How has top Silicon Valley companies like Apple, Amazon, Google, and Facebook achieved so much scale at the world stage? How have they managed to reach valuations of $500 billion and above?

The answer is in their strategies.

These companies have the best strategies to dominate the world. For example, Facebook has achieved a global scale by offering its products free of charge while Apple offers its products to a loyal user base for a premium. Apple has invested in quality and loyalty.

Let us bring this close. How has Warren Buffet managed to achieve success for more than five decades? The answer is that Buffet has mastered his strategy of value investing. He has avoided investing in companies he doesn’t understand.

In the dot com bubble, he had the capital to invest in the new dot com companies. He had an opportunity to make a fortune, but, he avoided to do that because those companies did not meet his value investing criteria.

Is it easy to build these strategies? No. It takes patience and consistency, even learning from your mistakes.

But once fine-tuned, are these foolproof? Not even. The market is constantly changing, which is the reason why it is crucial to keep optimizing one’s strategies over time.

Table of Contents

The importance of your trading strategy

As a trader, it is very important to have a good trading strategy. A strategy that has been tested and backtested using historical data.

By having such a strategy, you are able to navigate complex and volatile markets without having any worry. Remember, there is no trading system that is 100% perfect. Optimizing your system will help get your system close to that.

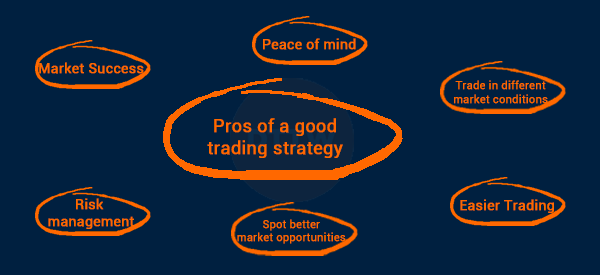

There are several benefits of having a trading strategy in the market. Some of them are:

- Market success – Having a good trading strategy will help you achieve success when trading all assets.

- Peace of mind – When you have a strategy, you will have peace of mind in all market conditions.

- Different market conditions – A strategy will help you achieve substantial success in both ranging and volatile conditions.

- Trading becomes easy – A trader with a good trading strategy often makes the whole process easy.

- Spot market opportunities – Further, the process helps traders to spot market opportunities.

- Risk management – Finally, another benefit is that it helps to mitigate risks.

How to refine your strategy

There are several strategies you can use to refine your trading strategy. First, you should consider having a trading journal. This is a document where you write down all details about your trades.

For example, you can write down why you entered a certain trade, the profit or loss it generated, and other important notes about the trade.

Just to give a couple more examples: was there any news that affected the stock? How much were the volatility and volume traded?

Introspection

Second, you can set private meetings with yourself where you assess your performance and identify areas where you can improve. These meetings are essential because they will help you identify your weak points and how you can improve them.

We just had some winning trades. Great! But could we have done better? Maybe we could have identified the entry point earlier, or we could have held the asset longer.

Instead, We had bad trades and suffered losses. In addition to reviewing the journal, we should understand the causes of our mistakes. Was it a miscalculation on our side, perhaps because we underestimated some signals? Or was the analysis okay and it was just a particular event?

Test more strategies

Third, you should refine your strategy by testing the performance of several of them and gauging the best-performing one.

For example, you can decide to test strategies like scalping, swing trading, and algorithmic trading and assess the best-performing one.

Refine your strategy: actionable steps

Backtest

First, you need to backtest your strategy. This is where many new traders go wrong. They create a strategy, test it in their demo account for a few days, and when it works, they believe that they have a good strategy.

In many cases, when this is done, it is usually the start of the end for the trader.

Truth is, any trading strategy needs to be backtested using long-term data. This is data that has existed for a long time.

Fortunately, this data is freely available in most trading platforms. Using historical data will help you see how your strategy would have performed in the long-term.

Set parameters

Secondly, you need to regularly add or remove parameters from your strategy. Even when you have backtested the data, the fact is that conditions will change in future.

Therefore, you should always analyze the strategy and make changes when necessary. Doing this will help you remain active and improve your trading strategy.

Do you remember? We said above ‘no trading strategy is 100% perfect’. Here, market conditions are one of the most relevant reasons, so we always have to adapt to what the markets tell us.

Don’t go it alone

Third, to optimize your trading strategy, We recommend that you don’t develop your strategy alone. We recommend that you work as a team to create and test the strategy.

When you work as a team, you will be at a good position to find opportunities and vulnerabilities in your system. Especially when it has not yet been implemented in live, but only in demo mode.

Don’t stop learning

Fourth, We recommend that even when you have a good trading strategy, you take time to learn. You should not just sit there and wait for the strategy to work out well.

As a trader, you should always work to expand your knowledge about your trading strategy (following the model of the t-shape approach). You can do this by watching videos, listening podcasts, reading books and engaging with fellow traders.

By doing this, will help you expand your knowledge and experience on trading. It will empower you to become a better trader and learn new tricks to improve your trading strategy.

Final thoughts

As We mentioned, no trading strategy is ever perfect. Your role as a trader is to work hard to optimize your trading strategy to make it better every day. Doing this will ensure that your strategy continues to be better.

External useful resources

- Optimizing a Trading Strategy without Backtesting the Alpha – Medium