Correlation is a very important strategy that many traders and hedge funds have used to make profitable trades. The concept behind this interaction is that in currencies operate in pairs. When a currency pair such as EUR/USD goes up, there could be a possibility that a pair such as GBP/USD goes down.

Table of Contents

Why traders need correlation

Correlation therefore looks at these relationships and how traders can take advantage of them. Traders use these numbers of reasons.

Eliminate counterproductive trading

This is where traders might be tempted to trade positions that eventually cancel one another. A good example is on the EURUSD and USDCHF pairs which move in the opposite direction most of the time. When EURUSD is moving up, chances that USDCHF will be moving down are very high. Placing a buy position in the two pairs is therefore counterproductive and can lead to huge losses.

Leverage Profits

The second reasons why you should use this strategy is to leverage on your profits. When using the strategy, you have a chance to double-up on positions which leads to maximized profits.

In many cases, the EURUSD and GBPUSD pairs have a very strong correlation. The GBPUSD mostly follows what EURUSD does. Therefore, going long the two pairs will lead to more profits because of leverage.

Diversify your portfolio

Understanding correlations also helps in diversifying and hedging out a portfolio. Diversification has for long been identified as a key way of minimizing losses. That is the main reason why successful traders such as George Soros and David Einhorn have taken positions in many companies.

» Related: How to diversify a stock and a currency trading portfolio.

What is correlation for?

By using correlation, it will help you identify the best positions to go long, short or both. Hedging also helps to minimize losses. A trader using these correspondences needs to understand a number of things.

- He needs to understand the procedure of calculating interrelationship.

- The trader needs to understand how to interpret the results from these relationship.

- The trader needs to understand how to incorporate this in his trading strategy

This last point is very important because this data will not always be adequate to determine a sell, buy, or hold position.

» Related: How to maximize the Benefits of Correlation

How to calculate

Calculating the correlation between currency pairs might seem difficult. However, doing this is not as difficult as it seems. All you need to do this is Microsoft Excel and historical data (available for free in most charting platforms). Many data vendors also provide the data for a fee.

Once you have calculated the data, you need to download it and export it to Excel. The best data to use to calculate correlation is a combination of 1 year, 3 month, and one month data. You can also narrow it down to weeks and days.

In Excel, you should use the =CORREL (range 1, range 2) function. Since the correlation data changes, you should update it on a regular basis.

Another good strategy to get these data is by the use of websites and brokers who provide the information for free.

» Related: Top free resource

Interpreting the correlations

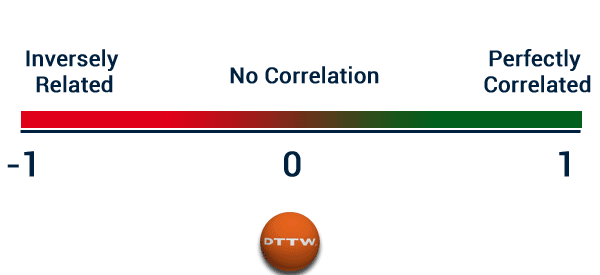

Having the correlated data is not enough. Interpreting it is the most important aspect in trading. The table below will help you a great deal in interpreting the data. In the table above, you can see three main areas: Perfect positive, perfect negative and no correlation.

In perfect correlation, the two currency pairs are most likely to move in the same direction. When the correlation is a perfect negative, the two currency pairs will move in different directions. If the correlation is 0, then no correlation exists. The following table is an example of an automated correlation table.

From the above table, a number of things are evident. One, the correlation figures are never the same. In the AUDCAD pair, the 1 hour correlation figure shows a negative correlation while the daily is positive. In addition, it is evident that a perfect correlation of 1 is never possible.

What can reduce pairs volatility?

If you are active in the financial markets, you might have noticed an important aspect: Some currency pairs in some periods simply do not move. This situation has been mostly pronounced in the sterling and euros pairs in past years. As such, it has become increasingly difficult to make money trading these pairs.

There are many reasons that can lead to this situation.

The biggest one is when central banks around the world become dovish. In 2019 in the United States, the Fed has changed its outlook for rate hikes. Previously, the Fed was expecting to hike rates at least two times in that year. This language has changed to zero rates. There have even been talk about rate cuts and a return to quantitative easing.

The same could happen in Europe with the European Central Bank (ECB), in the United Kingdom with the BOE, in Japan with the Bank of Japan (BOJ) or in the Pacific Area with the RBA.

Another aspect to keep under control are the Emerging Markets, especially if there are signs that their economy is in a slowdown phase. For example, in Turkey the lack of confidence on the Turkish currency has seen it tank against the USD.

Therefore, as a trader, it is important to change your tact when trading during these periods of low volatility. Instead of focusing on the major currency pairs, you should reconsider looking at other currencies. For example, you can look at the AUD/NZD and EUR/GBP crosses. Doing this will help you spot currencies with the most volatility. Also, you should consider other asset classes like commodities and energies.

» Related: How to Day Trade Profitably in Periods of Low Volatility

Conclusion

It is very important to understand how currency pairs move in relation to one another. This will help you understand the exposure of each trade that you enter. Some pairs move in tandem with one another while others move in direct opposites.

By having a good understanding of these issues, you will be at a good position to achieve success by avoiding mistakes that are common to traders.

External Useful Resources

- Top 5 Forex Correlations – LogikFx