A market bottom is defined as a point in which a stock or any other asset finds a floor after experiencing a major decline. A top, on the other hand, is a point where a bullish asset turns around and becomes bearish.

Successful traders are those who know how to identify both tops and bottoms. Because, as we always emphasize, an experienced day trader is able to profit in any market condition.

In this article, we will look at some of the ways to find them and some strategies to gain an edge.

Table of Contents

Stages of a market grief

To identify market bottoms, it is important for you to know the five stages of a market grief. By having a good understanding about this, you will be at a good point to know where the asset is and what is causing it.

1. Denial

The first step is known as denial. It is a situation where an asset whose price is rising starts to decline. When this happens, some of the bullish traders believe that the bullish trend is still ongoing and they keep on buying the dips.

2. Anger

The second step in a market sell-off is known as anger. It is where existing bullish investors move from denial to anger.

They simply get sad simply because the asset does not seem to be moving upwards as they expected. As a result, they respond by panicking and selling their assets.

3. Bargaining

The third stage is known as bargaining. It is where some investors start to bargain and find assets to buy. Here, they start buying the dip.

But still, in this stage, the bearish trend is still ongoing, which brings more anger among these investors.

4. / 5. Depression and acceptance

Fourth, there is the depression stage where investors lose hope and sell their holdings.

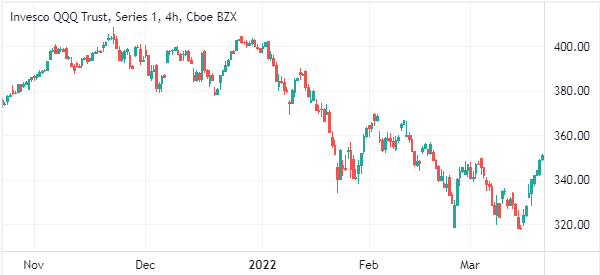

The final stage is known as acceptance. A closer look at the chart below shows that these stages happened in the Nasdaq 100 index during its 2022 sell-off.

What causes market dips?

The best process to identify market bottoms is to understand what causes these dips. There are several factors that could be the cause, and each one has to be evaluated in a different manner.

The asset itself

First, a dip can happen when there are concerns about asset valuations. For example, during the dot com bubble, stocks declined sharply because investors were concerned about the valuations of most companies that had a dot com suffix.

» Related: How to know if we are in a market bubble

Macro factors

Second, it can happen because of macro factors. For example, in 2008/9, the market dip happened because of the dysfunction of the housing market. Banks had given out billions of dollars worth of subprime mortgages and people were not paying.

Fed Decision

Third, a dip can happen because of the Federal Reserve decisions. In 2022, the dip happened as the Federal Reserve started moving from being extremely dovish to hawkish. It started hiking interest rates as inflation surged.

Others

Additionally, natural and artificial situations can lead to a market dip. For example, in 2020, stocks crashed after the Covid-19 illness was declared a global pandemic.

Meanwhile, individual stocks can have a dip after weak earnings, management changes, and other internal factors such as investigations.

How to find market bottoms

It is difficult to find a market bottom. Still, there are several strategies you can use to find out when market bottoms are happening. Let’s see together some of these strategies.

Elliot Wave Analysis

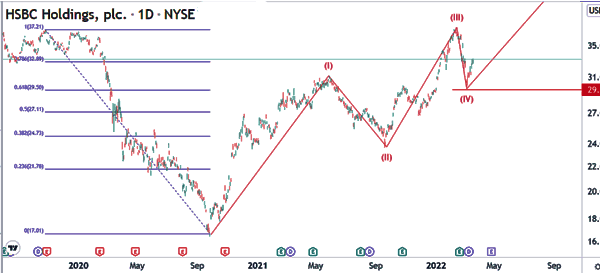

Elliot Wave analysis is a way to analyze markets by looking at the various movements of the wave of the asset. There are two main types of Elliot waves like impulse and corrective. Ideally, when an asset is in an impulse wave, it will make several pullbacks in wave 2 and 4.

Therefore, by looking at these waves closely, you will be at a good position to understand whether a market bottom has happened. For example, if the fourth wave moves below the half point of wave five, it means that the bottom has not yet happened because it will be invalidated.

For example, in the chart below, see that the HSBC share price has formed an Elliot wave pattern. Therefore, if the stock moves below $29.53, which is along the 61.8% Fibonacci retracement level, it will signal that the bottom has not yet happened.

Volume analysis

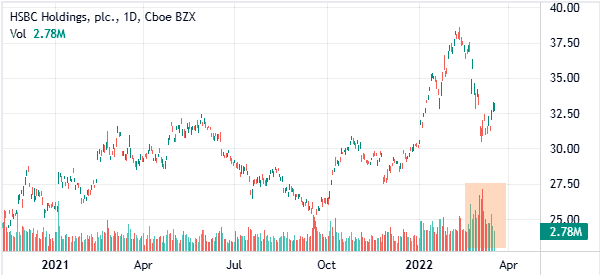

Another way of identifying a market bottom is to conduct a volume analysis. Ideally, when a stock or index starts rising in a high-volume environment, it is a sign that bulls are taking over and that the stock will keep rising.

The chart below shows that the volume of the stock suddenly rose, which was a sign that a bottom was nearing.

Using technical indicators

Another way of finding market bottoms is to use technical indicators. In this, you can use both trend indicators and oscillators. For example, you can use two moving averages to determine whether a bottom is happening. If the two lines make a crossover, it is a sign that bulls are taking over in the market.

Alternatively, if an oscillator like the Relative Strength Index (RSI) or Stochastic moves to an extreme level, it can be a sign that a reversal is happening.

Chart patterns

At times, some chart patterns can help you to identify when a market bottom is about to happen. For example, a double bottom forms when an asset price forms a first bottom and then it retests that same point. When it happens, it usually signals that a bottom is about to happen.

Other chart patterns that signal that a bottom is nearing are the inverted head and shoulders, rounded bottom, and a falling wedge.

Therefore, a closer look at these patterns can tell you whether the market has bottomed or not.

Final thoughts

Finding market bottoms is not an easy process. If it was that easy, many people would be making a fortune in the market, which is not the case. But using these strategies will make it a bit easier in the longer term.

Do you have other strategies to recommend? Let us know in the comments!

External useful resources

- Use Market Volume Data to Determine a Bottom – Investopedia