Running a trading and investing company can be a highly profitable venture. Besides, one does not need a lot of funds to start one unlike other capital-intensive businesses like manufacturing and logistics.

For example, you don’t need to have a standalone office space to start a trading business. In fact, most people start this business in their homes.

In this article, we will look at the ideal process for starting a trading company or business. As you will see, starting such a business is not easy and the steps you take early on will have an impact on its success

Related » Is day trading right for you?

Table of Contents

Trading as an employee, independent trader, and office manager

There are three main ways in which you can start your journey in the financial trading and investing industry.

Start as an employee

First, you can start as an employee of another trading floor, investment bank, prop trading company, or hedge fund. This is where most successful people start their trading careers. The idea is to get a job in one of these institutions, learn how the industry works, and then move ahead and start your trading company.

Indeed, many well-known trading and investing companies were started by people who had experience working for others. For example, Steve Schwarzman started Blackstone after working in Lehman Brothers for a while. Similarly, Philip Duff started Duff Advisors after working for Tiger Global for a while.

Independent trader

Second, you can start your trading floor as an independent trader. This is a process where you start your trading journey independently and then grow it within some time. In this, most people start as retail traders using brokers like Robinhood, Schwab, and WeBull.

Related » Retail Trading vs Proprietary Trading Accounts

As they become more successful, they then shift their focus to creating their own firms.

A good example of this is Ken Griffin, who started his hedge fund, Citadel Advisors, after graduating from Harvard where he was trading all types of assets. Today, Citadel is one of the biggest hedge funds in the world with over $50 billion in assets under management.

Office manager

Finally, you can be an office manager. This is where your focus is on trading and managing the operations of the trading floor. It could be your own floor or one owned by another person.

As you will find out, managing a floor has so many challenges and only a handful of people succeed in it.

A trading floor is an ideal trading business!

In a recent post, we noted that successful traders are those who do it as a business. This includes people who are retail traders and those who work in an organization structure.

As an independent trader, you have two main options to run it as a business. First, you can decide to use a retail account such as the one provided by Robinhood and WeBull to trade. Second, you can decide to start a trading floor, possibly using a prop trading firm like Real Trading.

In our experience, we believe that traders should embrace the latter option. It is not meant to be something self-serving, now we will explain why.

More scalable

For one, running the trading floor or office is more scalable than operating an independent trading account.

In this, it is relatively easy to hire traders and even raising capital from high-net-worth individuals and even institutions. It is relatively difficult to do that when running a regular trading account.

If you are having trouble scaling your business, you might also take a look at our guide to changing your trading approach.

Team Working

Second, running a trading floor is better because having more people is usually better than being a lone trader.

For example, it is possible to validate ideas before you implement them in the market. Many people who run their trading floors with Real Trading often start the day with meetings in which they deliberate on the prevailing market conditions.

Growing experience and expertise

Third, a trading office is an ideal place for people to grow their trading experience and expertise. In most cases, highly inexperienced people have managed to grow and become excellent traders when being part of a trading floor.

Related » Trading Mentor: Why It Matters (and How to Find the Right One)

Most importantly, a trading floor will often be more profitable than a retail trader. For one, as a lone trader, you can only do so for a certain period of time such as from 9 to 5.

On the other hand, a trading firm can make money on a 24-hour basis since people can work in shifts.

Steps to starting your trading business

Starting a trading business is a relatively simple process. We have helped thousands of traders from around the world establish their trading floors in the past two decades.

So, here are some of the most important steps to follow when establishing your trading business. We have understood and finalized this process over time to address the needs of those who want to start a trading business as best we can.

Learn more about trading

Anyone with any experience can easily create their trading floors. However, we recommend that you have some experience in the market as a profitable trader. Doing so will give you more leverage when implementing the other stages.

This is in line with how other industries work. For example, to start a car repair shop, it is ideal that you have some experience as a mechanic. Similarly, to start an accounting firm, you should have experience in the accounting industry.

Fortunately, it is relatively easy to move from a novice to an expert within less than a year. All you need to do is to use free or premium resources on the internet to do it. You can also use YouTube videos to learn about the financial market.

At the same time, you should use a demo account to create and test your trading strategy. You should move in the next stage after ensuring that your trading strategy is highly profitable.

To find out in detail how to smoothly switch from demo mode to live trading, you can read this article.

