There are many financial assets you can trade in the market. Among the most important assets are stocks, commodities, bonds, and Exchange Traded Funds (ETFs). Which to trade and with which strategy obviously changes depending on your trading style and objective. Nothing, however, prevents you from diversifying your portfolio.

In this report, we will have an in-depth look at ETFs, what they are, and how you can trade them successfully.

Table of Contents

What is an ETF?

An ETF is a financial asset that is created by several large investment companies to offer diversification across assets. The fund is eerily like a mutual fund.

An ETF is created in several ways. Passive funds are those that track specific indices. For example, a fund like Invesco QQQ tracks the Nasdaq 100. As such, ETFs that track the index must first buy the stocks using the same weightings. And, the fund cannot buy more or sell specific holdings in the fund.

Actively managed ETFs are those where the money manager can adjust their weightings. A good example of this is Cathy Wood’s Ark Innovation Fund. In this, the portfolio manager typically buys and sells portfolio companies often.

The only difference is that a mutual fund can only be bought and sold after the market closes. An ETF, on the other hand, can be traded in the same way a stock is traded.

Some of the biggest creators of ETFs are Blackrock, Vanguard, and Invesco.

Types and examples of ETFs

There are many types of ETFs. Among the most common are:

- stock

- commodity

- bond

- International

- sector

A commodity ETF is one that allows you to a single or diversified group of commodities (like gold). A bond ETF, on the other hand, is an ETF that invests in corporate, municipal, and sovereign bonds.

International ETFs invest in foreign companies and bonds. Among these, there are those ETFs that invest in emerging markets, Europe, Asia, and Latin America.

Stocks ETFs are the most popular. These funds invest in different types of companies and offer them to traders. A good example is SPDR S&P 500 ETF, which tracks all companies listed in the S&P 500. Another example is Invesco QQQ, which also tracks companies in the S&P 500.

Sector ETFs are those that focus on individual sectors of the stock market. Some of these sectors are technology, consumer discretionary, and consumer staples, among others.

Examples of these are Fidelity® MSCI Information Tech ETF, Vanguard Information Technology ETF, and Vanguard Consumer Discretionary ETF, among others.

How ETFs work

The idea behind is relatively simple. First, an ETF provider needs to come up with a fund and go through the regulatory process.

Most recently, an ETF provider known as VanEck was denied permission of launching a Bitcoin one.

Second, the company creates an ETF by buying the assets. So, if it is a stock ETF, the company will by all the constituent stocks.

Similarly, if it is a gold ETF, the company behind it will buy physical gold.

Finally, the ETF is listed in a major exchange and you can trade them as you trade shares. Many brokerage companies like Robinhood, Charles Schwab, and Fidelity offers these ETFs.

How to day trade ETFs

In most cases, ETFs are usually preferred for passive investors. These are people who want to invest their money for a long time. These people prefer ETFs because of their diversified nature, which enable them to minimize risks.

Still, it is possible to day trade ETFs because they are offered by brokers and that they look like stocks. Therefore, you can read our online trading course if you are just getting started.

Basically, there are three steps for trading ETFs.

#1 – Check the Platform

First, you need to ensure that your broker offers ETFs in their platforms. This is an important part because not all brokers offer the ETFs.

#2 – Identify what you want to Trade

Second, you need to identify the ETFs you want to trade. You can do this by identifying and learning more about them. Fortunately, most brokers and online platforms provide more details of ETFs.

For example, Seeking Alpha offers an excellent platform for ETF analysis. For istance, this page on iShares Core S&P MidCap ETF provides details like the companies that make up the ETF and their weightings.

