Meta Platforms, formerly known as Facebook, is one of the biggest companies in the world with a market cap of over $735 billion.

According to Companies by Market Cap, it is the 9th biggest company in the world after Apple, Microsoft, Saudi Aramco, Alphabet, Amazon, Nvidia, Tesla, and Berkshire Hathaway.

Does such a well-known symbol represent a good trading opportunity or not? Of course, it does! The ones who benefit most are those who trade stocks with a very short time horizon.

In this article, we will look at how to invest and trade in Meta Platforms.

Table of Contents

What is Meta Platforms?

Meta Platforms, the parent company of Facebook, is bigger than what most people believe. The company owns several other platforms that have billions of users internationally.

It owns Instagram, which has over 2.35 billion users. Furthermore, Whatsapp has more than 3 billion users. Meta owns platforms like Messenger and Reality Labs, which focuses on virtual reality.

How Meta Platforms makes money

Meta Platforms makes a lot of money. Its annual revenue jumped from over $7.8 billion in 2013 to over $116 billion in 2022. Its revenue has risen from $55.5 billion in 2018. It is also one of the most profitable companies globally.

Meta Platforms annual profit moved from $1.5 billion in 2013 to over $23 billion in 2022. Its biggest annual profit came in at over $39 billion in 2021.

Therefore, the biggest question is how Meta Platforms makes money. It makes most of its money from advertisements. Like Google, the firm enables people and companies to advertise on its platforms. These adverts account for more than 90% of its revenue.

Meta Platforms also makes some money in other ways. For example, it has some fintech solutions that makes it possible for people to pay and send money.

Related » Large Cap vs Small-Cap Stocks

How safe is Meta stock?

Meta Platforms is a leading company that has some key pros. For example, it has a solid balance sheet with over $37 billion in cash and short-term investments.

At its peak, the company had over $67 billion in cash and investments. Its total current assets stands at over $52 billion.

Meta Platforms has little debt for a company of its size. It has over $9.9 billion in long-term debt, meaning that it can easily pay back its debt. Most importantly, the company has also been reducing its outstanding shares.

Related » Economic Data Day Traders Should Monitor

Meta Platforms risks

Despite this, Meta Platforms has several risks ahead. For example, its biggest challenge is TikTok, a Chinese application that has billions of users internationally. TikTok is slowly stealing market share from platforms like Instagram and Facebook.

Further, there is a view that Meta Platform’s assets are ancient. For one, most people who use Facebook are between 25 and 34. This is a major challenge since its most ideal users should be young.

Meta also has several other risks. For example, unlike Apple and Alphabet, the company does not control its ecosystem since it does not have its own operating system. A few years ago, Apple introduced a new upgrade that removed trackers in its iOS platform.

The challenge for this is that Meta Platforms’s apps use trackers to target ads. As a result, Facebook and Instagram have struggled to target ads on its platform.

In addition, the company is facing substantial regulatory scrutiny because of how it handles customer data. It has also lost some credibility in some corners of the US, where people see it as being too liberal. It has been accused of suppressing conservative views.

Biggest Meta Platforms competitors

Meta Platforms competes with a handful of companies. The biggest competitor is Alphabet, a company that has a strong market share in the digital advertising industry. Google has its eponymous brand and other platforms like YouTube and Android.

The other big Meta Platforms competitor is TikTok, a platform that has become popular among users and advertisers.

Other leading competitors are Snap, Twitter, Pinterest, and even Netflix. The latter company started offering advertisements on its platform.

Does Meta Platforms pay dividends?

Meta, like other similar tech companies, does not pay dividends. Instead, the company uses its revenue and profits to fund its growth.

However, because of its strong cash balances, most investors believe that the company will start paying dividends in the next few years.

While Meta does not pay dividends, it has other ways of returning money to investors. The company spends billions of dollars every year buying back its own shares.

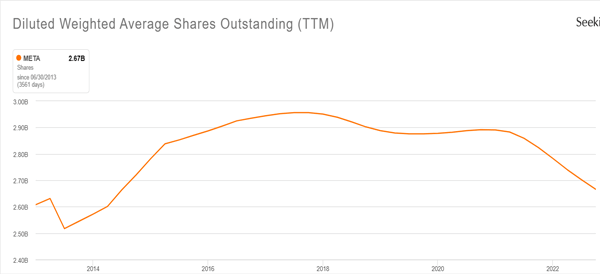

Share repurchases are important because they reduce the number of outstanding shares and boost the earnings per share. As shown below, the number of outstanding shares has dropped sharply in the past few years.

How to invest and trade in Meta

Meta Platforms is one of the best companies to trade and invest in, thanks to its high float, liquidity, and high volatility. There are several things that affect the company’s stock price, including:

Earnings statement

The biggest catalyst for the Meta Platforms stock price is its earnings, which come out every quarter. There are several factors that traders and investors looks at in its earnings release, including:

- Headline revenue and earnings – Traders and investors look at the company’s revenue and profitability numbers. Better results tend to lead to a higher price.

- Forward guidance – The headline results are important but most traders look at the forward guidance. As such, it is often possible for its stock to drop after publishing strong earnings. This happens when the firm provides a weak guidance,

- User metrics – Meta Platforms shares tend to react to its user growth metrics. Recently, however, these numbers have not led to volatility because the company’s user metrics have been a bit mild.

Regulatory issues

Meta Platforms is disliked by both Republicans and Democrats. Republicans worry that the company is interfering with free speech and limiting conservative talk.

Democrats, on the other hand, argue that the company does not do much to protect users. Therefore, the company is facing numerous investigations, which could affect its stock.

Metaverse

Meta Platforms has been investing in the metaverse, making it one of the biggest players in the industry. However, the company is yet to gain traction in the industry.

Therefore, the performance of the stock will depend on the performance of the division.

Technicals

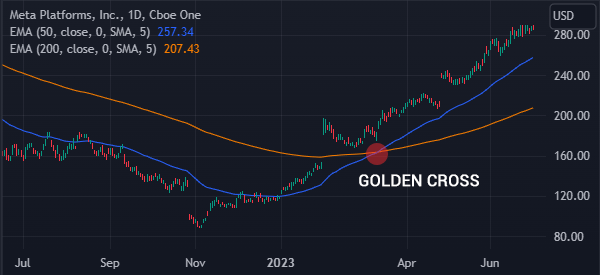

Finally, the stock tends to react to its technicals. For example, it tends to keep rising when it forms a golden cross pattern, where the 50-day and 200-day moving averages make a crossover.

A good example of this is shown in the chart below. It also jumps when it makes a bullish breakout above a key resistance level.

Summary

Meta Platforms is moving from being a well-loved growth stock to a value stock. It is facing major headwinds, including its failure to conquer the metaverse and competition with TikTok.

Therefore, we recommend that people should focus on day trading the company instead of investing in it.

External useful resources

- How to buy Facebook stock & shares – BrokerChooser