Banks are an important part of the American economy. As you recall, banks contributed to the financial crash of 2008/9 and were among the best performers during the Covid recovery.

The six banks in the S&P 500 are worth more than $1 trillion. They are led by JP Morgan, which has a market cap of more than $459 billion and Bank of America that is valued at more than $328 billion.

In this article, we will look at the types of banking companies and how to day trade bank stocks.

Table of Contents

Types of banks

To day trade banks stocks well, you need to understand their different types. That’s because there are several types of banks. They include:

- Commercial banks – These are banks that specialize their services on consumers and busineses. They provide services like savings and loans. Some of the biggest consumer banks are Truist and PNC Financial.

- Bank holdings companies – These are companies that house banks with diverse business lines. Examples of these firms are Goldman Sachs and JP Morgan.

- Investment banks – These are firms that make money by offering investment solutions like M&A advisory and research services. Examples are Moelis and Houlihan Lokey.

- Regional banks – These are banks that offer their services in states. They mostly don’t have a national brand. Examples are Cross River Bank, SilverGate Capital, and Western Alliance Bancorp.

- Neobanks – Neobanks are relatively young banks that offer their services through mobile applications. They mostly target young people. Most neobanks are privately owned but because of their strong capital raising, many like Dave, NuBank, and Revolut will go public.

- Credit unions – These are companies that offer banking services to consumers and businesses. The only difference is that they operate as non-profits.

How banks make money

A common question is how banks make money. There is no straight answer to this question owing to the several types of banks that are available.

For example, commercial banks make most of their money by offering loans and mortgages to people and businesses. After offering loans, they make their money through the interest payments. They also make money through ATM withdrawals and overdraft fees

Investment banks, on the other hand, have several channels in which they make money. For example, they make money by advising companies that are going public or those that are merging.

They also make money by offering services like investment research and by helping companies and governments raise money. Further, these banks make money through their fixed income, commodities, and currencies (FICC) business lines.

Meanwhile, other banks like neobanks make money through a subscription service. This is where they charge their customers a monthly fee to use their services.

How to day trade bank stocks

Bank stocks are almost similar to other types of stocks like technology and retail. However, they are also moved by different things and are valued differently.

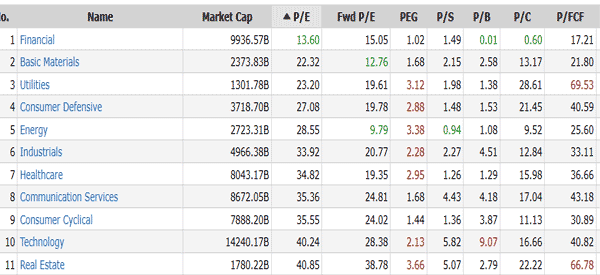

For example, as shown below, banks, which are classified in the financial segment have the lowest price-to-earnings (PE) ratio. This is simply because many banks have already moved from their growth sector.

Stock traders also look at different things when focusing on banks. Let us look at some of the key top movers for bank stocks.

Interest rates

Banks are sensitive to interest rates changes. Unlike most sectors, banks do well when interest rates rise. This is simply because higher interest rates leads to better margins for their loan products.

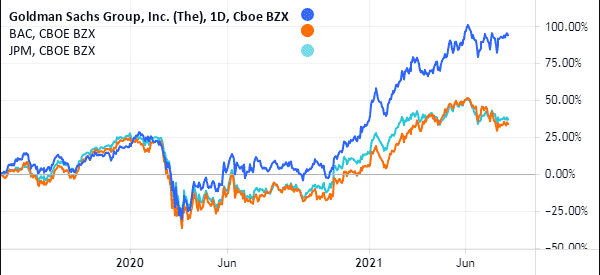

For example, in 2021, banks did well even as interest rates remained low. This happened because the market started pricing in more rate hikes as the American economy moved from the pandemic. Their shares crashed in 2020 when central banks lowered interest rates.

