There are thousands of publicly-traded companies in the United States. All these companies are grouped in certain sectors like technology, consumer staples, and energy. A closer look at these firms shows that many of them tend to move in the same direction when some news emerges.

Well, this thing is called sympathy plays. In this article, we will cover this topic and how you can look at sympathy plays when trading stocks.

Table of Contents

What is a sympathy play in stocks?

A sympathy play emerges when the stock of a company is affected by news delivered by another company. For example, if a social media company like Twitter publishes strong results, there is a high possibility that Snap, its competitor will also publish strong results.

The logic is simple. If Twitter publishes strong earnings, it is a sign that the advertisement industry is doing well. As such, analysts and investors will start pricing in robust outcomes from other companies in the sector.

Similarly, if a semiconductor manufacturer like Advanced Micro Devices (AMD) publishes strong results, it is a sign that the CPU industry is doing well. This, in turn, pushes investors to start pricing in strong earnings by related companies like AMD and Taiwan Semiconductor, among others.

»Benefits of Trading Correlations«

How to find sympathy stocks

Sympathy plays also happen during a period of mergers and acquisitions. For example, in May 2021, AT&T decided to spin its Time Warner media business and merge it with Discovery Communications.

The announcement created a major media business with more than $150 billion in assets. The resulting company’s biggest shareholders were AT&T and Discovery.

In the aftermath of the deal, investors started looking ahead to other potential mergers and acquisition deals. The most logical view was that ViscomCBS would then merge with NBC Universal, the company owned by Comcast. As a result, their share prices rose after the deal.

In most cases, when a major M&A deal happens, many investors start to price in future deals as companies attempt to take market share through scale.

There are other situations where sympathy plays come out. For example, if a major hedge fund investor like Elliot Management invests in a company, its share price tends to rise since many investors start anticipating changes. Other companies in the sector tends to do well as they anticipate mergers and acquisitions.

Supply chain sympathy plays

In an article we pushed a while ago, we looked at how supply chains are important in the financial market. In it, we looked at how the process works and why investors look at companies based on their supply chains.

There are many examples of this. For example, we know that Apple’s biggest manufacturer is a Chinese company known as Foxconn. The company has the scale, technology, and capability to create millions of iPhones and iMacs every year. Therefore, if a company like Apple publishes strong quarterly hardware results, it is usually a sign that Foxconn did well since it is the biggest manufacturer.

Therefore, the stock tends to rise during this period. However, as Apple pivots more into services and as Foxconn expands its business, there is a possibility that this relationship will start to erode.

Another good example of this is Infineon, the German semiconductor company. The firm manufactures chips that are mostly used in the auto industry. It mostly sells these chips to German automakers like Daimler, BMW, and Volkswagen, among others.

According to its earnings report, the firm makes more than 40% of its income from the auto sector. Therefore, if the auto industry does well, it is usually a sign that demand for its chips rose. This, in turn, leads to a strong share performance, and vice versa.

Not only in stocks!

Sympathy plays do not happen only in stocks. Other sectors like currencies, cryptocurrencies and exchange-traded funds (ETFs) tend to be affected by these correlations.

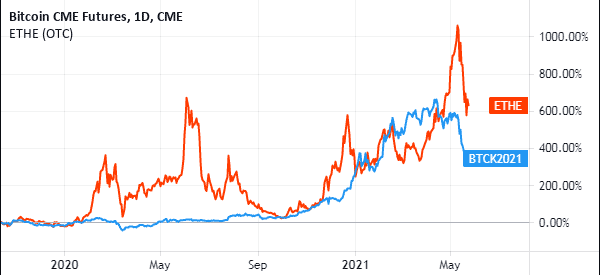

For example, in March 2020, the price of Bitcoin crashed as investors started to worry about the recession. As it did that, other cryptocurrency prices followed suit. This is simply because of the weight that the currency has in the digital currency industry. However, when the BTC price started to recover, other currencies also surged to an all-time high in May.

This increase was mostly because of Fear of Missing Out (FOMO) and the fact that interest rates were so low. In May, however, Bitcoin prices crashed and pushed all other cryptocurrencies lower.

Stock and indices

Meanwhile, there are sympathy plays between stocks and indices. For example, if Microsoft and Apple shares fall, there is usually a possibility that indices like S&P 500 and Dow Jones will also drop because of the weighting of these companies in the sector.

In the currencies market, if an emerging market currency like the Turkish lira rises, there is usually a possibility that other EM currencies like the South African rand and Mexican peso will rise too.

»The Best Currency Pairs to Trade«

Sympathy plays trading strategies

There are several strategies you need to follow when day trading sympathy plays. First, you need to know about the different relationships that exist between different companies and assets. For example, you need to know more about the volume of Apple’s and Foxconn’s trade. By having this knowledge, you will have a good opportunity to make money when these moves happen.

Second, you need to be aware of what is happening in the market. This simply means that you should have good sources of news about companies. Some of the best sources of this news is in platforms like CNBC and Bloomberg and social media platforms like Twitter and Reddit.

Finally, you can look at ETFs that are tied to certain companies. As mentioned, big companies like Microsoft and Apple tends to have a close relationship with ETFs like Invesco QQQ and even those linked to the S&P 500. You can trade this imbalance well.

Summary

Sympathy plays are common occurrences in the financial market. In this article, we have looked at what they are, how to use them, and some of the common sympathy plays in the market.

External Useful Resources

- Hot Sectors, Trends, and Sympathy Plays – Steady Trade