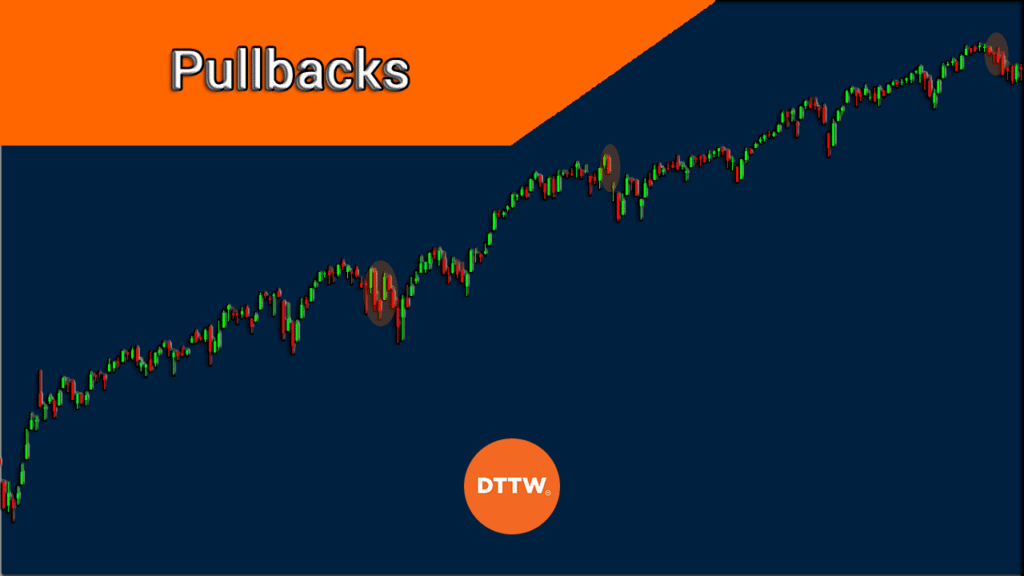

A market pullback is a situation where stocks in a bullish trend experience a sharp decline. The pullback can happen within a short period such as a day or go on for several months. Being very common situations within stocks (but also other assets), understanding how they work and how to generate profits from them is a very valuable point for day traders.

In this article, we will look at what market pullbacks are and some of the top strategies to trade them.

Table of Contents

What is a market pullback?

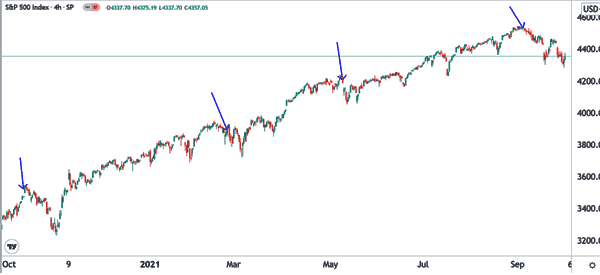

A stock market rally is a situation where equities are in a strong bullish trend. A good example is what happened after the stock market crash of 2020. The market dropped sharply after the World Health Organization (WHO) announced that Covid was a global pandemic. That initial decline was part of a market pullback.

After that, stocks staged a bullish rally, helped by the accommodative Federal Reserve and strong quarterly earnings. As the market rallied, several pullbacks happened, as shown below.

Types of a market pullback

There are three main types of a market pullback.

- First, there is the normal one that happened as part of a major stock market rally.

- Second, there is a market correction. A market correction happens when a stock market crashes by about 10% from its highest point.

- Finally, there is a bear market, which happens when a stock or the broad market declines by more than 20% from its highest point.

It is worth noting that a stock market pullback is mostly looked at in form of indices like the S&P 500 and Dow Jones. A stock one happens for a single stock like Peloton and Apple.

Causes of a market pullback

There are several reasons why a market pullback happens. Let us look at some of them:

- Profit-taking – At times, this will happen simply because investors are starting to take profits. This happens after a stock or index makes a major parabolic jump. When it happens, some investors tend to exit as they take profit.

