The financial market comprises different market cycles depending on the broad market environment.

In some periods, as we saw after the Global Financial Crisis of 2008/9, the world went through a major bull run that saw stocks surge to a record high. The same situation happened after the Covid-19 pandemic in 2020.

This article will explain what a bull market is and how it works (and, of course, the best strategies for taking advantage of it).

Table of Contents

What is a bull market?

A bull market is a period when stocks and other financial assets are doing well. In most periods, the market happens when the assets rise by 20% from their lowest period in a session.

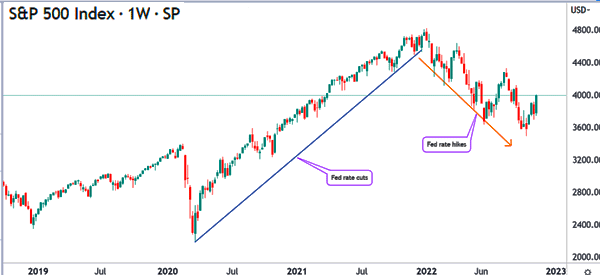

For example, in the chart below, we see that the S&P 500 index rose by about 20% from its lowest level in October to its highest point in February.

This means that it entered a bull market during this period. The term bull market comes from the concept of a charging bull during bull fights.

In all, a real bull market is stronger than that. In most periods, the bull market happens when stocks are in an overall strong upward trend in a certain duration.

Related » How to Understand Stock Market Cycles

A bull market can last a few weeks or even a few years. A good example of a bull market is what happened after the Global Financial Crisis of 2008. It lasted for over a decade.

Bull vs Bear market

A bull market is a period when financial assets are doing well. On the other hand, a bear market is a period when financial assets are not doing well.

In technical terms, a bear market is defined as a period when financial assets have dropped by 20% and more. A good example of this is in the Carvana stock below.

As you can see, the shares plunged by more than 20% from their highest point in August 2021 to its lowest point in September. Unlike the S&P 500 above, the stock then continued plunging as the situation worsened.

Another concept similar to a bear market is known as a correction. Correction is defined as a period when a stock declines by 10% from its highest point. In most periods, a correction can easily turn into a bear market if sell-off pressure happens.

Causes of a bull market

There are various causes of a bull market:

Federal Reserve

First, it is caused by the actions of the Federal Reserve. In most periods, investors tend to rotate into stocks and other assets when the Fed decides to maintain a dovish monetary policy statement.

This happens as other financial assets like bonds experience low returns. Some of the top examples of the most recent bull runs were caused by an extremely dovish Federal Reserve.

Thematic reasons

Second, bull markets happen because of the prevailing themes in the market. This happens when there are major themes that attract investors to certain assets.

For example, in the past few years, we have seen several market themes like in technology, electric vehicles, cloud computing, and artificial intelligence among others.

Geopolitics

At times, geopolitics can have an impact on the market. For example, the stock market can rise sharply when geopolitical tensions between two countries ease.

A good example of this is what happened when the Trump administration reached a deal with China. Before that, tensions had been rising as Trump sought to increase tariffs on Chinese goods.

Earnings

A stock may enter a bull market when there are positive earnings. It is common for a stock to rise sharply when a company publishes strong earnings and ups its forward estimate. The opposite is also true since it can enter a bear market when it publishes weak earnings.

There are other reasons why a bull market may happen, including management change, end of a major investigation, and the launch of a new product.

How to know we are in a bull market

A common question among market participants is on how to know whether we are in a bull market. There is no absolute way of determining when this market happens.

In most periods, a bull market happens after a major downturn in the financial market. For example, it happens after the dot com bubble burst in early 2000s. It also happened after the Global Financial Crisis of 2008 and after the Covid-19 pandemic of 2020.

You can tell whether the market is in a bull or bear market in various ways. The most basic is to look at whether stocks or commodities are continually rising or falling in a certain period. In technical periods, you should look at periods of higher highs and higher lows in the financial market.

There are other characteristics of a bull market. For example, the market is characterized by higher liquidity as investors continue buying assets. Further, it is usually characterized by irrational exuberance, where stocks of all qualities rise. Also, bull markets happen when there are elevated valuation metrics.

When does a bull market start and how long does it take?

In most periods, a bull market starts in a period when stocks are not doing well. It happens after a major dip, which is caused by a significant market event.

As mentioned above, some of the most common bull markets happen after a major event. Some of the most important events in the past few years were the dot com bubble, the global financial crisis, and the Covid-19 pandemic.

As shown above, the bull market that happened after the Covid-19 pandemic started in March 2020 and ended in January 2022. At times, a bull market can last for a shorter period, as we saw in the first chart, the 2023 bull run was a bit short.

Bull market trading strategies

In most periods, market participants can benefit by just buying and holding financial assets during a bull market. You can do that by buying an index like the Dow Jones and S&P 500 and benefiting as their prices rise.

The other trading strategy is where you buy the dip during the bull market. This is a situation where you buy stocks any time they drop during the bear market. When it happens, it usually leads to profits since assets tend to bounce back from their lowest points.

The best way of buying the dip during a bear market is to use a moving average. In this case, you simply buy a stock when it retests the moving average. Other trend indicators that you can use in this case are Bollinger Bands and Ichimoku kinko Hyo. A good example of this is shown in the chart below.

Instead of using technical indicators, you can use trendlines that touch key lows. In most periods, these trendlines are usually seen as good levels of support and buying opportunities.

Summary

A bull market is an important period in the market. In most periods, it has more opportunities than in a bear market. In this article, we have looked at what a bull market is, how it works, and some of the top strategies to use when trading in such a period.

External useful resources

- History of bull and bear market [PDF] – Uidaho