Day trading is not for the faint hearted. It is a complicated process that produces more failures than success stories.

Studies estimate that more than 80% of people who start day trading often lose money in the process. The success rate is usually negligible, including among some of the most experienced traders.

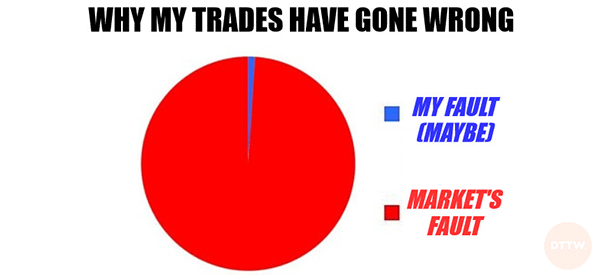

Therefore, in this article, we will explore this popular quote: your loss is not the market’s fault. We will also look at some of the ways to make you a better trader.

Table of Contents

Why traders lose money

Don’t worry about what the markets are going to do, worry about what you are going to do in response to the markets.

Michael Carr

There are many reasons why traders lose money in the market. Understanding these reasons will help you become a more efficient day trader and then know how to avoid losing money. Here are some of the top reasons why traders fail.

Lack of understanding of how the market works

The first main reason why traders lose money is that they simply don’t have a good understanding about how the market works.

In most situations, traders start their journeys by watching an ad about trading and then creating a trading account. When this happens, they execute trades and lose money simply because they didn’t have a good understanding of how the whole process works.

Overtrading

At times, overtrading can lead to strong profits. However, in most periods, there is usually a correlation between the number of trades and the losses a trader make.

Therefore, you should avoid making the mistake of implementing too much trades. Doing so will mostly lead to substantial losses.

Ignoring risk management

Another reason is that many traders tend to ignore basic risk management strategies when day trading.

There are several risk management strategies that you should always use, including having a stop-loss and placing trades of the right size. Trading without proper risk management strategies will often lead to more losses in the market.

There are other reasons why most day traders fail. Examples of these reasons are using the wrong trading strategy, using excessive leverage, and simply bad luck. Some highly experienced traders often lose money simply because of a losing streak.

Markets are unpredictable

The most predictable thing in the financial market is the fact that the market is usually unpredictable. While we have several techniques to analyse the market, the reality is that these approaches are usually not always accurate.

Therefore, since you cannot control this unpredictability, you can control how you deal with it. For example, you can control issues like avoiding overtrading, avoiding revenge-trading, and using a small leverage.

At the same time, you should always be open to change. This means that you should adapt to different market conditions, including ranging and highly volatile ones. When you do this, you will increase your possibility of making more money in the market.

Why you should take responsibility of your losses

It is important for you to take responsibility of your losses. By deflecting this responsibility, you will not be able to make money and address key issues in your trading.

There are several reasons why you should take responsibility, including:

- Taking responsibility will help you improve – When you take responsibility of your losses, you will be able to improve the trading process.

- It will help you identify the mistakes – Further, it will help you to identify mistakes that you make as a trader. By identifying these mistakes, you will be at a good position to improve yourself.

- Improves your performance – Taking responsibility will help you improve your performance in the market.

- Helps you validate your thoughts – Further, taking responsibility helps you validate your thoughts and trading strategies.

How to mitigate making significant losses

As we have noted above, losses in the market are inevitable. You will always make them. However, there are various ways of mitigating this challenge. Some of them are:

Have clear goals

Having a good goal will help you avoid making mistakes when trading. A goal is simply what you want to achieve in the market.

For example, if you want to make some extra money, you should focus on several trades per day. In this case, you will make less trades compared to those people who want to do it full-time.

Have a well-defined strategy

Having a good trading strategy will help you avoid making significant mistakes in the market. You should spend time coming up with a strategy and then testing it using a demo account.

Some of the most popular strategies you can use are scalping, algorithmic trading, copy trading, and swing trading among others.

Related » Recover a Blown account

Have a risk management strategy

Always have a risk management strategy that will help you avoid making significant losses. For example, you should have a strategy that involves having a stop-loss for all your trades.

Also, you should always position your trades well. Other risk management strategies are avoiding overnight trades and using a small amount of leverage.

Be disciplined and patient

Discpline and patience are important aspects that will help you avoid making big losses. A good example of patience is when you avoid opening a trade if conditions are not met.

For example, when trading using the VWAP, you can wait until you see the asset move above the indicator before you open a trade. As such, in certain periods, it is possible for you not to open a trade for a while.

Summary

In this article, we have looked at the concept of personal responsibility and why it matters in the market. The takeaway is that you should take responsible for your losses and then work towards improving the outcome of your future trades.

External useful resources

- Overcoming your inner critic: 4 tips for recovering from trading losses – Tradeciety