Cryptocurrencies have become a modern-day goldmine. They have become so popular that many people from around the world are hoarding them. They have also made a few people multi-millionaires. For example, if you bought bitcoins worth $1000 in 2010, you would now be a multi-millionaire.

Since 2020, Bitcoin has risen from just above 6,000 to 29,000, even surpassing $50,000 at its peak. On the other hand, Ethereum has gone from $180 to a high of $2700.

In the recent past, the two currencies have corrected, but still remaining at very high values compared to what was seen before. They have become the most volatile ‘asset classes’ in the market.

Table of Contents

Trade, Don’t Invest

Many experts for years have declared that cryptocurrencies are the future of finance. IBM has even started a new blockchain department that helps global companies on different areas. Big banks like Goldman Sachs and Morgan Stanley have published articles supporting cryptocurrencies. While the future might be this technology, the fact is that we are in a bubble territory.

A bubble is a period where prices of items go up without having an intrinsic value. For example, before the recession, the prices of homes in the United States went up fueled by cheap credit. People bought the houses with borrowed money expecting to exit at a big profit.

The price of houses nosedived when people could not afford the houses.

The same concept is true of the dot com bubble when many worthless companies held their IPO. Some of these companies had no revenues. Some only added the dot com value in their name. When the time of reckoning came, people who had bought the stocks had no one to sell to.

Conclusion? Billions of dollars ‘evaporated’.

» Related: Crypto vs Stocks

This is the same thing with the cryptocurrencies. Most of the people who own them don’t know what to do with them. Or at least, that’s how it was until a while ago. They even don’t understand the underlying technology. They buy them because of the hype.

Therefore, We recommend that you trade these currencies. You should not hold the temptation of buying and holding them forever. Doing this will expose you to a lot of risks.

Acceptance remains below expectations

From a fundamental perspective, Bitcoin has not achieved its desired goal of replacing fiat currencies. Also, with more than 10,000 cryptocurrencies in existence, there is evidence that some of them are not worth it. For example, a cryptocurrency like Shiba Inu, which does not solve any problem, is worth more than $3 billion.

» Related: Forex vs Crypto

At the same time, some cryptocurrency projects have been relatively successful. A good example of this is Ethereum, which has been used as a building bloc of many cryptocurrency projects.

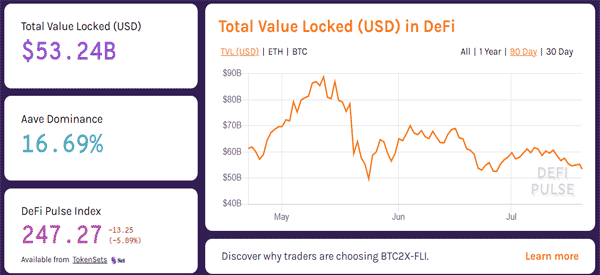

For example, it is used to build decentralized finance (DeFi) projects that are changing the finance industry. As shown below, the total value locked (TVL) of all DeFi projects is worth more than $53 billion.

Another way in which cryptocurrencies have changed finance is that they have incentivized central banks to think outside the box. Recently, central banks like the ECB, Norges Bank, and People’s Bank of China (PBOC) have announced intentions to launch central bank digital currencies (CBDC).

Strategies for trading cryptocurrencies

There are several strategies used to trade cryptocurrencies. Some of these strategies are:

- Using correlation – Since many cryptocurrencies have a close correlation to Bitcoin, traders use correlation or arbitrage to trade them. This is where they buy a cryptocurrency, short another one, and take advantage of the spread.

- Copy trading – This is a trading strategy where traders use technology to copy trades from other traders. Some online brokers provide tools to help people copy trades from other traders.

- Following the trend – This is a strategy where traders buy a cryptocurrency whose price is rising or short one that is falling.

- Buying the dip – This is where traders specialize on buying a cryptocurrency whose price has declined. Their hope is that the price will bounce back.

- Martingale strategy – This is a highly speculative strategy where traders increase their bets after losing. They hope that they will make profitable trades to cover the losses.

- Algorithmic trading – This is a strategy where traders use bots to implement trades.

Caution ahead

For traders and long-term bitcoin and other cryptocurrency holders, a lot of caution is required as we go into the future. On August 1 2017, there was the ‘civil war’ in the bitcoin scene. This day, two factions that control the bitcoin market will know whether to adopt a new software update or not. If this fails, the bitcoin could be split into two.

This move could lead to significant volatility in the market. There have been calls for regulation in the cryptocurrency market. These moves could lead to significant volatility in the market.

External Useful Resources

- Some insights into the latest Crypto technologies – Coinlist