Stocks are some of the best financial assets to invest in for the long-term. In fact, the major US exchanges like the S&P 500, Nasdaq 100, and Dow Jones are always rising when you look at the long-term charts.

The chart below shows how these indices have performed over the years.

In recent years, the rally of US stocks has been mostly because of the recent actions by the Federal Reserve and US government. In response to the coronavirus pandemic, the Fed slashed interest rates and implemented a quantitative easing program. The government also provided a stimulus package worth trillions of dollars.

All these led stocks and other financial assets like Bitcoin and Ethereum to surge.

Related » Fundamentals to Know about Interest Rates Trading

While most stocks have done well over the years, many companies have underperformed. These firms are known as laggards.

In this article, we will look at how you can day trade these lagging stocks.

Table of Contents

What are laggards in stocks?

The term laggards comes from the word lag. The Merriam-Webster Dictionary defines the term lag as, “to move, function, or develop with comparative slowness.”

In the stock market, laggards are companies that have underperformed the market for a long or short period of time. It also refers to companies that have underperformed their peer firms for a while.

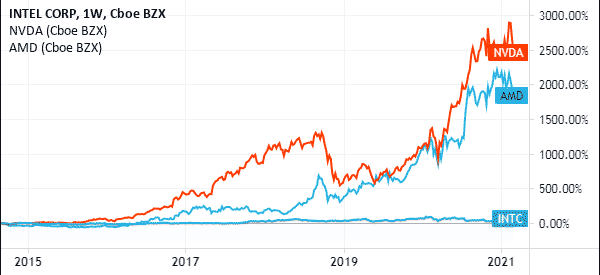

For example, a company like Intel can be said to be a laggard. That’s because, while the firm has been a tech pioneer, other companies like Advanced Micro Devices (AMD) and Nvidia (NVDA) have caught-up with it.

While the two firms are growing, Intel is underperforming.

IBM is another example of a company that is lagging. Once the biggest tech company in the United States, the company has been left behind by firms like Microsoft and Amazon.

A sector can also be said to be lagging. In the past few years, the focus among investors has been about companies in the technology and clean energy sectors. These firms have performed really well.

On the other hand, many investors have dumped companies in traditional sectors like retail and oil and gas.

How to find laggard stocks

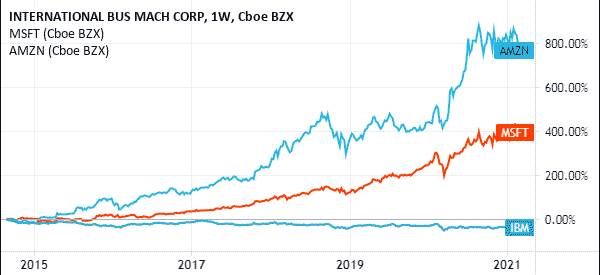

There are many ways of finding laggard stocks. One of these is using a platform known as Barchart.com. In it, you just select an index that you want to track and rank companies based on their performance.

These indices include the S&P 500, Dow Jones, and Nasdaq 100. They also include sector-specific indices like the S&P Retail and S&P Finance.

In the chart below, we have looked at the lagging stocks in the information technology industry. As you can see, companies like Xerox, IBM, Fidelity National Information Services, and Fleetcor Technologies have been the top laggards in the past 52 weeks.

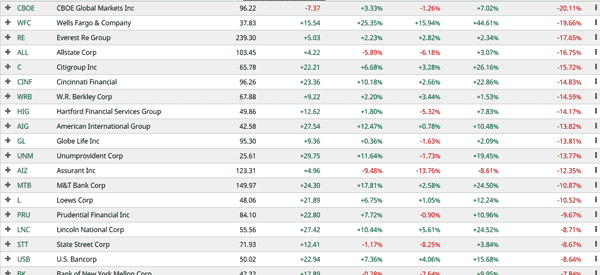

In the example below, we see the top laggards in the financial industry include companies like CBOE Markets, Wells fargo, Everest Re, and Allstate.

Qualities of laggard stocks

Lagging companies have some key characteristics. Some of these qualities are:

- Low share price – Many laggard stocks tend to have a low share price. That’s because, in most cases, their share prices have been dropping.

- Low PE ratio – The companies have a lower price-to-earnings, price-to-sales, and price-to-free cash flow ratios. That’s because investors are not ready to pay a premium for their shares.

- Underperform – In the past few years, lagging stocks have underperformed their better-performing companies.

- Less volatile – These firms tend to be less volatile than their better-performing rivals.

Drawbacks of investing in laggards

At times, it can be highly profitable to invest in laggard companies. This happens because some laggard companies tend to be highly undervalued. However, in other periods, it can be highly risky when you invest in laggard companies.

First, some of these companies tend to have major structural issues such as falling revenue, increasing competition, and lawsuits. Therefore, these companies could continue underperforming for an extended period. Examples of these firms are companies like Bed Bath & Beyond and Sears.

Second, some of these companies are often value traps. A value trap is a company that looks good because of its cheap valuation but that has significant challenges. Therefore, at times, it makes sense to invest in companies that have strong momentum.

Related » Do You Fall For These Day Trading Traps?

Finally, at times, laggards can remain in that area for a long time. Therefore, investing in such companies can be dead money.

A good example of a stock that has been dead money for a while is Deliveroo. As shown below, it has remained in a tight range for months.

How to day trade lagging stocks

In general, there is no major difference between day trading market leaders and lagging stocks. Therefore, here is what we prefer that you do as a day trader.

Extended & Premarket Hours

First, start your day looking at the extended hours or premarket hours. These are periods where you are able to see how stocks are performing before the market opens.

Ideally, you want to identify companies that are either rising or falling sharply in this period. You can use platforms like Market Chameleon and Investing.com to find this information and identify some of these companies.

Why are stocks moving up/down?

Second, read more about the premarket action. In this, try and find reasons why a company’s shares are moving up or down. You can find this information by just Googling.

In most cases, companies are either rising or falling because of news like earnings, management changes and an analyst upgrade or downgrade.

Identify support and resistance levels

Third, with this knowledge, use your charting provider to identify the key areas of support and resistance. Support is a floor where a stock struggles to move below while resistance is a ceiling where they struggle to move above.

We recommend that you draw these levels using a multi-time frame format. This is where you start from the daily chart, 12-hour chart, 6-hour chart, and down to a 5-minute chart. Drawing these levels will help you identify the key levels to watch.

Use pending orders

Fourth, a good approach is to use pending orders. This is where you direct your broker to open a trade when the price reaches a key level. In a buy stop, the broker will buy the stock above the price in a sell-stop, it will short the stock below the current price. In a buy limit, a buy order will be filled below the price while in a sell-limit order, it will be filled above the price.

Stop Loss (or take-profit)

Finally, you should always ensure that you have a stop loss and a a take-profit for all orders you initiate. Therefore, as you can see, there is no difference between trading lagging or strong stocks.

Final thoughts

As a day trader, you can make money by focusing on all types of stocks. Some traders have made a fortune focusing only on fast-growing stocks while others make money by focusing on laggards.

However, if you are a long-term investor, buying and holding laggards has proven to be a relatively poor strategy.

External useful Resources

- Leader or Laggard | Stock News & Stock Market Analysis – Investors.com