- Earnings – A stock market could pull back after an important company like Apple or Goldman Sachs publishes weak quarterly results. Expectations of weak earnings growth could push many investors to sell their shares.

- Political event – Some major political events could lead to a major pullback. Some of these are the election of an unpopular president or a bill to hike taxes.

- Monetary policy – At times, a shift in tone by a central bank can lead to a pullback in the stock market. When there are signs that a central bank like the Federal Reserve will start to tighten, it increases the possibility that a pullback will happen.

- Technicals – At times, this situation can happen simply because a stock market index reached a key technical level.

How to find pullback in a stock

Finding stocks that are going through a pullback is a relatively easy process. First, we recommend that you start by looking at the overall price action of the major indices like the Dow Jones and S&P 500. If these indices are declining, it increases the possibility that several specific stocks will also be in the red.

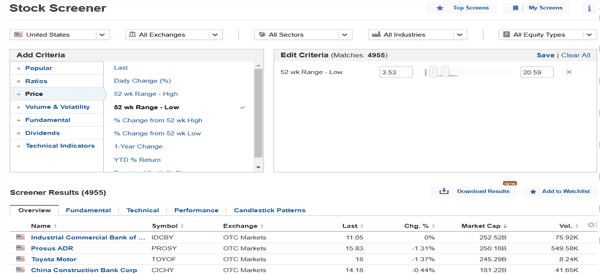

Second, another way is to use screeners that provide more details about the performance of stocks. For example, in the chart below, we have shown stocks that are hitting their 52-week lows. In most cases, a stock that is hitting its 52-week low is usually a sign that it is in a pullback.

Also, you could look at the top laggards in your watchlist to see the companies that are retreating. Using these screeners is a relatively easy process to find stocks in a pullback.

Pullback trading strategies

So, now that you know what a pullback is, how can you take advantage of it and make money? Let us look at some of the top trading strategies you can use in the market today.

Elliot wave pullbacks

Elliot Wave is a common approach in the financial market that was developed by Ralph Elliot. The theory states that a market moves in waves. An impulse wave is made up of five specific waves. The first bullish wave is followed by a small pullback. After this one, the next step is usually a long period of substantial gains followed by another pullback.

The third wave, which is usually bullish, is followed by a bearish wave. The final wave of an impulse Elliot wave is usually a bullish wave. Therefore, mastering how the Elliot Wave pattern forms can help you become an excellent trader of pullbacks.

Buying the dip

The next common approach to trading pullbacks is to buy the dip. The idea is to find when a pullback is happening and then timing your entry go back in. Some of the tools that can help you in this are Fibonacci retracement and Andrews Pitchfork.

Moving averages

There are many technical indicators that can help you trade pullbacks well. However, we believe that the moving averages provide the best features.

The idea is relatively simple. You just apply a moving average on a chart and then use it as a guide. If the stock moves below the moving average, it could be a sign that the pullback will be long-lived. As such, you could short the asset and continue holding the short trade as long as the price is below the moving average.

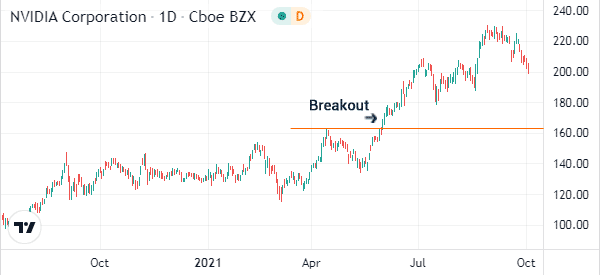

Pullback vs breakout

A pullback is relatively different from a breakout. A pullback is when a stock that is in a bullish trend suddenly turns lower. This can continue for a few days or a few weeks. A breakout, on the other hand, happens when a stock that has been in consolidation suddenly moves up or downwards. The chart below shows a stock that just made a breakout.

Summary

A stock market pullback is a common situation that happens several times in a month. In this article, we have looked at what a pullback is and some of the top strategies to trade it.

External Useful Resources

- A prolonged stock market pullback can pose a big risk early in retirement. Here’s what to know – CNBC