Sector rotation is an important concept that happens in the financial market. It is defined as a period when investors move from one broad sector to another due to certain factors.

In this article, we will look at what sector rotation is and explain how traders can take advantage of it.

Table of Contents

What is sector rotation?

Sector rotation is a process in which investors move from one sector to another due to a change of market performance or other themes. For example, if investors expect that interest rates will rise, they could shift their assets from risky assets to more secure ones.

A sector rotation can be in one asset class or multiple of them. For example, investors can move between different types of stocks to each other. Alternatively, they can move from an asset class like bonds to stocks depending on the market conditions.

Causes of sector rotations

Federal Reserve

There are several main causes of sector rotation in the market. First, they can happen because of the Federal Reserve.

As you already know, the Fed is given the mandate to set the US monetary policy. This means that the bank can hike interest rates to prevent the market from overheating. It can also cut interest rates when the economy is going through a challenging period.

Therefore, when investors believe that the Fed will start hiking interest rates, they start allocating their capital to companies that will do well when rates rise. For example, companies like banks and insurance firms do well in a period of high rates.

On the other hand, when the Fed starts cutting rates, it usually benefits high-risk companies that are bought mostly because of their price-to-sales ratios. These are mostly high-growth technology companies.

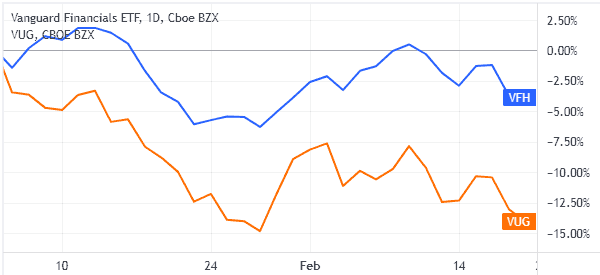

A good example of Fed-induced sector rotation in stocks is shown in the chart below. In it, we have compared the Vanguard Financials ETF (VFH) and the Vanguard Growth ETF (VUG). As you can see, the VFH did better than the VUG in early 2022 as the Fed hinted that it will implement multiple rate hikes as inflation soared.

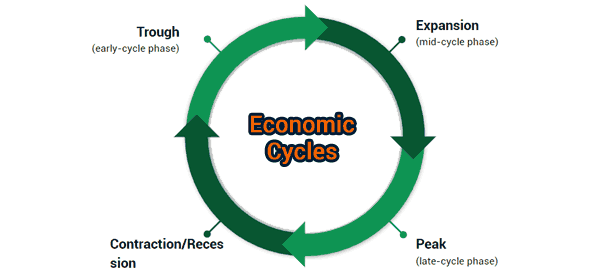

Economic cycle

Economies go through cycles. At times, they are typically seeing strong growth while in others, they are seeing slowing cycles. Investors allocate their capital in various assets depending on the stage where the economic cycle is at.

For example, in a period of robust economic growth, investors typically allocate most of their money in growth stocks. For example, after the financial crisis of 2008, technology companies like Apple and Microsoft recorded strong share growth.

Commodities cycles

Sector rotation can also happen due to the commodities market. For example, in a period of high energy prices, investors tend to move from energy-consuming industries to producing companies.

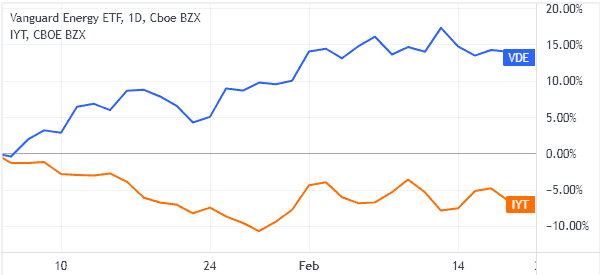

A good example is when you look at energy and transport-focused stocks. In early 2022, the price of crude oil jumped to the highest level in over 7 years. At the time, the aviation industry had not fully recovered from the pandemic.

