Momentum is an important and common concept in the financial market. It is applied by both long-term investors and day traders.

In general, there are two primary types of momentum in the market. There’s one that involves technical analysis and another one that has fundamental aspects.

In this article, we’ll look at various ways of using momentum in trading and some of the indicators that can help you do that.

Table of Contents

What is momentum in finance?

The term momentum refers to a force that keeps an object moving after the trend has already started. In finance, it refers to a situation where the price of an asset continues moving in a certain direction. In most cases momentum tends to defy logic.

A good way to look at momentum is to identify some of the best-performing stocks in recent years. For example, at the time of writing, Tesla is worth almost $797 billion. This makes it the most valuable automaker in the world even though it sold fewer cars than Toyota and GM.

In contrast, a company like Toyota sells more than 10 million cars every year. The reason why Tesla shares have performed so well is that there is momentum going on.

Another good momentum is Roku, the company that sells streaming devices. The firm is now worth more than $9.5 billion even though it has no strong profits.

This performance is primarily because of the perceived market size that Roku is looking up to and the fact that investors believe that it will dominate the television advertising industry.

The field of momentum is extremely large and highly-profitable. In fact, a look at historical performance shows that momentum traders make more money than other types of investors.

Using momentum in trading

Day traders can use momentum in two primary ways.

Momentum Stocks

For one, stock traders can focus on momentum stocks since they tend to be extremely volatile. For example, since Tesla is always in the news, one can make more money trading it than General Motors (a blue-chip stock).

Similarly, one can make more money day trading a highly-volatile stock like Roku than a traditional company like News Corp.

Trend Following

Another way of using momentum is known as trend following. This is a situation where traders look at a stock or another asset and jump-in in its direction. For example, if the EUR/USD is rising, they can take advantage of the price action and buy the pair.

Similarly, if Nikola’s stock is falling, they can short it and make money as the price drops.

Pre-trading preparation

Day traders using momentum trading should always do pre-trading preparation. Some of the top activities you should focus on before trading are:

Do your research

First, you should always do in-depth research about the market and various assets. The best way to do this is to read the news every morning and find some of the top events of the day.

These events could be corporate earnings, central bank actions, geopolitics, and even statements by analysts. Although fundamental analysis is not of great interest to day traders, understanding why a particular asset moves is critical.

Identify top movers

The next stage is where you identify the top moving stocks in the market. Ideally, you mostly want to trade companies that have either a bullish or bearish momentum. For example, you should consider companies with big moves.

One of the top ways to do this is to use a watchlist, a document that lists the most notable s stocks in the market and the reasons they are rising or falling.

Find notable stocks

Another way is to find notable stocks in the market. For example, you should identify shares that have just reached their 52-week high or low.

Also, you can look at technicals such as stocks that have moved above and below the 50-day moving averages.

Have a good entry and exit strategy

Like with other trading approaches, it is always important to have a good entry and exit strategy. An entry strategy refers to the conditions that are required for you to enter a trade.

For example, some people enter a trade only when the 25-day and 50-day moving averages make a bullish crossover.

On the other hand, an exit strategy refers to the conditions that need to be in place for you to exit a trade. For example, you can decide to exit a trade when it crosses the 50-day moving average when pointing downwards.

As part of your momentum strategy creating process, you should aim to find the best entry and exit strategies. You should also take time to test and retest the strategy to find the best positions.

In addition to technical indicators, you can also use chart patterns like head and shoulders, rising and falling wedges, cup and handle, and rising and falling wedge pattern.

Why volume and liquidity matters

A key thing to have in mind when thinking about momentum trading is volume. As mentioned above, it is always good to look at stocks that are making strong moves in the market.

As you will find out, most of these stocks are usually penny or biotech stocks. In most cases, these stocks tend to have limited volume and liquidity, Trading such stocks will always be difficult.

Therefore, before you enter a trade, look at its overall volume and liquidity in the market. Doing so will prevent you from buying stocks that are often difficult to exit from. It will also help you avoid trading stocks that are commonly pumped.

Top momentum indicators

An ideal way of trading using momentum is to use indicators. Fortunately, there are several indicators that can help you in this. For example, an indicator that is popular among momentum traders is the moving average.

Ideally, traders use the moving average to identify when the momentum is losing steam. For example, in the chart below, we see that the dollar index is in a sharp downward trend. As a result, the ideal action is to place a short on the index and make money as the price falls.

The challenge many day traders have is that they don’t know when the momentum is nearing its end. Therefore, using the 40-day exponential moving average can easily show them when to exit the short trade, as shown below.

Using the momentum indicator

Another popular indicator you can use to trade momentum is the momentum indicator that is available on most platforms like the MetaTrader and TradingView. The indicator appears like a single line that moves up and down below the chart. It basically measures the rate of change or speed of a financial asset.

As a result, by looking at this momentum, one can easily see whether the momentum will continue or whether it will change entirely. You can also use the indicator to identify divergences and even continuations.

