Investing and saving money isn’t always implemented based on a reasonable decision, which is why there’s an entire school of research dedicated to figuring out why humans behave in the manner we do.

Financial trade data sets are samples of the many choices that market players have made. To a large extent, mainstream finance theory is predicated on the premise that market players are always self-interested utility maximizers who never make errors. However, that’s not always true.

Investors have different emotions about the financial markets that are volatile and quite fluctuating. These emotions are defined by several factors – one of them is the number of money investors put into their assets and the approach they use in the marketplace.

These two things are the main reasons why traders behave differently while looking at the same market data. Let’s discuss this topic in more detail.

Table of Contents

The amount of money a trader risks matters

While investing, we are making a conscious effort to improve our financial situation in the future. Investment goods, such as currencies, may provide huge rewards, but they always come with a significant level of risk, as well.

Before starting investing, investors should be familiar with some facts, such as currency pricing. This is critical, since individuals may suffer losses if they are unable to get information about their assets.

Risk management

Forex trading has a high degree of risk, thus it is important to get as much precise information as possible prior to making any transactions. When it comes to Forex trading, many people risk a lot of money in order to get more benefits in the future. All of this can lead investors to emotional trading.

Loss aversion and regret aversion are two types of emotional considerations that affect financial decision-making.

Investment choices are influenced by several variables, including an individual’s willingness to accept a risk and their fear of losing money. In order to make rational decisions, it’s always better not to risk too much money.

The role of emotions

The main reason why investors can find that the market develops in a different way than expected is that some investors tend to trade emotionally, which affects their trading style as well. Emotional trading isn’t only typical of newcomers, it can be experienced by professional traders as well.

According to the new research, sixty-six percent of investors have regretted an investment choice they made as a result of a spur-of-the-moment or emotional decision. Gen Zers (85%) and millennials (73%) are more likely to experience this than Gen Xers (60%) or baby boomers (54 percent ).

When you risk too much money, you feel nervous about whether or not your investment can get you any benefit. In order to avoid emotional trading, you need to get more disciplined.

If you are a novice trader, you can start exercising with a demo account, which will allow you to get more skills and operate in the marketplace more rationally. If you are a professional Forex trader, you need to generate strategies, which will help you to protect yourself from losses.

Indicators vs. clean charts

Another reason which affects investors’ different behavior in the marketplace is that there are several approaches in terms of forecasting future price changes. The most common techniques in the Forex market are fundamental and technical analysis.

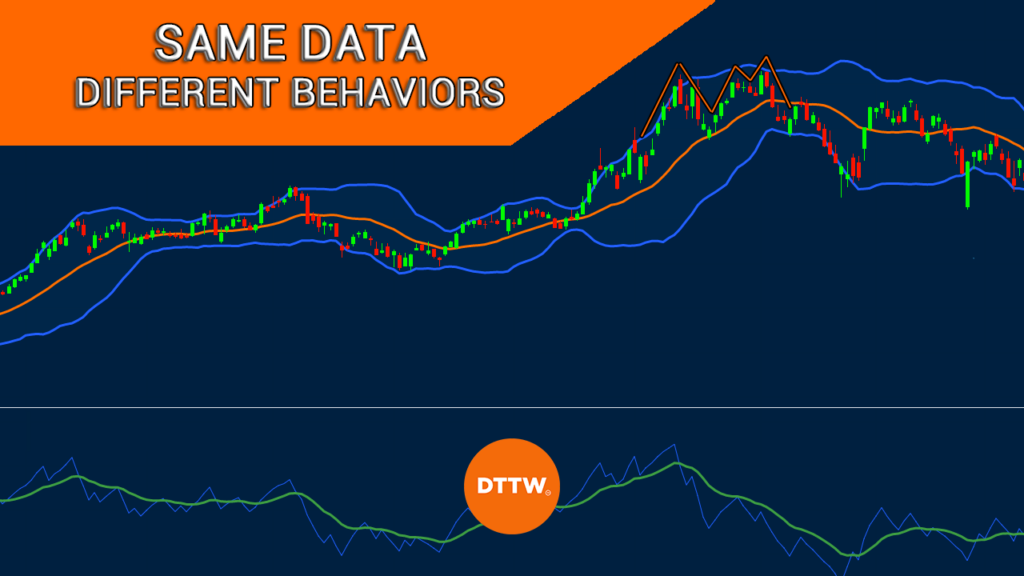

In the case of technical analysis, traders use technical indicators to foresee how the market and its prices will develop. There’s a huge variety of indicators, including, indicators that measure volatility, volume, trend, and momentum. With their help, investors can measure different things as shown.

For example, if the volatility measures the future fluctuations of the currency rates in the Forex market, the volume measures whether or not the current trend is going to continue.

Furthermore, there are even more indicators that are used for measuring example volume or volatility. These indicators in some cases show different or opposed results. As a result, based on the indicators an investor uses, the behavior is different.

Consequently, this can be one of the most important factors, which explain the different behavior of traders in the market.

As mentioned, there are two common approaches for analyzing the market. The technical strategy is already discussed, let’s get more information about fundamental analysis.

In the case of the fundamental analysis, investors use charts in order to analyze future price changes. They observe the way a certain currency or currency pair changes in price when it comes to the Forex market. The analysis of the charts is mainly based on subjective opinions.

As there are as many opinions as people around the world, it’s not a surprise that their behavior when it comes to investing money differentiates.