Raise funds to trade

After being an excellent trader, you now need to raise funds for your floor. Most people start this journey by raising funds from their family members and friends.

As you grow, your goal will be to raise funds from wealthy individuals and large institutional investors.

Or you can join a proprietary trading firm. In this case, the capital is provided by the firm, after going through the training and demo mode.

Form a team

The next stage of establishing your trading business is to create a team. Having a good team is actually one of the most important things that you can do.

Ideally, you want to hire people who love the financial market and those who have some experience. Doing this will make it relatively easy for your trading floor to start making money as soon as possible.

In addition to these skills, you need people who have good interpersonal skills. For example, you should go for people who relate well with each other and those who follow instructions. In other words, you don’t want a floor where people have a toxic relationship with each other.

Instead, you want a professional floor that has an experienced group of traders who relate well. Such a floor will not only be profitable but it will also be a fun place to work at.

Find a suitable office space

The next step for establishing a trading floor is to find a suitable office space. The type and size of the trading floor will depend on the amount of money you plan to start with and the number of people you are bringing in.

In most cases, we recommend that you start with a small office space at a relatively cheap location. In fact, most people start their floors using their spare rooms or garages. They then move to a bigger location as the number of traders and profitability increase.

Your working space should be comfortable, quiet, and have access to all the necessary amenities.

Procure hardware and software

The next stage when establishing your trading floor is to procure the required hardware and software.

Hardware includes all computers that your traders will be using. You should ensure that your traders have access to good-quality computers and monitors. Depending on the size of your floor, ensure that each trader has at least two monitors.

Related » How to Setup Your Day Trading Desk and Room

Further, equip your floor with good furniture. In this, acquire good desks and chairs that will keep your traders comfortable. Also, buy at least two television sets that will provide breaking news to traders.

In addition to hardware, there are other soft-copy items that you need to acquire or just download. For example, if you are using our hardware, you will be given access to the PPRo8 software that will give you access to the market.

Other software that you can install, depending on the size of your floor are the Bloomberg Terminal and Refinitiv Eikon. Also, you can subscribe to leading websites like WSJ and FT for your traders.

Real Trading floor owners benefit from the company’s experience and resources. For example, the company provides funds to its floor owners. It also offers them a complete suite of trading software that provides them with a direct market access (DMA).

Most importantly, our team of veteran traders provides all the necessary training.

Advantages of starting a trading floor business

There are several benefits of starting a trading floor business other than other types of firms. Let’s go deeper into some of these benefits.

Benefits vs other forms of businesses

First, starting a trading floor business has several advantages compared to other types of businesses like a physical shop or a SAAS business. As a result, you don’t need to have a retail store, hire sales executives, build supply chains, and have a marketing strategy (but a proven trading strategy is mandatory).

Instead, as shown above, trading business only requires hardware like computers and desks and trading software. You also don’t need to lease office space. Instead, you can use your spare room and save money on office space.

No time restriction

Second, a trading floor can operate on a 24-hour basis. Depending on its size, it is possible to have people make money at all times and on a daily basis.

For example, you can have a team that focuses on American equities and another one that focuses on Asian and European equities.

At the same time, you can have a team that trades other assets like currencies, crypto, and commodities. Cryptocurrencies are highly volatile and are provided on a 24-7 basis.

A very wide choice

Third, as mentioned, there are thousands of assets that you can trade. For example, if you are interested in trading stocks, there are thousands of them that are listed publicly. In the United States, there are over 6,000 stocks listed in the NYSE and Nasdaq.

In addition, there are many sectors from which to choose stocks. For example, if the technology sector is at a difficult stage to trade, you can choose dozens of others.

In addition to stocks, there are over 10,000 cryptocurrencies, tens of commodities, and hundreds of currency pairs.

Related » What to Consider when Choosing the Best Assets to Trade

Multiple strategies

Fourth, there are many strategies that one can use to beat the market. Some members of your trading floor may decide to use algorithmic trading while others will use trend following. Other popular strategies used by traders are reversal, scalping, and price action among others.

Finally, a trading floor ensures that a trader can make money in all market conditions. For example, many trading floors experienced a lot of success during the Covid-19 pandemic as volatility increased.