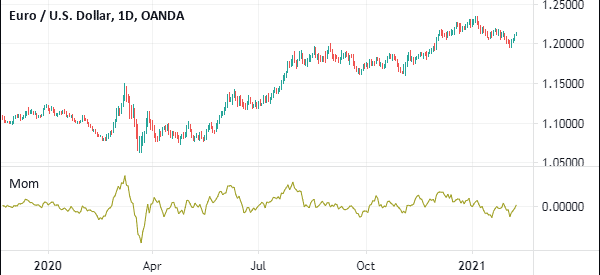

As shown in the EUR/USD chart below, the price continued to rise when the momentum indicator was above zero. This is known as the zero-line rule. In most cases, a sell signal will emerge when the price moves below the zero line.

The zero line plays a crucial role in the momentum trading, which dictates that you should buy when the momentum indicator crosses above the zero line and sell when it dips below it.

Why would you do that?

When the momentum indicator rises above the zero line, it means the price is trending upward, so it’s a good time to buy. When the indicator drops below the zero line, the price is trending downward, so you should sell.

Using the MACD in momentum trading

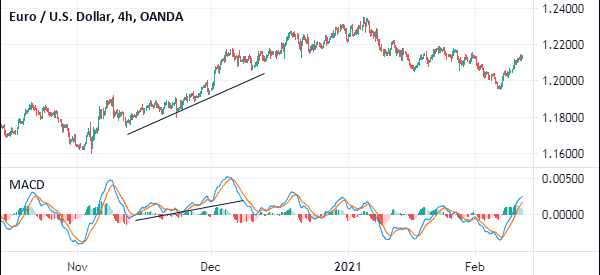

Another popular indicator you can use in momentum trading is the Moving Average Convergence Divergence (MACD). This is a relatively simple-to-understand indicator that converts two moving averages into an oscillator.

In most cases, the period of the fast moving average is 12 while the long MA is 26. The smoothing average used is 9.

Therefore, you can use the MACD in momentum trading when the two main moving averages have a crossover. For example, if the price of an asset is in a bullish momentum and the two moving averages crossover, it is usually a sign that the momentum is waning and it is time to short.

Similarly, in a bearish trend, when the two lines crossover, it is usually a signal to go long. A good example of this action is in the EUR/USD chart shown below.

Chart patterns and momentum trading

In addition to technical indicators, you should focus on chart patterns. There are two main types of chart patterns like reversals and continuation.

Reversal patterns like head and shoulders, rising and falling wedge, and double and triple top usually form before a new momentum forms. For example, Microsoft shares formed a triple-bottom pattern below before starting a strong bullish trend.

There are also continuation patterns like bullish flag and bullish pennant that you can always consider. These patterns point to more upside in the near term. As such, it makes sense to buy an asset when the price forms such a pattern.

Requirements for the momentum strategy

There are numerous requirements that are needed to do it well. First, you need to focus on continuous learning. This is a situation where you commit yourself to more learning by avoiding the comfort zone bias.

Comfort zone bias is a situation where you get comfortable with your performance. Instead, learn more details about how to improve your approach to trading.

Second, always stay up to date with the current state of events. As you will notice, news is an important part of momentum trading.

In most cases, stocks that have substantial momentum are those that are in the headlines. Above all, be updated about key issues in the market like geopolitics, earnings, and economic data.

Third, be adaptive to new events in the financial market. For example, if a stock has been in a strong bullish trend, you should prepare when conditions in the market change. For istance, if an asset was rising because of strong earnings, be ready to change direction when these conditions evolve.

Finally, adjust your trading strategy. As mentioned above, there are several momentum trading strategies, including moving averages and MACD. In this case, you can adapt other approaches when conditions change.

FAQs

What are the best risk management strategies in momentum trading?

Risk management is an important part of all trading strategies, including momentum approach. Some of the top risk management strategies to consider are: avoiding FOMO, position sizing, not leaving your positions open overnight, not using too much leverage, and avoiding common biases like anchoring and overconfidence.

What are the best indicators for momentum trading?

As mentioned above, there are numerous indicators you can use in momentum trading. Some of these common indicators are moving averages, Ichimoku Kinko Hyo, Parabolic SAR, and the Relative Strength Index (RSI).

Can I use momentum strategy in a ranging market?

In most cases, it is difficult to use the momentum strategy in a range-bound market. A key solution in this is to find companies that are doing well in that period. In this, you can find moves like stocks reaching the 52-week high and low and most active stocks.

What are some risks of momentum?

The biggest risk of momentum is when you buy at the top and then the price starts its reversal. The other risks are liquidity (especially when trading penny stocks), a sharp reversal (because of unexpected news), and emotional control.

Summary

Momentum is an important component of both day trading and long-term investing. It is an approach that works when used well. In day trading, we recommend that you identify some of the best momentum stocks and then come up with a strategy.

Also, you should learn more about support and resistance and momentum indicators.

External Useful Resources

- A Deeper Look At Momentum Strategies – Forbes