The financial industry is extremely wide, with so many assets available for you to trade. Some of the most common assets are stocks, currencies, bonds, commodities, futures, and cryptocurrencies among others. These assets can then be divided into other types.

Therefore, in this article, we will look at what these assets are, identify their types, and then look at the best ones to trade.

Table of Contents

Assets in the financial market

As mentioned, there are many assets that are available in the financial market. Let us look at some of these assets.

Stocks

Stocks are shares of publicly-traded companies. In the United States alone, publicly-traded stocks are worth over $50 trillion, with companies like Apple and Microsoft having a market cap of over $2 trillion.

Stocks are a wide market that can be divided into several key divisions. For example, they can be divided into growth and value stocks. Growth are companies seeing double or triple-digit annual growth while value stocks are those that have stable revenue.

They can also be divided into their sectors. Examples of sectors in the stock market are technology, financial, energy, consumer discretionary, consumer staples, and materials.

Currencies

Also known as forex, currencies are a big industry that has a volume of over $5 trillion per day. The forex market is divided into currency majors, minors, and exotics.

Majors are currencies of developed countries that have the US dollar. Minors, on the other hand, are pairs made up of developed market countries that exclude the US dollar. They include the EUR/GBP and GBP/JPY.

» Related: The best currencies pairs to trade

Bonds

The bond market is one of the most underrated industries in the world. For one, it is a market that is significantly bigger than the overall stock market.

Bonds are loans extended to companies and countries by investors. Examples of bonds are corporate, municipal, junk, and investment grade.

Cryptocurrencies

Cryptocurrencies are a new asset class that is worth approximately more than $2.5 trillion. There are several types of cryptocurrencies like stablecoins and altcoins.

Exchange-traded funds

ETFs are another important asset that is mostly popular among long-term investors. These assets track a portfolio of other stocks or bonds. Examples of the leading ETFs are Invesco QQQ and Vanguard S&P 500 index.

What to consider when selecting an asset

There are several key factors that you need to consider when selectng the best assets to trade. Let’s see now what some of the most important factors are.

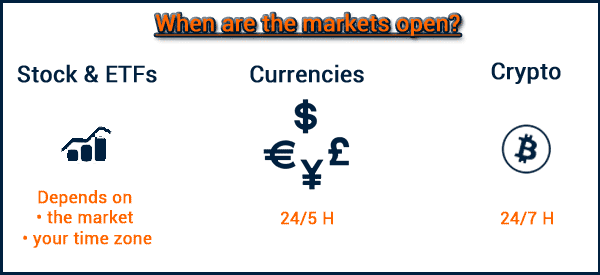

Time zone

At times, it is important for you to consider your timezone when considering the type of asset to trade. This is important because many assets are provided at certain times that may not be comfortable with you.

For example, cryptocurrencies are provided every day on a 24-hour basis. This means that you can craft a good trading plan based on your schedule. The forex market is also open on a 24-hour basis five days a week. Although there is no time limitation in 24 hours, timing is important in forex as well.

Stocks, on the other hand, are open for a small window of time. In most countries, the market is usually open for less than 10 hours per day. Therefore, at times, depending on your time zone, it may be a bit difficult to trade American equities.

Volatility

Day traders prefer assets that are a bit volatile. It is in this volatility that they are able to find entry and exit opportunities. Therefore, as a day trader, you should opt for assets that have a degree of volatility.

Some of the best ones in this regard are cryptocurrencies and some stock types. Some commodities like crude oil are also highly volatile.

To help you in these analyses there are some really useful volatility indicators that we recommend you to try.

Liquidity

Liquidity is an important concept in the financial market. It simply refers to the overall volume of a certain asset and how easy it is to ger in and out. Some assets have significantly low liquidity, making them more expensive to trade.

For example, many forex brokers offer thin spreads for highly liquid pairs like the EUR/USD and GBP/USD. They then offer wide spreads for thinly traded pairs like GBP/NZD and EUR/HUF.

Expertise

As a day trader, you may be familiar with several asset types. Some traders are usually better at some assets than others. For example, you may be an expert in stocks while another person is more knowledgeable with forex.

Obviously these assets, as we said at the beginning, can be further divided. Some traders may prefer tech stocks, but be specialized in ecommerce, cybersecurity, cloud computing or other stocks. This is where it’s up to you to find your niche(s).

Best assets to day trade

With this in mind, we can now look at some of the best assets for day traders. First, forex is one of the best assets to trade because of its global nature and the fact that there are economic data published every week.

Currencies are also moved by several things like interest rates and economic data like retail sales and inflation. Specifically, we recommend that you trade forex majors like the EUR/USD and USD/JPY because of their market action.

Second, if your timezone is right, you should go for stocks. While they are open for a short period, they also have a lot of activities.

Moreover, depending on your broker, you may have access to stocks of more than one country. At Day Trade the World, our traders have access to more than 50 stocks from countries like the United States, Canada, and Germany.

Stocks are good because there is no dull day. Even in a period when equities are moving sideways, you will find several outliers that are doing well or being slammed.

Third, commodities are also good options to day trade. We recommend that you trade volatile commodities like silver and crude oil (you could check this comprehensive list).

Finally, cryptocurrencies are good assets to day trade. Besides, they are among the most volatile assets in the financial market.

For other assets like bonds and ETFs, we recommend that you stay away from them. For one, many brokers don’t provide them. And, above all, they are not very profitable assets for a day trader. These instruments are in fact more suitable for a long time investor, and you should include them in your portfolio only if you plan to diversify your investments.

Summary

In this article, we have looked at some of the best markets to day trade. We have also looked at the different types of assets and identified some of their pros and cons.

As we have seen, to be a good day trader you don’t need to know all the assets on the market, it’s better to focus on one or two of them and understand the mechanics.

In short, in this case the figure of the ‘Jack of all trades, master of none’ is not really for us.

External useful resources

- Which Market To Day Trade? Stocks, Forex, Or Futures? – Vantage Point