Risks of starting a trading business

While starting a trading business has its advantages, there are also several risks that you should be aware of. Some of the top risks for starting and running a trading floor are listed below.

Profitability challenge

Many well-run trading floors are usually highly profitable. However, it is also possible that a floor will make losses.

In the past, we have seen many well-known hedge fund managers struggle to achieve profitability and lose a substantial amount of money.

For example, Tiger Global, one of the most successful hedge fund lost over 50% of its funds in the first part of 2022.

Sabotage

At times, it is possible for a trading floor to lose a lot of money because of sabotage by one or more traders.

This happens when relations in a trading floor deteriorate and a trader decides to cause substantial losses. For example, a trader who believes that they will be fired can decide to open trades without adding the required risk management tools.

Avoiding this kind of behavior is among the duties of the office manager.

Training challenge

Another risk for starting a trading business is that of training especially when you are starting with people who are inexperienced in the market.

Some people might take too long before they grasp the financial market. In line with this, another risk for starting a trading business is of hiring the wrong people.

Remember: trading is open to everyone, and anyone can do it. But not everyone is made for trading. And training is just one of the challenges you will have to deal with.

Redemption

Meanwhile, there is a risk that some or all of your investors will decide to redeem their funds within short notice. A sudden redemption can lead to substantial disruption of business operations and even run the office out of business.

This risk does not exist when relying on proprietary trading firms. However, in case of some major losses in a short time, you may see your buying power reduced.

What is needed to run a successful trading

As in all businesses, success in trading is not due to one big thing but is hidden in the details. There are several factors that affect the success of a trading floor operation, let’s go over the most relevant ones.

Teamwork

First, as mentioned above, there is the concept of teamwork. This is one of the most important part of a trading business.

You need to ensure that the team is passionate about trading and that it has enough experience in the industry. Regular training sessions will go a long way to ensure that it is profitable.

Passion

Second, passion for the industry is important. On this, it is vital to ensure that all members of the team has a passion and interest of the financial market.

It will be relatively difficult to succeed when team members are not passionate about the industry. Especially in difficult times, when losses are more than profits and stress increases.

Related » Mind, Method & Money Management

The right tools

Third, your hardware and software should work well. In this, ensure that you have modern computers and a significantly fast internet speed.

Although these may not seem like relevant factors, they are. With a slow or unstable connection, your order may not be executed immediately, and thus you would run into the phenomenon of slippage.

Fortunately, the cost of all these is relatively small these days. It is possible to get a cheap computer for less than $700.

Manage your team at best

Fourth, as a trading floor owner, it is vital that you compensate your traders well. In addition to their monthly salaries, ensure that you provide them with bonuses on a regular basis.

The benefit of doing this is that it will give them an incentive to work hard for the firm. At the same time, it will reduce turnover among the staff.

Additionally, there are other factors that will ensure the trading business succeeds. For example, regular training to staff will help them be more motivated and learn more skills. Also, team-building events can help to boost their morale.

Finally, like other companies, it is important that you have quality risk management strategies. In this, all team members should be aware of how to mitigate losses while maximizing returns.

FAQs

How profitable is a trading office?

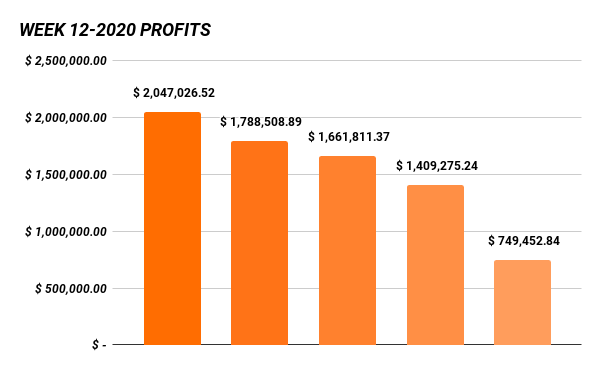

For example, it depends on the amount of money that the fund is managing. For example, a floor with $1 million that makes a 2% return in a month will generate $20,000 in return.

On the other hand, a fund with $10 million that generates a similar return will have $200,000.

How to start a trading business with $500

The best option is to use Real Trading™.

With $500, you will receive the trading software and hardware that you need. You will also have access to funds that you can use to run a trading floor.

The benefit of using this offer is that you will be joining thousands of people who use the product to run their floors.