Investors and traders use different strategies to make profits. There are those investors who believe in holding hundreds of positions while some believe in having a very lean and concentrated portfolio.

Investors such as Warren Buffet have positions in hundreds of companies. On the other hand, investors such as Bill Ackman of Pershing Square Capital believes in having a small portfolio which he can easily monitor. There are other traders who believe in having positions in just one asset class.

It is possible to make money in all these strategies. However, as a day trader, We believe that having positions in very few asset classes is more beneficial.

In this article, we will highlight a few issues about strategies to create a good day trading portfolio.

Table of Contents

Portfolio Construction Models

As a trader, having a good portfolio is very important especially when you want to make trading your career. Therefore, the goal of a portfolio model cannot be understated.

This is because the model acts as the arbitrator among three components: alpha model (the optimist), the pessimist (the risk model), and the cost-conscious (transactional cost model) before making the decision about how to proceed.

The model is important because if you focus on one of the above, chances are that you will make a tremendous mistake!

For instance, if you focus on the alpha, you will tend to be greedy and ultimately lose all your holdings. On the other hand, if you are pessimistic, you will underperform and if you are a cost-conscious person, you will tend to hold positions indefinitely.

Rule-Based and Optimized model

These models are particularly important to people who focus on quantitative trading. To build the models, you can either chose to use the rule-based model or the optimized model.

In the former model, the rules are based on heuristics defined by the quant trader. Since these depend on the trader, they can be simple models. On the other hand, the optimized model uses optimizers which use algorithms to get to a goal defined by the trader.

In rule based portfolio construction model, there are four main ways to do this. These are:

- equal position weighting

- equal risk weighting

- alpha-driven weighting

- decision-tree weighting

In the equal positioning weighting strategy, the users believe that if a position looks good to buy, then there is no other external information is necessary to determine the size.

In equal risk weighting, the model will adjust the position size inversely to their volatilities. As a result, more volatile positions are given smaller allocations while less volatile positions are given bigger positions.

For instance, in a portfolio that has Facebook and Exxon Mobil, Facebook which is more volatile will be given a bigger position than Exxon which is less volatile.

The alpha-driven weighting model on the other hand determines the positions by the alpha model where the model dictates how attractive a position is likely to be.

Conservative vs aggressive portfolios

Basically, a portfolio can fall into two main classes. It can fall into a conservative portfolio or an aggressive portfolio.

The goal of a conservative portfolio is to make some money while limiting some risks. A common approach of doing this is known as the 60/40 rule. In this, investors allocate 60% of their funds to stocks and the remaining in bonds.

Historically, stocks tend to do better than bonds. Therefore, the stocks segment will do relatively well while the returns of bonds will be relatively muted.

On the other hand, an aggressive portfolio is one whose goal is to make a lot of money while risking a lot. Such a portfolio could have risky assets like cryptocurrencies and growth stocks. In most cases, growth stocks like Fubo TV and Affirm tend to generate higher returns than boring dividend aristocrats. However, they tend to be highly volatile.

Investing and trading portfolio

At Real Trading, we are mostly focused on day trading. Still, we always recommend that even day traders should have long-term portfolios.

By so doing, you will be making money by both day trading and by investing. Besides, a long-term investment portfolio will shield you from some of the most common tax related challenges. Also, the portfolio will help you make money through dividends and share buybacks.

Tools that can make up your portfolio

Asset classes

One of the first things to decide as a trader is on the asset class to use. There are many types of asset classes with different subcategories to choose from. For instance, if you decide to trade currencies, there are emerging market currencies such as South African Rand and developed world currencies such as dollar and euro.

If you decide to trade commodities, there are agricultural commodities (such as corn and orange juice) and metals (such as gold and silver) to choose from.

If you decide to trade equities, you can chose between trading various industries such as technology and mining among others.

You can also decide to combine various asset classes. However, in our experience, we believe in trading one or two asset classes.

Correlation

So, as we said one of the first rule of creating a portfolio is to select an asset class that you have a good understanding on. If currencies are your thing, then you should create a portfolio that has various currencies on it.

