Indices, also known as indexes, are financial instruments that track tens, hundreds, or even thousands of stocks. These indices are offered by most trading platforms like Robinhood and other forex and CFD brokers.

In this article, we will look at what index trading is and some of the top strategies to succeed in it.

Table of Contents

What is an index?

An index is a financial instrument that tracks different companies. At times, the index is created to be a representative of the entire economy. At other times, it is created to track companies of a given sector of the financial market.

Therefore, by looking at a single index, you could get a clear picture of the performance of several companies. For example, when you look at an index like Hang Seng, it becomes relatively easy to predict how specific companies in the country performed.

Major indices

There are hundreds of indices in the market today. Some of the most popular indices in the financial market are:

- Dow Jones – This is an index of 30 companies of different sectors in the American market. Some of the biggest companies in the index are Apple, Microsoft, Nike, and Caterpillar.

- S&P 500 – This index is made up of 500 of the biggest companies in the United States. The companies are from all sectors in the market like retail, technology, and energy. Examples are ExxonMobil, JP Morgan, and Goldman Sachs.

- Nasdaq 100 – The index is made up of 100 of the biggest technology companies in the United States.

- DAX index – The DAX index is made up of the 40 biggest companies in Germany. The companies are from all market sectors.

- FTSE 100 – This index is made up of the biggest companies listed in London by market capitalization.

- CAC 40 – The index is made up of the 40 biggest companies in France.

Some of the other best-known market indices are the Nikkei 225, Hang Seng, FTSE MIB, and Bovespa, among others.

Indices vs ETFs

Indices are often confused with exchange-traded funds (ETFs). But they are different. As the name suggests, an ETF is a financial product that is made up of several assets such as stocks, bonds, and even cryptocurrencies. It is then listed in an exchange like the New York Stock Exchange (NYSE) or the Nasdaq.

ETFs are mostly created by financial services companies like Fidelity, Schwab, and Vanguard and are usually traded like stocks. Many ETFs are created to track indices. For example, the Invesco QQQ ETF was created to track the Nasdaq 100 index. Similarly, an ETF like the SPY was created to track the S&P 500 index.

Index trading strategies

There are several trading strategies that index traders use. As always, take your time to understand them and test them in a demo mode to see which one is best for you. Let’s go over some of these strategies.

Correlation trading strategy

A common situation that has recently happened in the financial market is synchronization. This simply means that many indices are moving in the same direction. In most periods, when the DAX index rises, you will find that other popular European indices like the CAC 40 and FTSE MIB will also rise.

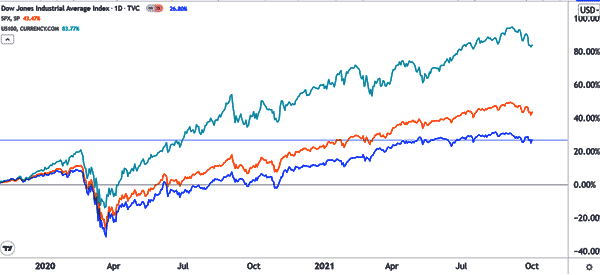

Similarly, when an index like the S&P 500 index rises, there is a high probability that other indices like the Dow Jones and Nasdaq 100 index will rise as well. As shown below, the three major indices in the United States tend to move in the same direction.

Therefore, a common trading strategy is to use the concept of correlation. One way of doing this is to buy one index and then place a small short bet against the other. In this case, the short trade’s role will be to protect yourself in case of a major pullback.

Using options to hedge

Another strategy of trading indices is to use the options market to hedge against risks. The idea behind this is relatively simple. If you believe that an index will keep rising, you could place a buy trade. At the same time, you could place an options trade that will protect you in case of a major pullback.

For example, in October 2020, a trader bought a 45,300 put-spread collars for about $94 million. The put-spread collars is an options trade that has several strike prices. The trade involved selling calls with a strike price of 4,505 while buying puts exercising at 4,135 and selling puts at 3,480.

Therefore, in case of a major drop, the portfolio will be protected.

Trend following

Another indices trading strategy is known as trend following. It is a strategy where one buys an asset when the price is rising and shorts an asset when its price is falling.

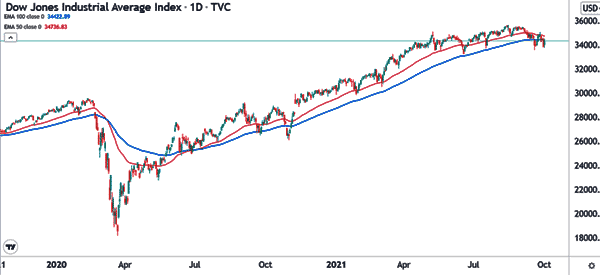

One of the best strategies to use this strategy is to use a technical indicator like moving averages. In a bullish trend, you could buy an index as long as it is above the moving averages. For example, in the chart below, you could have bought the Dow Jones index as long as it was above the 100-day and 50-day moving averages.

There are other index trading strategies like scalping, where you buy and sell an index within a short period of time, including minutes. There is also using the Elliot Wave trading strategy and algorithmic trading.

» Related: The best trend indicators

Index Trading vs Investing

A common question is on the best strategy to make money using indices. On the one hand, some participants believe that you can make better returns investing in the indices for the long term. Others believe that you can make more money by trading the indices.

In most cases, indices generate strong returns when invested. However, for trading, we recommend that you should focus on individual stocks instead of indices.

Summary

Indices are some of the most active financial assets in the market. In this article, we have looked at some of the best strategies to trade in these popular assets. We have also provided some of the top indices that exist in the market today.

Esternal Useful Resources

- Major World Market Indices – Investing.com