Candlestick patterns play an important role in day trading. These candlestick patterns can tell you whether a stock will continue rising or whether it will reverse.

In the past, we have looked at some popular candlestick patterns like doji, hammer, and engulfing. In this article, we will look at another pattern known as the tweezer top and bottom.

Table of Contents

What is the tweezer top and bottom?

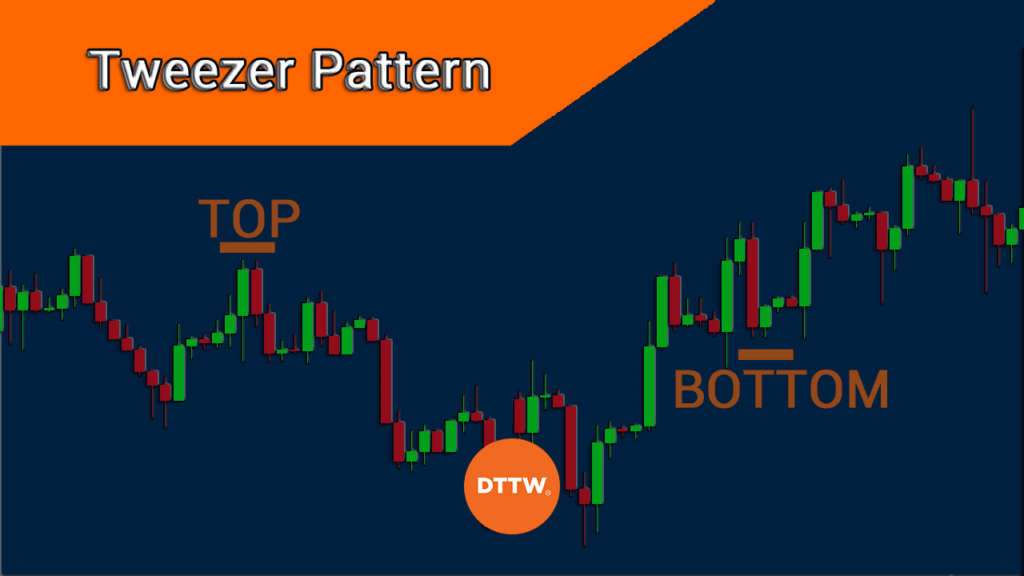

The tweezer top and bottom pattern is made up of two or more candlestick patterns. They form when the two candles have a matching high and low levels. According to Steve Nison, the main reason why they are known as tweezers is that they are compared to the two prongs of a tweezer.

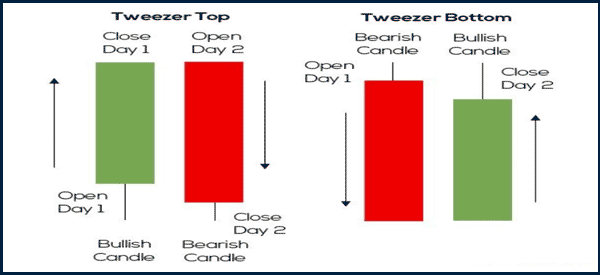

There are two main types of tweezers. There is a tweezers top, which is formed when the highs of two candles match. This one is also known as a bullish tweezer.

There is also a tweezers bottom, which forms when the lows of two candles is the same. The pattern can also be made up of two or more real bodies, shadows, and even a doji. The chart below shows the top and the bottom version of this candle pattern.

What tweezer top and bottom tells you

The tweezer top and bottom patterns are important in the financial market. They are important because of the signals that they send to day traders.

As shown above, a tweezer top forms when an asset’s price is in a bullish trend. It forms when an asset’s price opens lower and then closes higher. On the following day, the asset’s price opens at the same level as the previous day’s close but it then ends lower than that (So don’t suffer from a morning gap).

On the other hand, a tweezer bottom happens when an asset declines and ends at a certain point. The following day, the asset’s price opens at this point but it ends up lower.