Therefore, while energy stocks did well, those in the transport industry underperformed. As shown below, the Vanguard Energy ETF did better than the iShares Transport ETF (IYT).

Earnings

Another cause of sector rotation is the earnings season. The earnings season is a period when the biggest companies in the S&P 500 index start publishing their quarterly results. The season usually starts when big banks like JP Morgan and Goldman Sachs publish their results.

Depending on how earnings come in, a sector rotation can happen. For example, if financials record faster growth than consumer staples, investors can shift their resources to the fast-growing financial division.

Geographical

The final cause of sector rotation is geographical in nature. At times, stocks with a certain exposure to a geographical location can underperform those with an exposure to other places.

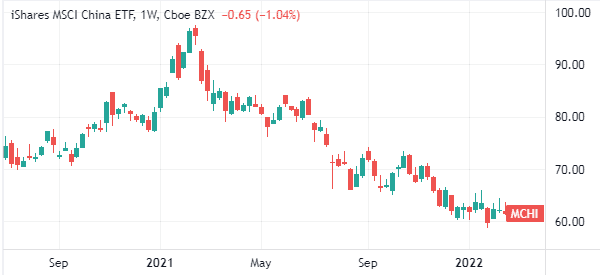

For example, the chart below shows that the iShares China ETF declined sharply in 2021 as the Chinese government intensified its crackdown on technology companies.

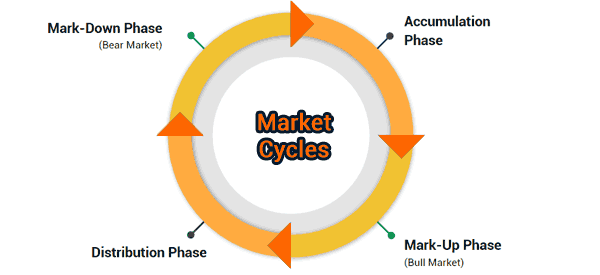

Strategies for sector rotation in day trading

Ideally, the concept of sector rotation is usually more important to long-term investors than for day traders. That’s because these rotations usually happen over a long period of time. Therefore, it is not always easy to embrace the concept when it comes to day trading.

But there are several strategies that can help you in all this.

52-week high/low

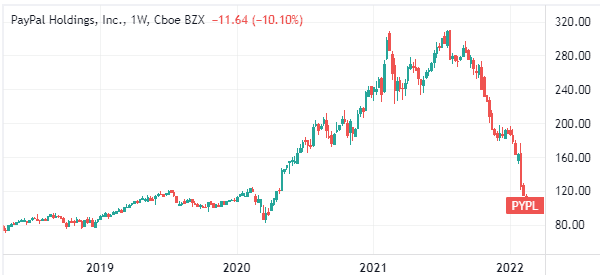

First, by identifying when a sector rotation is happening, you can easily predict the performance of key stocks. For example, in a period when investors are moving from growth to value, you can understand why popular stocks are testing their 52-week lows.

A good example is a company like PayPal, which is one of the best-known fintech firms. As shown below, the stock declined sharply during the sector rotation that happened in 2022. Therefore, if you are a day trader, understanding the concept of rotation will help you know what is happening.

Diversification for your portfolio

Second, knowing the concept of sector rotation will help you identify cheap and expensive stocks for your long-term portfolios. At times, when there is a rotation, many good companies become extremely cheap while many bad companies become expensive.

Therefore, when the rotation happens, it can help you find companies that are mispriced for your long-term portfolio. In other words, it can help you identify overbought and oversold levels.

» Related: The Power of Stock Diversification

Earnings Season

Third, traders can use sector rotation during the earnings season. For example, since banks are usually the first to report, traders can take advantage of their volatility and make money. Then, when technology stocks publish their results, they can move to them. To know when the earnings season is about to start, you should use the earnings calendar.

» Related: How to use the economic calendar

Final thoughts

Sector rotation is an important concept in the financial market. In this article, we have explained the multiple causes of sector rotation and identified some of the top strategies to use to trade the conditions.

External Useful Resources

- Sector Rotation Analysis – StockCharts