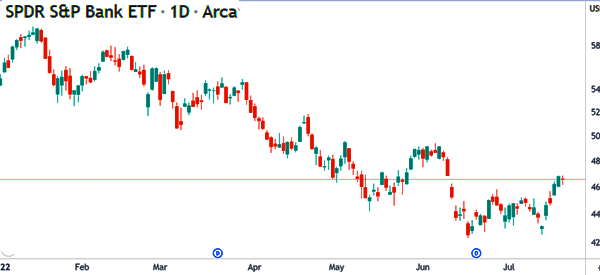

However, it is worth noting that higher interest rates are not always good for banks. For one, higher interest rates tend to increase delinquencies and slow customer spending. A good example is what happened in 2022 as the Fed delivered aggressive rate hikes.

As shown below, stocks declined sharply in this period as higher rates coincided with weak consumption. Higher rates also had an impact on deal-making as the number and volume of M&A declined sharply.

Volatility

Some banks do well when there is heightened volatility in the financial market. For example, investment banks make more trading money when there is substantial volatility in the market. This is because this volatility leads to more market action.

A good example of this is what happened when Goldman Sachs published its earnings in July 2022. At the time, the stock jumped sharply as its trading division surged while its other divisions suffered.

Another good example of this is what happened during the pandemic. While banks placed billions in provisions for bad debt, the volatility in the stock market helped to offset these loses.

Housing data

The housing market is an important segment of the economy. As such, many banks do well when the housing market is doing relatively well. For example, banks that focus on mortgages like Quicken Loans and Wells Fargo do well when there is more mortgages uptake.

They also do well when housing data like building permits, housing starts, and mortgages approvals are doing well.

Stress test results

Since the 2008/9 financial crisis, banks have been in a tighter regulatory environment. This regulatory environment involves annual stress test by the Federal Reserve. This is where the bank looks at their performance in different scenarios.

While stress test results led to volatility, their impacts have waned now that banks are well-capitalized.

Earnings

Like all companies, earnings have an impact on bank stocks. In fact, the earning season starts when big banks like JP Morgan and Wells Fargo publish their results. Better earnings often pushes their share prices higher and vice versa.

On earnings, traders watch the top-line figures like revenue and profits. They also look at key profitability ratios like margins. Most importantly, they look at the CET 1 ratio, which is good at predicting the financial stability of a bank.

There are other things that move bank stocks. These are regulations, corporate activity like mergers and acquisitions, management changes, and payouts like dividends and buybacks.

Key profitability metrics for banks

Bank investors and traders look at several important profitability metrics for banks. Some of these numbers are:

- Return on Equity (RoE) – This figure usually shows the amount of profit that a bank generates as a percentage to shareholder equity. It is calculated by dividing its net income with total shareholders equity X 100. A good number is usually above 10%.

- Return on Assets (RoA) – This figure measures the bank’s returns compared to its total assets. It is calculated using this formula: (net income / total assets) x 100. A good RoA should be at least 1%.

- Net interest margin (NiM) – It is calculated using this formula: (net interest /total interest generating assets ) x 100. It should be at least 3%.

- Efficiency ratio – This figure is calculated by dividing the non-interest expense by net revenue and multiplying it with 100.

Risks for trading bank stocks

There are several risks that accompany trading bank stocks. For one, unlike tech companies, bank stocks tends to lack volatility. This lack of volatility happens because banks rarely make headlines.

Related » How to Day Trade Profitably in Periods of Low Volatility

As such, as a trader, you can lack opportunities to buy and short the firms. Other risks when investing in bank stocks are:

- Cyclicality – Banks, like other industries such as commodities and tech, tends to be highly cyclical. As such, stocks usually go through a series of boom and bust cycles. A good example of this is what happened during the Global Financial Crisis.

- Interest rate risks – Interest rates change all the time and banks react differently to these changes. For example, some banks do well when rates are low and vice versa.

- Regulatory risks – Banks tend to be highly regulated. As such, a series of new regulations can affect their performance. For example, in 2022, investment banks were hit as the SEC unveiled new rules to limit corporate consolidation.

- Technology disruptions – Banks depend fully on technology these days. Therefore, a major hack or technology outage can lead to substantial losses .

Final thoughts

The banking sector is a diverse one in the US. The sector is home to some of the biggest companies in the US like Goldman Sachs, JP Morgan, and Citigroup. In this article, we have looked at some of the top types of banking stocks and the key data to watch.

External Useful Resources

- The Complete List of Bank Stocks Trading on NASDAQ – Top Foreign Stocks