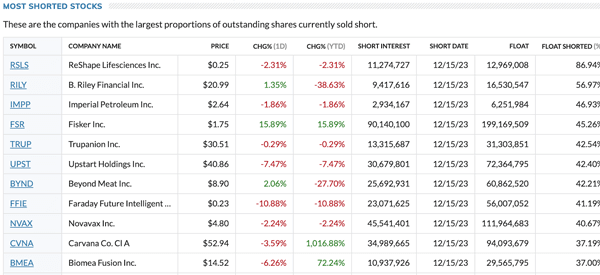

For example, as shown below, Fisker stock, which is highly shorted, rose by over 14% in a single day after the company delivered an important update about its deliveries.

Third, a short squeeze can happen because of the general hype of a stock or crypto. A good example of this is in 2021 when stocks like GameStop and AMC surged. That happened at a time when the Federal Reserve was aggressively cutting interest rates.

Tips to trade a short-squeeze

Short squeezes happen almost daily in the stock market. Therefore, there are some important tips that will help you make money when the stock is rising and when it resumes the downtrend.

- Always find the trigger – Look for the main news moving a stock before you execute a trade.

- Close before the end of the day – As a day trader, it is important that you close all your trades before the end of the day since these companies tend to show huge moves.

- Trailing stop – Always have a trailing stop loss, which will follow the trend and stop when a certain level is reached. A trailing stop is better than a static stop loss.

- Use level 2 data – Further, you should always check level-2 data to see the key levels among market makers.

- Social media – Most short-squeezes these days emerge from social media platforms like StockTwits and Reddit. Using these platforms will help you know what to expect in a stock.

Who can benefit in a short squeeze?

A short squeeze mostly benefits two key people in the market. First, it benefits the company itself. In most cases, when a squeeze happens, it usually gives them room to raise additional capital by selling their shares.

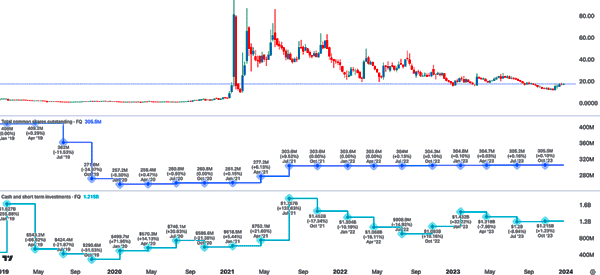

In the chart below, we see that GameStop’s outstanding shares rose from 260 million in January 2021 to 303 million during its meme stock era. At the same time, the company’s cash and short-term investments rose from $618 million to over $1.75 billion.

The other beneficiary of a short-squeeze are investors who are long the company. In this case, the squeeze can help them exit their positions with a profit.

Who loses in a short squeeze?

The only person who loses during a short squeeze is a trader or investor who is short the company. We have seen many similar investors lose substantial amounts of money over the years.

Short-sellers are more exposed to major losses compared to long investors since a stock can go up to infinity. For example, Melvin Capital, a hedge fund that was short GameStop, lost billions and shut down during the meme stock frenzy.

Similarly, Jim Chanos, one of the most popular short-sellers in the world, closed his hedge fund as the Tesla stock price continued soaring.

How to spot an impending squeeze

It is not easy to find an impending short-squeeze since these situations often happen suddenly. Still, there are several things that can help you know when a short-squeeze is about to happen or which stocks will be mostly affected.

First, look at short interest data to identify companies that are heavily shorted. The chart below shows some of the most heavily-shorted stocks at the time of writing. As you can see, Fisker, which I mentioned above, is one of them.

Second, look at impending news from the company. For example, keep in mind when these companies will publish their financial results. An earnings calendar can help you know this. In most cases, these companies tend to make major moves ahead or after earnings.

Third, always be on social media platforms like Reddit and StockTwits. By watching these deliberations, you will be in a better place to anticipate a major move.

Short squeeze risks

There are several risks associated with trading during a short squeeze. First, in most cases, these squeezes tend to be highly volatile, which can lead to major losses.

Second, a stock that goes up by over 10% in a single day can also retreat by a much bigger margin in the same period.

Third, there are risks associated with slippage, where a trade is executed at a different price than where you entered it. For example, you can place a trade at $20 and it is then executed at $20.50. In most cases, this slippage can have a major impact on your returns.

How to avoid short squeeze

To avoid a short squeeze, one is supposed to do a few things. However, it is necessary to know that there are also some methods to detect and exploit these squeeze situations.

Avoid trading small caps

While it is possible to have a short squeeze in companies of all sizes, they are usually common among small cap and penny stocks. That’s because these companies are mostly owned by retail investors, not institutional ones.

The latter type of investors tend to hold stocks for a long time. Therefore, reduce your exposure to small cap and penny stocks especially those in the biopharmaceutical industry.

Always have a stop loss

For starters, a stop loss is a tool that automatically stops your trade once it reaches a key pre-determined level. For example, if a company’s stock is trading at $10 and you short it, you can have a stop loss at $13.

In this case, if there is a short squeeze, the trade will be stopped automatically when it hits $13. Therefore, if it climbs to $20, you will be safe.

Keep an eye to your trade

Try to limit the amount of short trades you initiate. That’s because shorting a stock is usually riskier than buying one. When you short an asset, you are using borrowed money, meaning that you can lose more money than what you shorted in the first place.

Limit your exposure to overnight risks

These are risks that emerge when the market is closed. For example, if you have shorted a company, a takeover offer may be announced at night. As such, when the market opens, you will not have the time to shift your orders.

Therefore, avoiding these overnight risks can help you stay safe.

Final thoughts

Short squeezes are relatively common in the financial market. These squeezes became well-known during the Wall Street Bets short squeeze. In this article, we have looked at how shorting a stock works and how you can avoid a squeeze.

External Useful Resources

- Short Squeeze: In-Depth Guide On How to Profit from one – TymothySikes

- An interesting discussion about it on Quora