In the beginning of April, 2018, we all saw how the market that has been on an upward trend for years can lose its momentum within just a few days (but we could give many other examples).

During the crash the markets, which had been up for more than 7% turned negative, costing investors billions of dollars.

The choppiness of the market was also seen in 2020 at the start of the Covid-19 pandemic. At the time, stocks declined while crude oil price declined to the negative zone. The same situation happened during the Global Financial Crisis. At the time, most indices like the Dow Jones and S&P 500 went through significant ups and downs.

So, as a trader, how do you navigate these (and others) choppy markets? Below we are going to cover the five things you need to watch out for.

But first, let’s define what a choppy market is.

Table of Contents

What is a choppy market?

A choppy market is defined as a period when the market is making significant moves up and down. The choppiness can happen within a short period or an extended period of time. Also, it can happen in a single asset like a stock or in the broad market index like the Dow Jones or the S&P 500.

How to identify a choppy market

The easiest way to identify a choppy market is to look at the performance of major market indices. In the case of American stocks, you can look at the performance of key indices like the Dow Jones or S&P 500.

In countries like Europe, you can check the overall performance of indices like the DAX and FTSE 100. If you see major moves, then you can dig deeper to identify choppy stocks.

Another way to identify a choppy market is to look at key market gauges like the CBOE VIX index to see its level. In most cases, the VIX tends to rise in a period when the market is choppy. Or another tool called just choppiness index.

Choppy market for day trading

Long-term investors don’t love choppy markets. Instead, they prefer a period when their assets are moving in an upward trend. Traders, on the other hand, love it when there is volatility or choppiness because of the large swings that happen.

There are several strategies available when trading in a choppy market. For example, you can open bracket orders. This is where you focus on setting a buy-stop and a sell-stop and then protecting the trades with a stop-loss or a take-profit.

Another strategy is scalping, where you open a trade and then exit within a short period once you make a profit.

Why is this market risky?

While choppy markets are good for traders, they are also risky because there is no well-defined trend. As such, it is impossible to use the trend-following strategy, which is one of the most profitable.

Another risk when trading in choppy markets is that you are never sure when a stock will be halted. It is possible that a stock is halted when you have a position.

Ok, now it’s really time to see 5 strategies to trade in a choppy market!

Choppy Market Strategies

Look at the Treasury Yields

Investors are always risk averse. They like investing in the safest assets! Stocks and other assets are often riskier, because a company can go bankrupt. On the other hand, government bonds are usually safer because, a country has several ways of raising money.

As a result, the yields on the bonds are usually low, especially when people find that the country will have a challenge paying back the debt.

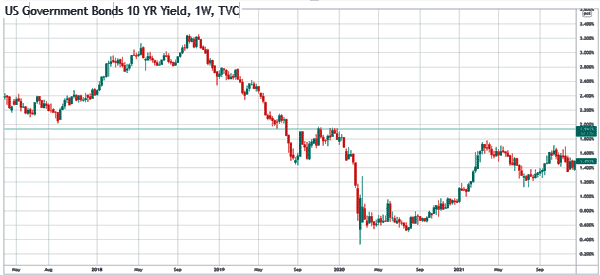

This is what happened almost in March 2018: Treasury yields soared after traders started worrying about the country’s financial position. As shown below, the yields on a ten year rose to almost 3%, which was the highest level in years. So, always pay attention to what is happening in these markets.

→ Yield Curve: Meaning and What You Need to Know About it

Focus on Trade Wars

The world is safer when there is free and fair trade. Unfortunately, we are not in a place of free trade.

For example, while China can continue to export almost everything to the United States, the vice versa is not true. Foreign companies entering the Chinese market find it so difficult.

To solve the issue of trade imbalances, the U.S under Trump started a trade war by putting in place tariffs on several products like Steel and many other.

At the same time, Trump has promised to either fix the NAFTA agreement or exit the deal all-together. This was very important, because an exit from NAFTA could lead to another trade war in an important region.

Focus on Geopolitics

Geopolitical issues are very important. What happened (and sure, is still happening) in the Middle East and Russia could lead to significant implications to the world order.

Therefore, as a trader, you need to have a good understanding about the policy issues in the Middle East, North America, Russia, and South America.

Always Be Informed

Today, it is very important for traders to be ahead of the flock. The way to go about this is being informed about everything.

There are several ways to do this, but the most important one is to have mobile applications, to give you access to breaking news.

Some of the most important apps that We recommend are: Bloomberg, Reuters, Investing.com, and Yahoo Finance. These apps will give you notifications when new things happen.

Always be hedged

As a trader, it is always very important to be prepared for the worst. One way to do this is to ensure that your account is hedged.

There are several ways of doing this. For example, you can consider pairs trading, where you buy and sell financial assets simultaneously. You can also consider buying hedging instruments like VIX and Gold.

External useful resources to understand Choppy Markets

- What Is a Choppy Market & How to Identify Ranging Markets? – BullishBears