Forex trading is a popular way of making money in the financial market. It involves buying and selling currency pairs with the goal of making a profit. In most cases, traders use leverage to maximize their profits.

To analyze different pairs, traders use different approaches depending on their style. The study of news stands out among them.

As you may have guessed, in this article, we will explain the concept of fundamental analysis applied to forex trading.

Table of Contents

What is fundamental analysis in forex?

Currency pairs are moved by a number of factors like news and economic data. For example, in most cases, the US dollar will tend to rally sharply when the Federal Reserve decided to embrace a more hawkish tone.

In 2022, the currency surged to the highest point in more than 20 years when the Fed decided to hike interest rates by more than 300 basis points.

Therefore, the fundamental analysis aims to identify the current macro data and news and then predict the performance of a currency. Traders look at the economic calendar to anticipate moves in the market. Also, they interpret the latest news to determine whether a currency will rise or fall.

Fundamental vs technical analysis in forex

Fundamental analysis is different from technical analysis. The latter relies on chart analysis to determine whether to buy or sell a currency pair. It involves several important approaches.

First, traders use technical indicators to predict whether a currency pair will continue the current trend or reverse.

Second, traders focus on chart pattern analysis, where thy look at continuation and reversal patterns. The most popular chart patterns in forex are triangles, head and shoulders, and rising wedges.

Third, there are candlestick patterns that are formed by one or two candlesticks to predict the next price action. The most popular candlestick patterns are hammer, doji, harami, evening star, and shooting star among others.

Key data in forex fundamental analysis

There are several important data that traders look for when doing fundamental analysis in forex trading. Let’s dig into the most important ones, at least to us.

Employment data

Jobs are an important part of any economy. Traders use jobs numbers to determine the strength of an economy. In most cases, an economy that is doing well tends to add a significant number of jobs. Therefore, forex traders look at these numbers to determine whether a central bank will hike or lower interest rates (in short, they consider monetary policy).

Jobs numbers are important because they form part of a central bank’s dual mandate. These banks are mandated to ensure that the economy has a low unemployment rate and that is adding more jobs. The most closely-watched jobs numbers in forex trading are from the US. Traders watch the following key data.

- Jobs added – The NFP data shows the number of non-farming jobs added in an economy. A higher figure is preferred.

- Unemployment rate – This number shows the percentage of people of working age who are out of work.

- Wages – Wages are an important part of an economy. In most cases, wages rise in a strong economy when people are competing for talent.

- Participation rate – This number shows the percentage of people of working age who are working.

Inflation

Inflation is another important data in fundamental analysis. It refers to the overall change of prices of items in an economy. Inflation forms the other part of the Fed’s dual mandate in that the bank is required to ensure a stable prices.

When inflation gets out of hand, as it happened in 2022, the Fed tends to react by hiking interest rates. There are several measures of inflation that are watched closely:

- Consumer price index (CPI) – The CPI measures the change in prices of most items in a country like food, energy, and furniture. Core CPI excludes the volatile food and energy products.

- Producer price index (PPI) – The PPI measures the change in selling prices received by domestic producers for their products.

- Personal Consumption Expenditure Index (PCE) – This is the Fed’s most accurate inflation gauge. It measures the prices that people in the US are buying on their behalf.

Retail sales

Another important data in fundamental analysis is known as retail sales. It measures the volume of goods sold by retailers in the US.

It is an important economic data because of the crucial role that the retail sector plays in the economy. In most cases, the volume of retail sales rises when an economy is doing well.

Manufacturing and services PMI

The manufacturing and services PMI numbers are published every month. They provide an estimate of the output of the two industries on a month-on-month basis. A figure of 50 and above is usually a sign that the industry is growing. On the other hand, a drop below 50 is a sign that the industry is growing.

There are other important data that forex traders watch in fundamental analysis, including:

- Industrial production – It measures the output of key industries like mining, agriculture, and manufacturing.

- Consumer confidence – This is an important data since consumer spending is the biggest constituent of the American economy.

- Housing data – The most popular housing data are the house price index (HPI), new and existing home sales, pending home sales, building stats, and housing stats.

Economic calendar in fundamental analysis

A common question is on how to find the latest news and economic events in forex trading. The economic calendar is an important tool that provides a schedule of the upcoming economic events.

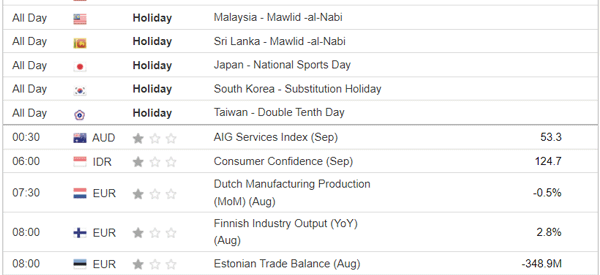

Most forex traders look at the calendar every day before they start trading. The chart below shows how an economic calendar looks like.

As you can see, the calendar has the date, time, affected currency, implied volatility, actual, forecast, and previous.

How to use fundamental analysis in forex trading

Fundamental analysis is an important way to predict the direction of a financial asset. However, in most cases, it is ideal for traders with a medium to long-term horizon. Scalpers only use the economic calendar to anticipate volatility across key currency pairs.

In fundamental analysis (in Forex), all economic data flows to central bank decisions. In most cases, strong numbers usually signal that the central bank will start or continue embracing a more hawkish tone. On the other hand, weak numbers point to more easing in a bid to boost the economy.

Summary

Fundamental analysis plays an important role in day trading. This, however, differs depending on the asset we are considering: analyzing news about a stock requires different data than those interested in currencies.

That is why it is important to understand how to use fundamental analysis specifically for forex trading and how we can use this data to build strategies. Also, we have explained the common economic data in this type of analysis.

External useful resources

- What factors should I consider in my Forex fundamental analysis? – Quora