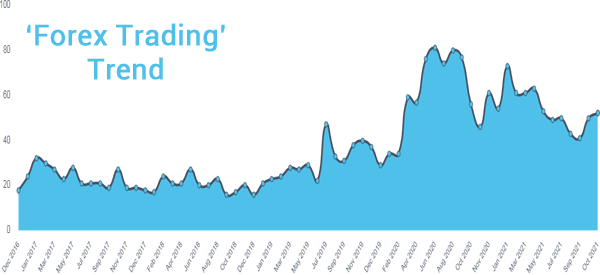

Forex trading is getting more popular globally as more people seek to make extra money online. This trend has pushed more brokers to offer products that seek to offer trading to a wider mass. For example, the minimum account deposit has dropped substantially to as little as $50.

They have also introduced more currency pairs. In this article, we will look at how you can trade one of the most popular pairs (indeed, just the most traded): the EUR/USD.

Table of Contents

What is the EUR/USD pair?

The EUR/USD stands for the euro vs the US dollar (also known as ‘the Fiber‘). Because of the close relationship between the US and the European Union, it has become the most popular pair in the world.

Also, the euro and the US dollar are the most popular currencies in the world. Every day, they both provide payments worth trillions of dollars.

The EUR/USD has a long and colourful history. The pair came to life in 1999 when the European Union countries moved to a single currency. In this period, countries like France, Germany, and Italy all abandoned their national currencies.

What moves the EUR/USD?

To understand how to trade the EUR/USD, first of all it is important for you to understand what moves it in the long and medium-term.

Federal Reserve and European Central Bank (ECB)

The most important mover of the pair is the interest rate decisions by the European Central Bank (ECB) and Federal Reserve. The two central banks meet about eight times per year to deliberate on the economy and adjust policy. They are also the most powerful central banks in the world, with trillions in assets.

All data published by the United States and the Eurozone always points to the two central banks. For example, when the US publishes strong employment and inflation data, the market always focuses on how it will impact the two central bank decisions.

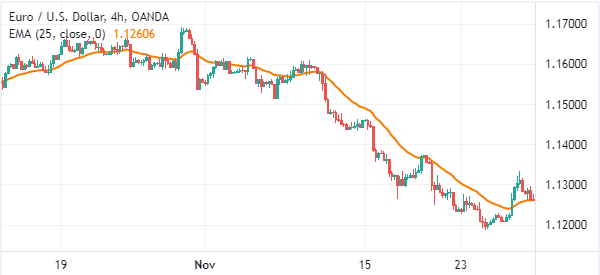

The chart below shows that the EUR/USD pair tumbled in November 2021 after it became clear that the Fed will embrace a more hawkish tone than the ECB.

Geopolitics

The EUR/USD tends to react to major geopolitical issues that happen globally. In most cases, when there are major risks globally, the pair will tend to retreat. That happens simply because of the fact that the US dollar is often seen as a safe-haven currency.

Some of the biggest geopolitical issues that have pushed the pair lower in the past are Brexit, US and China tensions, and Trump’s trade wars with Europe.

Economic data

There are several important economic data that usually moves the pair. First, the US usually publishes its non-farm payroll numbers every first Friday of the month. When this happens, the EUR/USD pair tends to react based on the numbers. If the numbers are strong, the pair will tend to drop since it signals that the Federal Reserve will start tightening.

The Eurozone also publishes its jobs numbers every month. The same happens with some of its member states. Still, in addition to the overall EU jobs numbers, those that move the pair are from key countries like Germany, France, Spain, and Italy.

Second, the next key major economic data is inflation. The US publishes its inflation data every month. The Eurozone, on the other hand, publishes two inflation numbers. The first one is usually an estimate of inflation.

The second one is the final inflation data. The EUR/USD pair tends to decline when the US publishes strong inflation numbers. This is because higher inflation tends to lead to a more hawkish Federal Reserve.

Third, retail sales are important movers of the EUR/USD. They are important because of the fact that the retail sector is a major employer in the US and Europe. Also, retail sales provide signs of consumer spending, which is the biggest part of the two economies.

Other important numbers that move the pair are manufacturing and services PMIs, industrial production, and consumer confidence.

Strategies to trade the EUR/USD

There are several strategies you can use to trade the EUR/USD. Each type of analysis is effective, as you can study the chart either by using technical indicators (better if trend specific) or simply by looking for visual patterns.

Trend Following

First, you can embrace the strategy of following the trend. This is a situation where you identify an existing trend and then follow it. If the pair is rising, you can buy it.

Similarly, if the pair is dropping, you can sell it. A good way of using this strategy is to use trend indicators like moving averages, VWAP, and Bollinger Bands.

For example, in the chart below, traders would have “sold” the EUR/USD as long as it remained below the 25-period moving average.

Reversals

Second, you can use the reversal trading strategy, where you identify areas where the pair is starting a new bullish or bearish trend. You can use technical indicators to predict when a reversal is getting started.

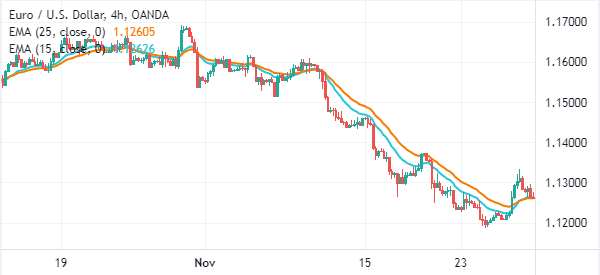

For example, in the chart below, we see that the 25-period and 15-period moving averages have made a bullish crossover.

Price Action

Third, you can use price action strategies to trade the EUR/USD pair. This means that you can look at areas where some unique patterns have come out. Some of the top patterns to consider are triangle, bullish and bearish flag, and rising and falling wedges.

FAQs about the EUR/USD pair

Which is the best time to trade the EUR/USD pair?

The EUR/USD pair can be traded at any time between Monday and Friday. It is even possible to trade its synthetic contracts during the weekend. However, in most cases, the pair experiences the most movements during the European and American sessions of the market.

Which brokers offer the EUR/USD?

All forex brokers offer the EUR/USD pair since it is the most popular one among traders an investors. Some of these brokers are ATFX and easyMarkets.

Which indicators can be used to trade the EUR/USD?

Most technical indicators can be used to trade the EUR/USD pair. The most popular ones among traders are moving averages, Bollinger Bands, and the Relative Strength Index.

Summary

The EUR/USD is the most popular forex trading pair. In this article, we’ve seen why it’s so important and more than anything, what are the reasons why its value moves.

These are key to being able to choose the best strategy to trade it.

External Useful Resources

- What Makes Up the EUR/USD Forex Pair? – Plus500