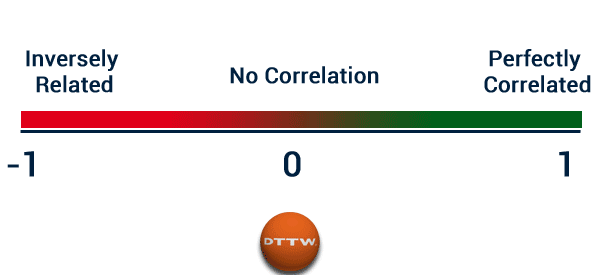

It is also important to conduct a deep correlation analysis for various asset classes that you put in your portfolio. For example, if you are trading currencies, you can conduct a currencies correlation analysis for EUR/USD and GBP/JPY. The reason for this is that the currency pair that you decide to use are all interrelated.

For instance, if EUR/USD pair goes up, chances are that EUR/GBP will go high because of the strengthening Euro. However, these chances are not guaranteed thus the need for this analysis.

In addition, correlation analysis is important if you are trading various asset classes. For instance, if you are trading gold and EUR/USD, you need to understand the relationship between the two.

Gold and the dollar have a near perfect inverse correlation whereby the price of gold will go down when the dollar strengthens. In creating your portfolio, constantly conduct this analysis. There are websites which provide these analysis too.

Portfolio optimizers

For anyone thinking of becoming a quant trader, the portfolio optimizer topic is a very important one.

The optimizers are based on the principles of Modern Portfolio Theory. In short, this theory tends to explain that investors are inherently risk averse. This means that if two assets offer the same return, but at different levels of risk, they will buy the less risky asset. This led to the concepts of risk-adjusted return and mean variance optimization.

In the optimizer, mean and averages will be the key inputs.

Other inputs will be: the size of the portfolio in currency terms, the desired risk, expected return, expected volatility, expected correlation, and any other constraint. By combining all these single inputs, one will be at a good position to optimize his trading.

For new traders, these concepts might seem complicated, We know. In fact, these models are recommended to the sophisticated trader, particularly one who wants to try building his own algorithms to execute trades on his behalf.

Cases of failed quantitative funds are rife to this date. Therefore, if all you need to do is to make money, there are other strategies which we have explained in the past including: scalping, hedging, and swing trading among others. You can use these instead.

How to reduce risks in a portfolio

There are several strategies you can use to reduce risks in a portfolio. These include:

- Having a stop loss – A stop loss will automatically stop your trades when a certain loss threshold is reached.

- Portfolio rebalancing – Rebalancing is the strategy of changing your portfolio when situations change. For example, you could move from growth stocks to value when monetary conditions change.

- Adding less risky assets – Having assets that are less risky in a portfolio can help you reduce risks. These includes assets like bonds and dividend stocks.

- Diversify your portfolio – Investing in a singular asset tends to be relatively riskier than investing in several of them. You should do the diversification well. For example, creating a portfolio of oil and gas companies is not diversification since these stocks tend to move in sync.

Watch your portfolio

As we have written before, none of these models is perfect. A common misconception about diversifying your trades is that it will make you money all the time. The fact is that it is possible to lose money in a diversified account even more than in a single asset.

As stated aboce, You should place stops to limit the amount of money you lose.

A good example of this is a hedge fund which nearly led to the collapse of the financial markets in the United States. Long Term Capital Management was a highly sophisticated hedge fund with partners who included 3 Nobel winning economists. The fund also had top-notch PhD physicists to develop the systems.

For three years, the fund returned more than 30% of net returns. But, in the fourth year, the fund collapsed.

Final thoughts

Portfolio creation is an important aspect for anyone who wants to make money in the financial market. In this article, we have looked at what a portfolio is, how to create one, and how to combine your day trading with your long-term portfolios.

External Useful Resources

- Modern Portfolio Theory: Why It’s Still Hip – Investopedia

- The Fall Of Long-Term Capital Management – BusinessInsider