Confirmation of other patterns

The most important part about tweezer tops and bottoms is that they can also happen as part of other candlestick patterns. Some of the most common situations is when the patterns form as part of the harami, hanging man, shooting star, dark cloud cover, hammer, and piercing patterns.

In other words, the tweezer top and bottoms can be used to confirm other candlestick patterns.

Sign of an upcoming reversal

The tweezer top and bottom is an example of a reversal pattern. When a tweezer top pattern happens, it is usually a sign that a stock will reverse and start a bearish trend. On the other hand, when a tweezer bottom happens it is usually a signal that a new bullish trend may be about to start.

How to trade tweezer top and bottoms

To be clear, like most candlesticks, tweezer tops and bottoms are not very popular in the financial market. Also, like other patterns, it is usually recommended to trade these patterns by combining them with other tools and patterns.

You can combine them with technical indicators like moving averages and Bollinger Bands. You can also combine them with patterns like triangles and bullish flag and pennants.

Ways to spot the pattern

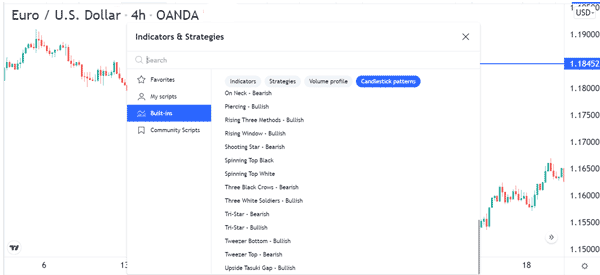

The easiest way of using these patterns is to automatically find them in the market. You can do this using the built-in feature that is found in TradingView. You do this by going to the indicator tab followed by candlestick patterns and then tweezer top and bottoms. This is shown below.

Still, if you are using another trading platform, you can easily identify the pattern visually. As mentioned, when a top tweezer happens, it means bulls are a bit scared about buying the asset. Similarly, when the bottom tweezer happens, it means that there are no more bears in the market.

Market orders

Therefore, one way of trading these patterns is to use pending orders. For example, in case of a top tweezer, you can open a sell-stop trade below the first shadow and a stop-loss above the candle. If a bearish breakout happens, it means that the sell-stop trade will be initiated. In this case, the stop-loss will be initiated when the pattern is initiated.

Example of tweezer patterns

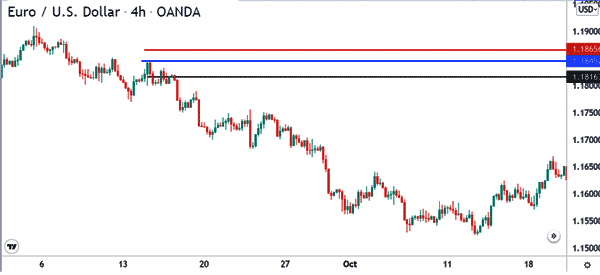

A good example of this is in the chart below. In this chart, we see that the tweezer pattern formed at 1.1845. In this case, you could have placed a sell-stop at the level shown in black and a stop-loss at the level showed in red.

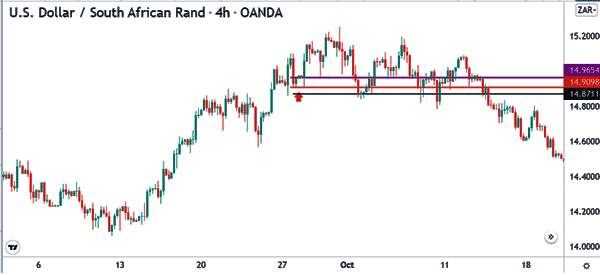

Similarly, in the chart below, we see that the USD/ZAR pair formed a tweezer bottom pattern. Therefore, in this case, you could have placed a buy-stop trade at the level shown in purple and a stop-loss at the level shown in black.

Summary

Top and bottom tweezer patterns are an important reversals patterns that you can use in trading all types of assets. In this article, we have looked at how the two patterns form and some of the top strategies of using the patterns.

External Useful Resources

- Tweezers Provide Precision for Trend Traders – Investopedia