Stocks, commodities, and other financial assets like crypto and bonds are hard to predict. As a result, day traders and investors must always have a strategy that helps them to identify entry and exit points. In this case, the strategies are mostly based on technical and fundamental analysis.

Technical analysis is the approach of relying on chart patterns and indicators to find these points. Fundamental analysis, on the other hand, relies on economic and financial data to make decisions. The most common data used in trading stocks is corporate earnings and macro numbers like inflation and non-farm payrolls (NFP).

This article will look at the concept of a bounce back in day trading and some of the top strategies to use. We will also look at some of the common mistakes to use when trading bounce backs.

Table of Contents

Definition of a bounce back

A bounce back is defined in two main ways in day trading. First, it refers to a situation where a financial asset drops to a certain support level and then resumes its comeback.

For example, if a stock rises from $20 to $40, it can pull back to $30 when it reaches $35. In this case, a trader can buy that dip with hopes that the stock will bounce back in due time.

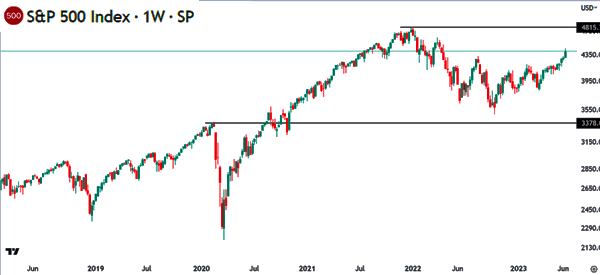

Similarly to this, a bounce back can be when an asset crashes hard and then recovers. A good example of this is the S&P 500 index, which crashed to $2,192 at the onset of the COVID-19 pandemic in 2020. It then bounced back, as shown below.

Profit perspective

The other idea of a bounce back is when you want to recover from a setback, such as a big loss when trading. For example, if you make a big loss, you can strive to bounce back and move to your profit-making ways.

Many well-known individuals have bounced back from their slump in the finance industry. Bill Ackman is one of them. After a stellar track record, Ackman made losses for three years in 2016, 2017, and 2019.

In this period, he lost over $7 billion as his investments went south. He then bounced back in the next few years and he is still one of the best hedge fund managers in the world.

Understanding these concepts of bouncing back is important because, as a day trader, you will go through them. From the chart side, you will always need to buy the dip and wait for the asset to go up. Also, you will make some losses and aim to bounce back.

Approaches to bouncing back

Psychological resilience

The first key approach to bouncing back is psychological resilience. As a human being, you will always feel bad when you go through a difficult situation such as a big loss. It is also normal to go through a period of stress and denial when a big loss happens.

Therefore, in all this, you need to have the best psychological resilience when handling a big challenge. Some of the things that will help you bounce back are:

- Acceptance

- Talking to an expert or a trader who has been there for a long time

- Avoiding rumination

- Evaluating your goals

Other things that will help you bounce back are setting realistic goals, creating an action plan, and seeking feedback from an experienced person. You should also review your approach to find the root cause of the loss.

Taken together, it is not always easy to bounce back from a big loss. Some people take a few months or even years to recover fully. Therefore, you need to take your time, assess the situation and learn from it.

Analytical approach

The other approach of spotting a bounce back relies on your experience and expertise in the financial market. This knowledge will help you identify when an asset is about to bounce back.

For example, technical analysis tools like Andrew’s Pitchfork and the Fibonacci Retracement will help you to identify key support and resistance levels in the market. Technical indicators will also help you to achieve this.

Bounce back strategies

There are several bounce back strategies that you can use in the financial market. Some of these strategies are:

Trend reversals

A trend reversal is a situation where an asset moving in one direction changes and starts moving in another one. In this case, if a stock is falling, a reversal happens when it resumes the upward trend.

Traders use two main approaches to identify these reversals: indicators and patterns. The most popular indicators used to find reversals are moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

For example, you can use a fast and slow moving averages to identify crossovers such as a golden cross. A golden cross happens when the 50-day and 200-day moving averages make a crossover.

There are two types of patterns to use in the market: chart and candlestick. Reversal chart patterns include a head and shoulder, wedge, and double-top and a double-bottom. On the other hand, reversal candlestick patterns are engulfing, hammer, and a morning star.

