News is an important part of the trading ecosystem, which is why many hedge funds and investment banks pay thousands of dollars per month in Bloomberg Terminals and other expensive news services.

In this article, we will look at how to incorporate price action concepts when day trading breaking news.

Table of Contents

News in the financial market

Every day, we receive hundreds of news from around the world. These news events include economic events like:

- Interest rates

- Mergers and acquisitions (M&A)

- Earnings

- Management changes

- Product launches

among others.

Major news events have impacts on all financial assets like stocks and currencies usually experience major movements when news breaks out.

For example, when a company releases good results, its stock price usually rises. Similarly, when it publishes weak results, the stock price will mostly decline.

M&A Sample

Mergers and acquisitions usually have an impact on the two companies share prices. For example, the share price of the company being acquired tends to rise because of the premium that the acquirer will need to pay. On the other hand, the share price of the acquirer will decline because the acquisition will likely add more debt to the firm.

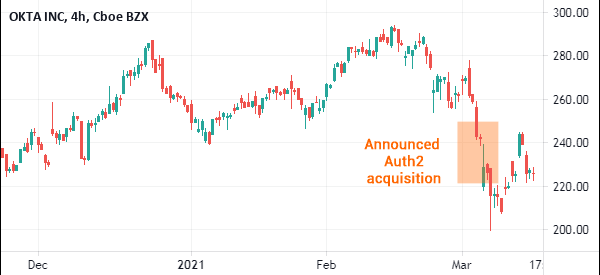

For example, on the chart below, we see that the shares of Okta declined sharply when the company announced that it would acquire Auth2 for more than $6.3 billion. The shares declined simply because traders believed that the company overpaid.

Other popular types of news in the market are geopolitics, macro news, and global pandemics.

Trading the news

As a trader, mastering the process of day trading news can help you perfect your trading and maximize your profits. Traders use several approaches to trade the news.

Access to the latest news

First, you should ensure that you have access to the latest news. For news like earnings, the process is relatively easy because of the earnings calendar (or the economic calendar).

This is a tool that provides a list of all companies that are set to publish their earnings and the analysts’ expectations. You can find this information in websites like Seeking Alpha and Investing.com.

Breaking’s platforms

Second, you should have access to the best platforms that offer breaking news. Fortunately, you don’t need to pay the thousands that hedge funds and other investment managers pay. Instead, you should just subscribe to television channels like Bloomberg and CNBC.

These channels are provided for free by most cable providers and are usually the first ones to break news. Further, you should have access to social media, where most news tend to come out.

» Suggestions for a Twitter’s Feed

Premarket movers

Third, it is important to find the top movers in the premarket. Ideally, since most news comes out at night or in the morning, taking time in the premarket can help you do a better job.

You can achieve this in two ways: First, you can always spend time looking at premarket gainers and losers and identifying the reasons for their action. Second, a simpler way is to have a watchlist that looks at some of the top movers.

At Real Trading, we offer our traders a free watchlist. CNBC also does a list of the top movers every morning.

Trading the news price action

Price action is a trading strategy that includes looking at a chart arrangement and pattern and predicting how the price will move. Unlike other trading strategies, price action does not necessarily require the use of technical indicators like VWAP and the Average Directional Index.

Instead, it relies on several continuation and reversal patterns to identify whether to buy or sell an asset. It also involves identifying support and resistance levels.

Some of the popular continuation patterns you can use to trade the news are:

- Bullish and bearish flags

- Bullish and bearish pennants

- Cup and handle

- Ascending and descending triangles

On the other hand, some of the popular reversal patterns are double and triple tops, head and shoulders, and symmetrical triangles. There are other reversal candlestick patterns that include the hammer, doji, and shooting star pattern.

As a day trader, identifying these chart patterns early can help you understand how to use price action in news trading. They can help you know whether a gap-up will accelerate or whether it will fade.

Further, identifying key levels of support and resistance can help you use price action in a good way.

Use multiple timeframes

A popular approach is to conduct what is known as a multi-timeframe analysis. This is a situation where you draw support and resistance levels starting from a monthly chart down to a short-timeframe chart. These lines will give you a clear picture of what to expect when an asset’s price declines or rises.

For example, the Okta chart shown above is a four-hour. It shows that the stock declined to $199 after the company made the announcement. However, a closer look at the daily chart shows that this was an important level of support because it was the lowest level several times before.

These levels are shown in blue.

Therefore, it is possible to predict the next key level to watch if the stock keeps dropping. In this case, the level to watch is $185, which is the lowest level on September 2020. This multi-time analysis can help you identify the points to watch.

Further, you can also combine price action with some technical indicators. Some of the popular indicators you can use are the MACD, VWAP, and the Relative Strength Index. These indicators will help you identify key levels of support and resistance also.

Final thoughts

Trading the news is an important aspect in day trading. In fact, the market is usually boring when there are no major events. In this article, we have looked at some of the popular events that you should focus on, how stocks react when news come out, and how to use price action to trade the news.