There are thousands of stocks listed in major exchanges around the world. In the US, the most prominent names are Apple, Microsoft, and Facebook. In Europe, the best-known companies are Royal Dutch Shell, Volkswagen, and Daimler.

As such, these stocks make important moves every day and a stock screener can help you become a more efficient trader.

In this report, we will explain what a screener is and how you can use it in trading.

Table of Contents

What is a stock screener?

A stock screener is a tool that helps you to “sieve” stocks based on several unique characteristics. The goal of this screener is to remove the clutter in stocks.

For example, if you are a trader who focuses on technology stocks, you can use a screener to see only tech firms. Similarly, if you focus on small cap companies, you can use the screener to remove large cap names like Microsoft and Google.

› How to Day Trade Small Cap Stocks

Stock screeners are provided by various digital platforms. Among the most popular websites that offer the tools are Yahoo Finance, Investing.com, Barchart.com, and Webull. Most brokers, too, offer a screener to help their traders make better decisions.

Best stock screener criteria

As such, these stock screeners are usually different but the main parts tend to be the same. Among the most popular criteria are:

- Country – This will display stocks of a particular country like the United States and the UK.

- Exchange – This will show you companies in a specific exchange like Nasdaq and NYSE.

- Sector – This criterion will show you companies in a certain sector.

- Ratios – This will show you companies with a specific ratio. Examples of ratios are price to earnings, price to sales, and enterprise value to EBITDA.

- Volume – This will rank stocks according to their trading volume.

- Fundamental – This will focus on the fundamentals of a company, including revenue, market cap, and margins.

How to Choose the best stock screener

There are several key things that will help you select the best stock screener. First, identify a screener that offers the assets that you normally trade. For example, screeners by Yahoo Finance, Investing, and Market Chameleon tends to have most assets.

Second, look for a screener that is relatively easy to use. In my experience, I have identified several screeners that are relatively complicated to use.

Third, identify a market screener that has more filters. These filters should include technical and fundamental features. Also, look for a screener that is free. There is no need to use a premium screener.

Example in Day trading

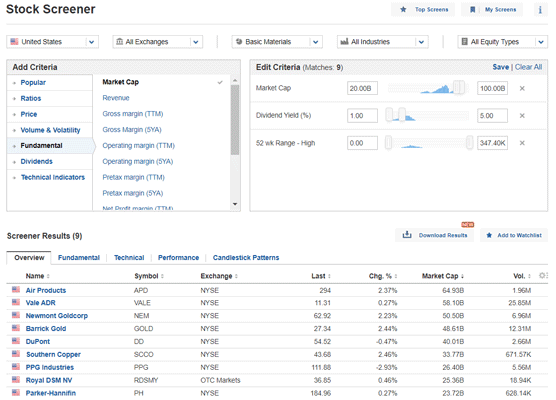

There are other things in a stock screener that you can use. In the chart below, we have used the screener to produce companies with the following criteria:

- They must be firms listed in all exchanges in the United States.

- Must be in the basic materials sector

- Have a dividend yield of between 1% and 5%.

- They must be trading near their 52-week high

- Have a market cap of between $20 billion and $100 billion.

This screening produced 9 companies as shown below.

How to use a stock screener in day trading

The example above is relatively general. As you can see, we have added some items that are not necessarily important for day traders. For example, traders are not necessarily interested in the dividend yield of a company.

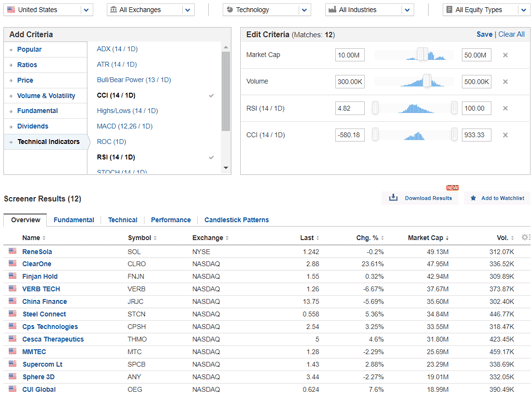

Therefore, in the example below, we have created a screener that one can use when trading.

In this example, we have sieved technology companies with a market cap between $10 million and $20 million. They also need to have a daily average volume of between 300k and 500K.

Also, We have created two technical criteria. As we have written before, volume is important because it will help you show key details of a company and strength of its price action.

Best stock screener settings for day trading

There are many settings that you can filter using a stock screener. For example, as shown above, you can screen stocks based on their geographical location, market capitalization, revenue growth, and price-to-earnings (PE), among others.

However, in most cases, traders are not always interested in these. For example, a scalper does not want to know whether a stock is overvalued or not. What they want to see is price action. This includes stocks that are making strong moves during the premarket and stocks that are hitting their 52-week lows and lows.

You can also incorporate technical tools in the stock screener. For example, you could filter stocks that are trading just above the 50-day moving average.

Advantages of using a stock screener

If you are a stock trader and you never use a stock screener, we recommend that you start using it soon because of its many benefits! Among the key benefits that you get for using it are:

- It is easy to use – As shown above, there are many providers and the process to use it is relatively simple.

- Saves you time – A screener will save you a lot of time to see companies that are within your criteria.

- Identify more signals – A screener will help you identify more signals within a few seconds.

- Identify more companies – You can identify companies that you never heard of before.

Final thoughts

A stock screener is an important tool that can help improve your day trading. It can save you time, identify stocks you have never heard about before and show stocks according to your specifications.

Therefore, we recommend that you spend some time to practice before you go ahead and use it in trading.

External Useful Resources

- Benefits of using a stock screener when investing in stocks – Quant Investing