Candlestick patterns are essential in determining the direction of a financial asset. In the past few weeks, we have looked at several candlestick patterns like the hammer and the morning star.

We have explained how they work and how they can help you identify trading opportunities.

In this piece, we will look at the hanging man and his reversal, how it works and how you can use it in the market.

Table of Contents

What is a Hanging Man Pattern?

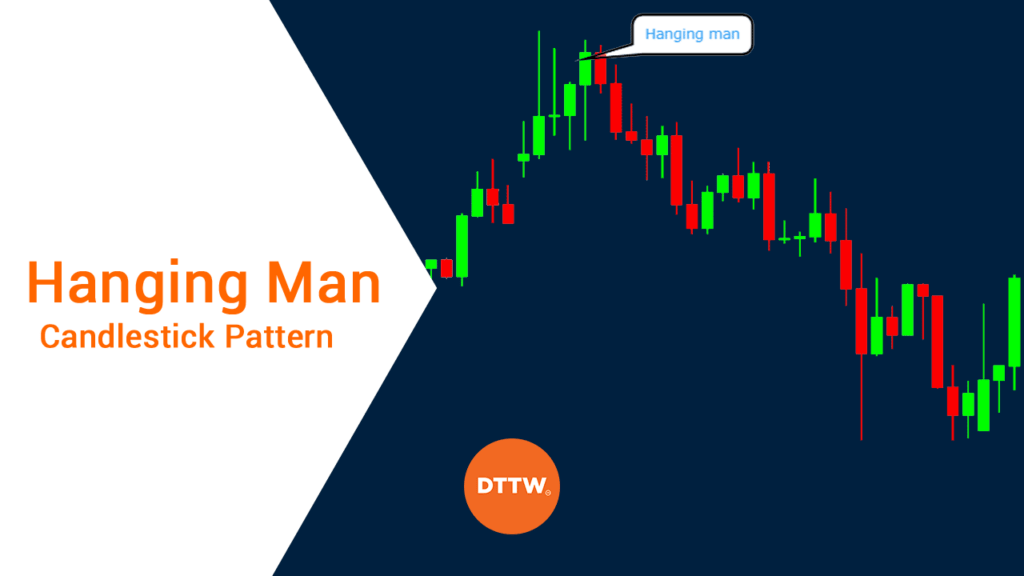

As the name suggests, it is a candlestick pattern that happens when the financial asset is in an upward trend. Whenever it does, it usually sends a signal that a reversal is about to happen. As you will see below, it is earily similar to the hammer.

Hanging Candle vs Hammer

The only difference is that the hammer is a bottom reversal line that appear during a decline. A hammer happens during a downward trend and is characterized by its small body and long lower shadow. When it happens, it is usually a sign that the financial asset is about to start a bullish trend.

Characteristics of the Hanging Man Candle

There are five many characteristics of the hanging man candle:

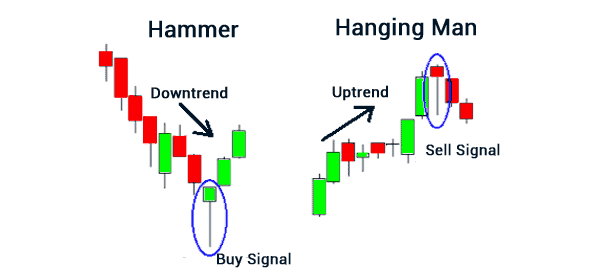

- Upward Trend – It happens when the price of an asset is in an upward trend as we have mentioned above.

- Opening Level – The opening level of the candle can either be bullish or bearish. Because it is a reversal pattern, the bearish candle is usually a better indicator of a weakening market.

- Upper Shadow – The candle needs to have a very small upper shadow. The reason is that this shadow show that bulls were attempting to continue with the bullish trend.

- Long Lower Shadow – There needs to be a long lower shadow, which shows that there was a significant sell off before bulls tried to regain some of the ground.

- Closing Level – The closing level needs to be below the open level. An illustration of the hanging man and the hammer is shown below.

How do you trade the Hanging Man ?

The hanging man is a reversal candle that happens when a bullish trend is about to turn. Therefore, the first thing you need to do is to identify a bullish trend. That can be in a 30-minute, one-hour, or chart with any period.

Second, identify when the candle is forming the pattern shown above.

In most cases, opening a short position when the hanging man candle forms is not an ideal situation. This is because in certain times, the reversal does not happen. Therefore, you should wait and see that the downward trend is forming.

Ideally, you should enter the trade after the third red or bearish candle because it will confirm that the bears are taking over.

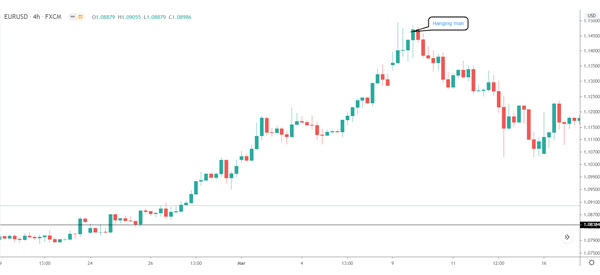

Example of this candle pattern

The chart above shows a hanging man pattern on the EUR/USD pair. As you can see, the pair was in an upward trend when the hanging pattern happened. This became the starting point of a new reversal trend.

Another way of using the hanging man pattern is to use pending orders. These are orders that are initiated only when a currency pair or any other asset reaches a key level. In this case, you could place a sell-stop below the lower shadow.

And then, you could protect the trade using a stop loss hat is placed slightly above the upper part of the hanging man pattern.

What about a reversal hanging man ?

A reversal hanging man is very similar to the hammer pattern. It happens in a downward trend and is usually a signal that the trend is about to reverse.

This reversal pattern is characterized by having a long upper shadow and a small body. At times, it can have a small lower shadow or not. It is more effective when it has a longer upper shadow.

A good example of this pattern is shown on the daily chart of the EUR/USD pair.

Trading with the inverted hanging man is relatively easy. Ideally, when it happens, it is a sign that a currency pair, stock, or another asset will start rising. Therefore, you can use it by placing a buy-stop trade above the upper shadow and a stop-loss below the lower shadow.

In this case, if the bullish reversal happens, the trade will trigger the buy-stop and you will be in the money. If the new trend is not strong enough, the stop-loss will be triggered at a small loss.

While the inverse hanging man is an effective pattern, we recommend that you use it in combination with other patterns and technical indicators.

Benefits of using the Hanging Man Candlestick Pattern

There are several benefits of using the this candles pattern.

- Accurate most of the times.

- Easy to spot.

- Easy to use with other reversal indicators like the double EMA.

Limitations

While the hanging man is a relatively accurate and easy to spot candlestick pattern, it has several limitations.

- The candlestick is not always a sign of a reversal. As such, you must always be careful when using it to trade.

- Unlike other candlestick patterns, it is a relatively rare one.

- It is best used in combination with other technical indicators and chart patterns like triangles and pennants.

Final thoughts

The hanging man is one of the many candlestick patterns. Other popular ones are the Doji, Morning Star, The Window, and cloud covers among others.

Using these patterns can help you identify the ideal points to enter and exit trades.

External useful Resources

- What is the difference between a hanging and a hammer? – Stockcharts

- What is the Hammer & Hanging Man candlestick pattern? – Quora