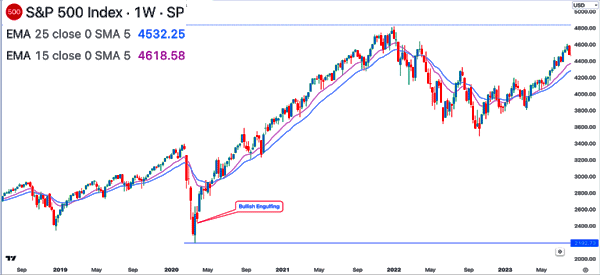

A good example of this is in the S&P 500 chart below. In this, we see that the index formed a bullish engulfing pattern, leading to a bounce back. The 25-week and 15-week moving averages also made a bullish crossover shortly after that.

Scalping

Scalping is another popular strategy used to trade bounce backs. It is an approach where a trader opens tens or even hundreds of trades per day to make a small profit in each.

The idea is that making these small profits per day will translate to something big. For example, a trader who opens 100 profitable trades per day, making just $5 nets $500, which is not a bad return.

In this case, you can specialize on buying an asset that dips hoping that it will bounce back within the session. One approach to this is to use indicators like moving averages, Bollinger Bands, and the VWAP.

Contrarian approach

The contrarian trading approach is a risky one since it involves going against the trend. In most cases, especially in bull markets, people who use the contrarian strategy tend to fail.

One way of doing this is to use the dollar cost averaging (DCA), where you buy an asset several times as it drops. For example, if a stock is trading at $20 and falling, you can buy when it moves to $19.5 followed by $19, $18.5, and $18.

All your trades will become profitable if it recovers. The risk of this approach is where the asset continues plunging with no recovery in sight.

Support and resistance

The most important approach when trading bounce backs is to identify support and resistance. A support is a price where an asset fails to move below several times while a resistance is where it fails to move above a few times.

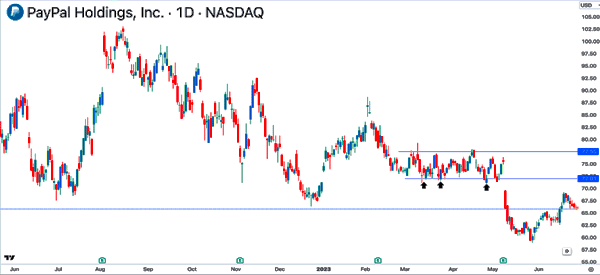

A good example of how you can use support and resistance is shown below. In it, a trader could have used the strategy of buying the stock when it moved to the support level at $72. The risk, as shown here, is where the stock breaks the support and continues falling.

Common mistakes when trading bounce backs

There are several mistakes that people use that lead to substantial losses in the market. Some of these mistakes are:

Ignoring your trading plan

A trading plan is an essential part in day trading in that it is the one that guides a person on where to buy an asset. It also guides them on the size of trades, where to put a stop-loss or take-profit, and how long to hold it.

Therefore, ignoring your trading plan or strategy will often lead to mistakes and losses. Also, you should work to create a good trading plan that includes triggers on when to buy and where to place a stop-loss and a take-profit.

Revenge trading

The other mistake that will hinder you from bouncing back is revenge trading. This is a situation where you attempt to recover your losses after making a big loss. In most cases, people who do revenge trading without doing a lot of research.

Here is an example of how it works. A trader buys a stock at $10 expecting that it will continue rising. But it does not and it drops and drops and hits $7. Making a big loss, the trader ends the trade and decides to short it hoping that the downtrend will continue.

While it is possible to recover and make a profit doing this, in most cases, the trader will often lose money.

Overconfidence

There are several forms of biases that can push you to make losses when day trading. One of these is known as overconfidence, which involves overestimating your skills. It applies to bounce trading in several ways.

For example, if a stock hits a certain support, you might be so overconfident and decide to place a big trade. When it happens, it can lead to a big loss when the price continues falling.

Not doing adequate analysis

The other big risk to have in mind is not doing enough analysis when trading. As a trader, we recommend that you focus on doing both fundamental and technical analysis before entering any position. Doing this analysis will help you identify potential entry and exit positions.

Prop tips for bouncing back

- Continuous learning – Focus on learning new things about trading. Doing this will help you to identify new strategies and avoid common mistakes that people make when trading.

- Adapt to market conditions – The market is highly versatile and traders who are not adaptive will often make mistakes. Therefore, you should learn about how to adapt in various conditions.

- Have a trading journal – This is a document where you enter all your trades, analysis, and their outcome. It will help you prevent making common mistakes in the market.

- Avoid popular bias – Biases like trend-following, anchoring, contrarian, and overconfidence can lead to substantial losses. You should learn more about these biases and how to avoid them.

- Emotional balance – The market can be highly volatile and as such, it is important for you to maintain emotional balance even in difficult periods.

External useful resources

- Bouncing Back After a Big Trading Loss – The Balance