Anchoring bias is an important concept in our daily lives. It is a vital feature that is seen in all areas of our lives such as when shopping and even when investing. When understood well, it can help you make better decisions and let you avoid popular mistakes when buying and selling assets.

Have you ever had a clear idea about something (like the price of an item) at first impression, and not changed your mind even in the face of clear evidence? Now you can name it.

In this article, we will explain what anchoring bias is, how to recognize it (because it’s not always easy) and how to stay away from it.

Table of Contents

What is anchoring bias?

The concept of anchoring bias was not developed with the financial market in mind. Instead, it was created by Amos Tversky and Daniel Kahneman in 1970s to explain how people make decisions and how systemic bias affects their outlook.

The idea behind anchoring bias is a bit easy to understand especially when explained using an example.

Assume that you are shopping for a new smartphone. Like most people these days, the starting point of this process will be in the internet. You find out that the phone you want to buy costs about $1,000 on average. This price then becomes your anchor.

The following day, you go to shop for the phone and you find that the first seller is selling it at $950. Since they are selling it at $50 below your anchor, you then decide to buy it without even negotiating. Besides, this seems like a good deal.

But as you walk home, you find that other sellers are selling the same phone for $800. In this case, anchoring your price to $1000 has cost you at least $200.

There are other areas where anchoring bias is shown. For example, it is possible to estimate the age of a person by looking at how they look and what they have achieved in their life.

You know the Starbucks pricing strategy of the three cups? Well, that falls under anchoring, too.

Anchoring bias in trading and investing

While the concept of anchoring bias was developed with sociology in mind, it is now widely used in the financial market. Indeed, it is one of the main reasons why people make the decisions they make on a daily basis when buying and selling assets. At times, it could lead to a major loss.

Ideally, traders tend to make decisions based on what has been said or written in the financial media or what they believe to be true. Soon we will analyze look at some of the ways that anchoring bias is manifested in the market, but first we want to explain why it is so threatening.

Why is this bias dangerous?

The points to highlight are not many but they are very, very important. A potentially harmful mistake would be to base our analysis – both technical and fundamental, but also price action – only on the first signal we spot. If, for example, we analyze a stock and we identify a trend signal, the risk could be that we do not check for possible reversals.

This leads us to the next point, that is to take wrong trading decisions with subsequent losses. Let’s go back to the previous example: if we enter in a trade relying on a bullish trend but this trend reverses, our trade will surely be negative.

This bias can also be easily matched with other cognitive biases, such as confirmation or overconfidence, making it even more tricky and difficult to detect.

A couple more dangerous biases that can be added are the so called ‘status quo bias‘ and the ‘halo effect‘.

Anchoring Bias: potential triggers

Average analyst rating

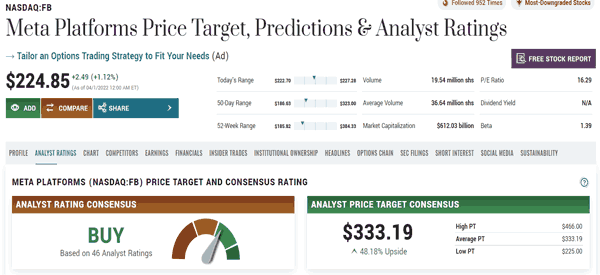

One way that anchoring bias happens is when you base your investment decision based on the average estimate by analysts. For example, using websites like Yahoo Finance, MarketBeat, and WeBull, you can find the average estimate of a stock. This average can then be your anchor and it can cost you a great deal of money.

For example, in the chart below, we see that the Facebook stock price is trading at $224 while the average by analysts is $333. Therefore, if you base your investment decision on this view, you will likely lose money.

Analyst call

Another cause of anchoring bias is an analyst call. While the above example focused on analysts average, this one is about a specific analyst call. It means that you can base your investing or trading decision based on what a specific analyst said.

By basing your trading on this call, you will likely be making a mistake.

Technical indicators

While technical indicators are good tools in analysis, unfortunately, they can also be misleading. For example, you can base your investing on the concept of oscillators like the Relative Strength Index and Money Flow Index.

The conventional view is that a stock will start falling after hitting the overbought level. Therefore, this level will become your anchor and it could fail you when the stock continues rising after hitting the overbought point.

Psychological price

Another cause of an anchoring bias is the psychological price. This happens when you decide to short a stock because it moved above a psychological level of $100 or $200. In most cases, this could be a wrong decision.

How to avoid anchoring bias

Anchoring bias can lead to substantial losses for both traders and investors. Therefore, there are several strategies we believe will help you avoid these mistakes. Here are the ones we think are more important.

Working as part of a team

At Real Trading, we believe in the concept of teamwork when it comes to trading. That is why we encourage our users to be part of a trading floor or office.

Consulting with your team member can help slow the bias substantially. This is the same concept as we looked at above. If you were three of you buying the phone, someone would have suggested that you check other stores before purchasing it.

Multiple scenarios

Another way of avoiding anchoring bias is to always consider several scenarios whenever you open a trade. Taking time to do this will help you map several options and avoid this bias.

For example, when the Relative Strength Index moves above the overbought level, look at other scenarios. In this case, look at other indicators and the reason why it is moving upwards.

Protect your trades

To be clear, it is a bit difficult to avoid anchoring bias in the market. Therefore, it is always recommended to protect your trades using popular tools like a stop-loss and a take-profit. By so-doing, you will avoid making substantial losses even when you are wrong.

Trading sizes

Another way of doing this is to ensure that you are not implementing large trades. In most cases, the bigger the size of the trade is, the more losses you are exposed to. Therefore, limit your trade sizes to avoid making substantial losses.

Summary: How to deal with anchoring bias

The emotional and psychological aspect is something that every trader must be able to manage (but it is valid for all areas). Even if the risk of being influenced by some bias is very frequent, and we are not always able to notice it.

In this article, we have looked at what anchoring bias is, how it works, and some of the top strategies to avoid it.

External useful Resources

- Understanding anchoring bias and its influence on your investment patterns – TataCapital