News plays an important role in the financial market. Indeed, it is one of the biggest sources of market volatility, as we have written before. In this article, we will look at the best approach to trade breaking news continuation moves in stocks, commodities, and other assets.

Table of Contents

Why news matters

News is very essential in the financial market such that many advanced traders pay hundreds or thousands of dollars every month to have access to the latest information. The famous Bloomberg Terminal costs more than $20,000 per year while Reuters Eikon goes for more than $1,800 per month.

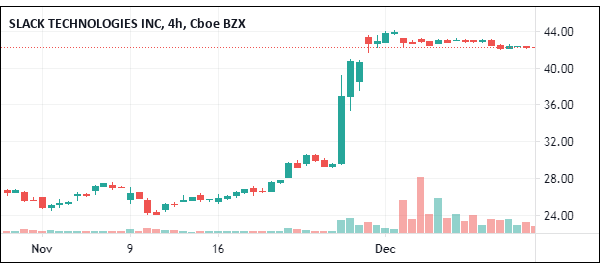

News are important because they affect the prices of assets directly. For example, in stocks, news about a company may have a major effect on its performance. In 2021, Salesforce announced that it had spent more than $27 billion to acquire Slack, the collaboration tool.

This news led to major market moves, with the share price of Slack rising by more than 15%.

Related » How do mergers and acquisitions work?

Also, in forex, the British pound rallied when the United Kingdom and the European Union reached a Brexit agreement. The deal prevented a situation where the two sides were to impose sanctions against one another in 2021.

In cryptocurrencies, XRP tumbled by more than 50% when the Securities and Exchange Commission (SEC) launched an investigation into Ripple. The agency alleged that Ripple ran security without its authorisation.

Hard to catch the first move

In an ideal situation, traders usually benefit a lot when they are able to catch the first move when the news comes out. However, in most cases, this is usually not possible. For one, most news tends to come out when the market is closed.

Indeed, many companies will release important information just after the market closes or before the open. As such, unless you have direct market access (DMA), it is often difficult to trade such moves in a normal account.

Also, most of these moves happen instantly because of the important role algorithms play. These days, a substantial amount of volume in the market is because of automated systems by firms like Citadel and Virtu Finance.

Still, it is possible to catch some of the news early and ride the trend. To do this, we recommend that you use quality online platforms that have access to quality breaking news. Most importantly, you should have access to Bloomberg, CNBC, and Fox Business, which are the most reputable financial television channels.

Related » Why you should avoid information overload

How to trade breaking news continuation

There are several steps you need to trade breaking news continuation moves.

Avoid the trap of pump and dump schemes

First, you need to verify the source of the information. This is important, because, in the past, many unscrupulous entities have pushed false information to pump and dump stocks.

For example, they will publish a news item that is later denied. Most times, you should do your best to verify the authenticity of these reports. Ideally, you should use legitimate news sources like Bloomberg, CNBC, Wall Street Journal, and Financial Times to do this. The pump and dump schemes often happen in small-cap stocks.

Watch out for volume

Next, you should go to your trading terminal and look at the volume. In a perfect situation, the volume of a financial asset tends to increase when there is genuine breaking news.

That’s because more people are attempting to get into the asset and ride the wave. You should be very careful if the event is not supported by volume.

Main outcomes

Ideally, there are three main outcomes after a piece of major news comes out.

- First, after the initial pop, the price of the financial asset could pullback as the market participants digest the news.

- Alternatively, the price of the asset could continue moving in the original direction. If it rose at first, the trend could continue going forward.

- Another option is where the price pops and then remains at the same level. This often happens after a merger and acquisition, as it happened with Slack.

The role of volume, technical analysis, and chart patterns

As mentioned above, the role of the volume is usually very important when trading news and their continuation patterns. If a major move is not backed by volume, it can be a warning that this move will not continue and vice versa.

In addition to the typical volume that is provided in your chart, you should take advantage of level 2 and time and sales if your broker provides them. At Real Trading, our traders have access to this information.

Level 2 shows you the bid and ask price trends while time and sales shows you the movement in volume.

Equally important is the role of technical analysis when you are trading breaking news continuation patterns. That’s because, in most periods, the price will often land on key support and resistance levels. Some of the technical tools you should use are Fibonacci retracement, Andrews Pitchfork, and Gann box, among others

Also, it is important to use candlestick patterns to identify potential breakouts. Some of the most popular patterns that can help you achieve this are:

- bullish pennant and flag

- triangle patterns

- bullish and bearish engulfing patterns

- hammer patterns

Useful strategies

Trend following strategy

Trend following is a trading strategy that involves buying and holding an asset that is already in an uptrend. Similarly, a trend follower can short an asset that is already falling.

Therefore, the best approach is to identify an asset that has formed a trend and then enter it in that direction. Some technical indicators like moving averages and Bollinger Bands can help you follow trends well.

For example, in the chart below, we see that Tesla stock formed a bullish trend between $169.79 and $264.09. In this period, it remains above the 25-day exponential moving average (EMA).

Therefore, a trend-follower would have bought the stock and exited when it retreated to the 25-day EMA.

The other approach of trend-following is identifying chart patterns. The most popular continuation chart patterns are bullish and bearish flag, bullish and bearish pennant, and ascending or descending triangles. In most periods, these patterns lead to continuations, which you can take advantage of.

Reversals

Another approach is to find reversals in the market. A reversal is defined as a period when a stock or any other asset moving in an upward or downward trend changes direction.

After this happens, the trader follows the trend to the end. In some cases, they can also identify the next reversal and follow the new trend.

There are several approaches to find reversals. First, you can use trend indicators like moving averages and Bollinger Bands. One of the best approaches is the Death Cross or Golden Cross.

A death cross is where the 50-day and 200-day moving averages make a crossover when they are pointing downwards. A golden cross is when the two crossovers are pointing upwards. In most cases, traders use short timeframes like 10 and 20 to find these reversals.

The other approach is to use chart and candlestick patterns like hammer, doji, double-top, rising and falling wedge, and head and shoulders.

Breakouts

The other strategy is to trade breakouts. A breakout is a situation where an asset moves out of a consolidation pattern. One of the top approaches to do this is to use pending orders.

For example, in the chart below, we see that Brent was trading in a tight range between $71.93 and $78.37. In this case, one would place a buy-stop at $79.70 and a sell-stop at $70.90.

Waiting for a pullback

The other approach for trading news is to wait for a pullback. In most periods, investors tend to overreact when there is a major news event. They buy the shares when a company has good news and vice versa. In most periods, the stock tends to retreat after that.

For example, as shown below, the Cassava Sciences stock jumped after publishing encouraging trial news. As such, a good approach would be to wait for the news to fade and then short the stock.

Final thoughts

Breaking news is essential in the financial market because of the amount of volatility they bring. Unfortunately, there is no well-defined strategy of trading such events because they are usually different.

Still, using the approaches and skills we mentioned above will help you make excellent trading decisions.