#3 – Conduct a Technical Analysis

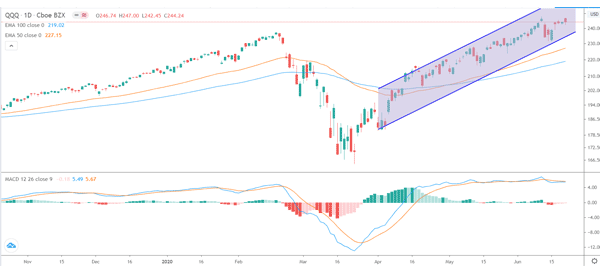

Third, you need to conduct a technical analysis just as you do in stocks, currencies, and commodities. For example, the daily chart below shows Invesco QQQ with moving averages and MACD.

Some of the strategies you can use to day trade ETFs are scalping, algorithmic trading, price action, swing trading, and arbitrage among others.

How to short ETFs

It is possible to short ETFs. By shorting, you basically borrow the fund, sell it, and then buy it back again when it drops. Several brokerage companies have features that enable you to short these funds automatically. Still, it is not recommended to short ETFs.

Example of technical analysis in ETFs

Here is a good example of technical analysis in ETFs. In the chart below, you can see that the Vanguard Midcap ETF.

On it, you can see the abandoned baby, which is a reversal candlestick pattern. You can also see that we have applied an impulse Elliot Wave pattern and double exponential moving average pattern.

Pros, cons and comparisons

Advantages of trading ETFs

There are three main benefits of trading ETFs.

-

They are like stocks, which means that you can trade them as you trade individual stocks.

-

ETFs are transparent, which means that you can find all the information about them from the provider. As mentioned above, you can find their information in other brokerages.

-

Diversified. ETFs are highly diversified, which is a good thing if you are investing in them.

Disadvantages of ETFs

There are four main cons of trading ETFs:

-

Since ETFs are diversified, conducting a fundamental analysis about them is usually time consuming. For example, if you are conducting a fundamental analysis on iShares Core S&P MidCap ETF, you need to know more about the constituent companies.

-

ETFs are recommended for long-term investors – Compared with individual stocks, ETFs are usually recommended for people looking at holding them for years.

-

Less volatile – ETFs are usually less volatile than individual stocks. This is a good thing for long term investors but a bad thing for traders. As we have written before, traders do well in periods of high volatility.

-

Not provided by most brokers – Another disadvantage of ETFs is that they are not provided by most brokers.

ETFs vs stocks

So, what is the difference between stocks and ETFs? There are several differences.

First, a stock is simply shares of a company. When you buy a stock, you are simply buying a small portion of a company. You are a part owner of the firm. An ETF, on the other hand, is made up of tens, hundreds, or thousands of companies (and different assets).

Second, investing in stocks does not have an expense ratio. Indeed, most brokers like Robinhood and Schwab no longer charge a commission to invest in a stock. While these brokers don’t charge a commission on stocks, you will need to pay a fee when you invest in an ETF. This fee is known as the expense ratio.

Third, there is no limit on the amount of money you can invest in stocks. Indeed, it is possible to buy and sell shares with as little as $50. Some ETFs have a lower limit on the amount of money that you can spend.

ETFs vs index

A common question among new traders is on the main difference between an index and an ETF. An index is a financial asset that tracks a certain number of stocks. For example, the Nasdaq 100 index tracks the biggest tech companies in the United States. There are other indices that track other sectors and businesses of different sizes.

The main difference between an index and ETF is that it is almost impossible to buy and sell an index. In most cases, you can buy and sell a CFD that tracks a certain index. Another way to buy and sell indices is to buy and sell ETFs that track these indices.

For example, you could buy Invesco QQQ, which tracks the Nasdaq 100 index.

Final thoughts

ETFs are great financial assets that are mostly used as investment vehicles. In fact, very few people day trade them and we recommend that you stick to individual assets like stocks.

Still, if you are interested in ETFs, we recommend that you take time to learn more about them and craft a good trading strategy.

External Useful Resources

- Rules to Follow if you Day Trade ETFs – Dummies

- How to Day Trade Volatility Exchange Traded Funds – Investopedia