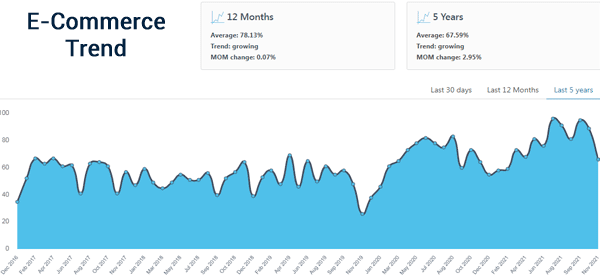

The way people shop has been changing in the past few decades. In the past few years, the proportion of people shopping online has jumped. This shift accelerated during the Covid-19 pandemic as more people were forced to stay and work from home.

Subsequently, this trend has led to the significant growth of many e-commerce companies. In this article, we will look at what identifies an e-commece stock, some popular examples and how to trade.

Table of Contents

E-commerce stock definition

An e-commerce stock is defined as that of a company that sells its products fully online. For example, a company like e-Bay is considered as an e-commerce firm.

At the same time, the term can also include companies like Amazon that offer a hybrid format of shopping. While most of Amazon’s business is through its website and apps, the company also has a substantial retail business.

Another way to look at e-commerce companies is to consider traditional retailers that generate a substantial amount of revenue in the internet. For example, while Walmart sells most of its goods in its retail stores, its fastest-growing business is digital.

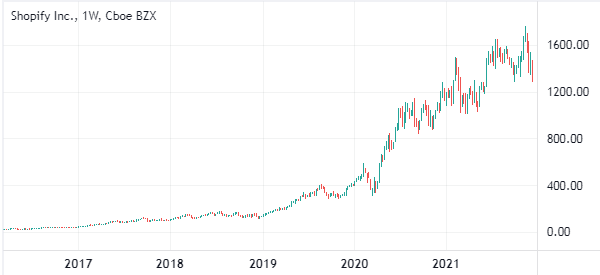

In addition to this, an e-commerce stock is also defined as a company that offers technology that enables people to launch and run their e-commerce firms. For example, companies like Shopify and BigCommerce enable thousands of companies to set up and run their shops.

In short, giving a simple definition is not really possible, given the different types of companies that can be grouped under the word ‘e-commerce’!

This type of company is one of those included in the broader group of tech stocks.

Examples of e-commerce stocks

In the previous section, we have looked at some of the best-known e-commerce stocks. In this section, we will take a deeper dive some of these stocks to invest in.

- Amazon – Amazon is the biggest e-commerce stock in the world with a valuation of more than $1.7 trillion. In addition to e-commerce, the firm makes a lot of money selling cloud products.

- Shopify – Shopify is a company that enables people to build and run their e-commerce shops. It has a market cap of more than $166 billion.

- BigCommerce – This is a relatively smaller company that offers similar services to Shopify. It is valued at more than $1.5 billion.

- Williams-Sonoma – While Williams is a big retail company, it generates more than 50% from its e-commerce store.

- E-Bay – E-Bay is a leading e-commerce firm that enables people to buy and sell their products online. It is valued at about $40 billion.

- Walmart – Walmart is one of the biggest retailers in the US. While it sells most of its products in its retail outlets, the firm’s fastest-growing segment is online.

- Jumia Technologies – Jumia is a leading e-commerce platform in Africa. It has a market cap of about $1.5 billion.

- ContextLogic – The company’s main product is Wish.com, one of the best-known e-commerce platforms in the world.

Other e-commerce stocks to consider are Chewy, Coupang, Alibaba, Wayfair, Etsy. Pinduoduo, Home Depot, Stitch-Fix, and Target, among others.

How to trade and analyze e-commerce stocks

For traders, e-commerce stocks are traded in the same way as other companies. As you possibly know, day traders are usually not concerned about a company’s fundamentals when they trade. Instead, they focus mostly on chart patterns since their trades are only open for a few minutes or hours every day.

Therefore, to trade these stocks, you need to do several things. First, look at how a stock is trading in the premarket session. You can get this data in various free platforms like Investing.com and Yahoo Finance.

Second, conduct a multi-timeframe analysis in a bid to see how the stock is trading. Use tools provided by your broker to draw the key support and resistance levels.

Third, identify chart patterns and incorporate technical analysis to predict the future direction of the stock. Some of the patterns to look are triangles, head and shoulders, and wedges. Also, you can look at candlestick patterns like doji, hammer, and harami.

Finally, open your trade and set up your stop-loss and take-profit. These stops will help to protect your trades when it gets active.

How to invest in e-commerce stocks

Trading and investing in e-commerce stocks are different. As a trader, you are only interested in the short-term movements of an asset. On the other hand, if you are an investor, your focus is on looking at the long-term. There are several things you need to look at when investing in e-commerce stocks.

- Growth – Look at the year-on-year revenue and profitability growth. In most cases, focus on companies that have substantial growth.

- Profitability – Take a closer look at a company’s profitability and how it is growing. You want to invest in a company that is either profitable or showing signs of profitability.

- Market share – Ideally, look for a company that is quickly growing its market share in its industry.

- Valuation – Always look at the company’s valuation because you want to invest in undervalued firms. However, at times, for growth stocks, looking at a valuation could see you avoiding really good companies.

Example

A good example on the last point is Shopify. This is a company that enables people to build and run their e-commerce shops. A quick look at its valuation shows that the firm is overvalued. For one, it has a market cap of more than $166 billion even though it generates less than $3 billion in revenue and just $319 million in profit.

While Shopify is highly overvalued, the company can justify this valuation by its growth and substantial market share in its industry. Despite its overvaluation, the stock has surged by more than 5000% as a public company.

Summary

E-commerce companies have done well in the past few years. The industry has done so well that some traditional retailers that pivoted to e-commerce are considering splitting their businesses in a bid to capitalize on the industry. A good example of this is Saks Fifth Avenue.

This growth, accelerated as mentioned by Covid-19, has sharply increased the already strong interest in these companies. Both in terms of investments and day trading. In fact both styles, with the right strategies, can generate profits.

External useful Resources

- Why E-Commerce Companies Don’t Pay Dividends – Dividend.com