Panic selling is a period where a financial asset that has been doing well suddenly starts selling off. This selling can happen within a short or extended period. This psychological condition comes from traders’ fear of incurring further losses; this often leads to an overreact and generates even more panic.

In this article, we will explain what panic selling is and how to trade it safely.

Table of Contents

What is panic selling?

The financial market is often driven by the concept of fear and greed. Greed causes people to buy assets that are constantly gaining in value despite their fundamental challenges. For example, during the dot com bubble, most investors and traders were buying companies that had a dot com suffix.

Similarly, during the electric vehicle boom, most of them were buying stocks that had exposure to the industry. The same can be said about the cryptocurrencies market when most people were buying all types of digital currencies.

In most cases, greed is often followed by fear as investors start to worry about valuations. As the assets start falling, investors develop what is known as panic selling, which leads to a substantial sell-off. They do it mostly because they remember historical periods when asset prices sold off such as during the dot com bubble or the 2008 financial crisis.

Examples of panic selling

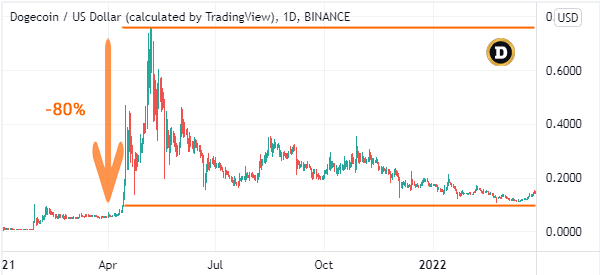

There are many examples of panic selling in the financial market. A good example is in 2021 when cryptocurrency prices dropped dramatically as the bull run started. As shown below, during the panic selling that ensued, the price of Dogecoin dropped from a high of $0.7624 to a low of $0.1520. This is a 80% decline.

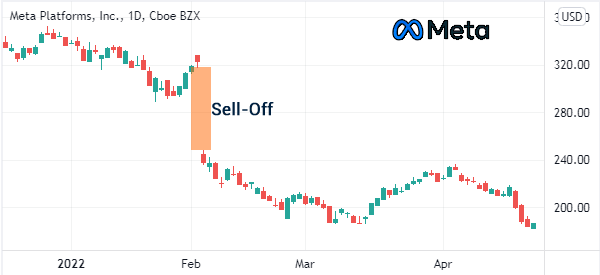

The other example of a panic selling is Meta Platforms. In the first quarter of 2022, the stock declined sharply after the company published weak results. In a statement, the firm said that it had seen a dramatic decline of its advertising business as competition with TikTok jumped and as the impact of Apple’s software upgrade jumped.

The final example of a panic selling is Netflix. As shown below, the Netflix stock price collapsed hard after the company published weak results and warned that its number of users was slowing. This happened in April 2022.

Causes of panic selling

There are a number of causes of panic selling. So, let us look at some of them.

Exceptional events

A major global or national event could lead to a major sell-off. For example, in 2001, American and global stocks went through a major sell-off after the 911 attack. Airlines and other industries declined as investors feared about the future of the American financial industry because the attacks were in New York.

Therefore, people who had shares sold them as soon as possible as they rushed to the safety of the US dollar.

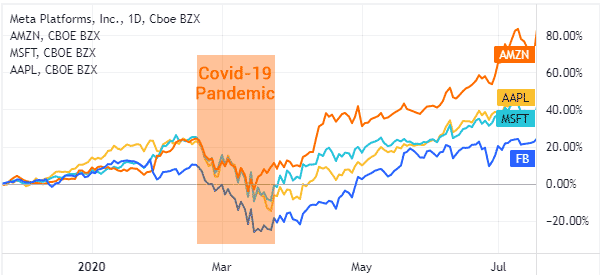

Another example of an exceptional event is the Covid-19 pandemic. In early 2020, global stocks declined sharply as governments announced measures to slow the pandemic.

These measures included unprecedented approaches like national shutdowns. Therefore, investors were fearful about would happen to global assets.

Wars

At times, wars can have major implications for stocks, commodities, and currencies. Depending on where these wars are happening, the impact can be dangerous.

For example, in 2022, we saw panic selling of the Russian ruble as western countries implemented sanctions on Russia for its invasion of Ukraine. And the Russian stock exchange has been closed for several days.

Earnings

As shown on the Netflix and Meta Platforms examples above, earnings can lead to panic selling in the market. In most cases, investors use quarterly earnings to gauge the overall performance of a company. As such, if they sense that growth is slowing, these investors can sell the shares.

In addition to the affected companies, a sell-off also tends to happen in other related companies. For example, streaming stocks like Disney declined sharply after the weak Netflix earnings as shown below.

» Related: The concept of trading correlation

Psychological triggers

The other main cause of panic selling is psychological in nature. At times, a panic selling can happen when investors believe that stocks have reached overbought territory or when they believe that they are extremely overvalued.

There are several psychological levels that a trader should always monitor.

Federal Reserve

The Fed is one of the most important institutions in the financial market because of its ability to boost and reduce liquidity in the market. For example, American stocks jumped to record highs during the Covid-19 pandemic.

At the time, the Fed brought interest rates to a record low and then started a long period of the quantitative easing policy. Therefore, a panic selling can happen when the Fed starts to unwind these policies.

The exhausted selling model

In most cases, panic selling usually leads to attractive entry points. Besides, it leads to a situation where high-quality stocks have seen their valuation crash hard. Therefore, the exhausted selling model has been proposed to help find a floor during a major sell-off.

The exhausted selling model is achieved by using a combination of indicators like:

- trendlines

- volume

- moving averages

- chart patterns

This model has a number of rules. For example, the stock needs to decline at a time of high volume.

Further, the volume spike will happen and create a new low. Also, a higher low wave needs to happen while a break of the predominant downward trend should happen. Finally, the 50-day moving averages must be broken and retested.

How to stop panic selling

Unfortunately, panic selling is a situation that cannot be stopped because of the idea of fear and greed. There will always be greed in the market and in most cases, it will always lead to panic selling.

Therefore, what traders and investors need to do is to know how to protect themselves. Some of the strategies to use are:

- Have a stop-loss on all your trades.

- Take caution about your leverage. A high leverage will lead to more losses.

- Take profits periodically.

- Embrace the idea of having a trailing stop loss.

- Use the exhausted selling model to identify a floor.

Summary

Panic selling is a popular activity in the market. That’ s because Fear and Greed are the two feelings that drive the market, and therefore are always present.

What does this mean? They cannot be stopped. But, as a trader, your job is to understand these situations and prevent (or mitigate) them.

In this article, we have explained how this selling works, its causes (and triggers), and some of the strategies to use, both to avoid and profit from this panic.

External useful resources

- Panic Selling During a Market Crash is Human Nature, but You Can Avoid It – Medium