A shakeout is a popular situation that affects the market, one that can lead to substantial losses among inexperienced traders. It refers to a situation where a financial asset like a stock, cryptocurrency, forex pair, commodity, or bond suddenly retreats.

In some cases, these shakeouts happen without any fundamental reason. In this article, we will explain what a shakeout is, why it happens, and how to stay safe.

Table of Contents

What is a Shakeout?

A shakeout is a situation that happens often in a bull market or when an asset is in consolidation mode. It happens when the asset drops suddenly leading to a panic among inexperienced traders, who dump their holdings fearing that a new bearish trend is about to form.

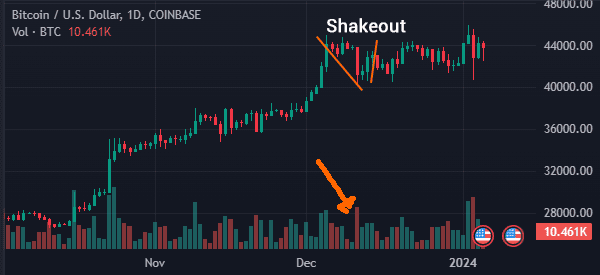

A shakeout is usually followed by a quick recovery of the asset. A good example of a shakeout is shown in the chart below.

We see that Bitcoin was in a strong bullish trend for a while. Then, the coin dropped from $44,000 to about $40,000 in a single session. It then staged a smooth recovery.

In some cases, shakeouts are usually good events for the health of the market since they get r

Technical and industrial shakeouts

There are two main types of shakeouts: technical and industrial shakeouts. A technical shakeout happens because of how chart patterns are arranged. For example, if an asset has had a strong parabolic bullish move, there is a possibility that its price will retreat at some point as traders take profit.

This is known as a technical shakeout. Some of the most common patterns of technical shakeouts are head and shoulders, wedges, and symmetrical triangles.

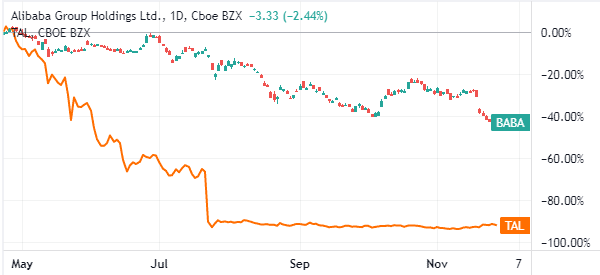

An industrial shakeout is when the sell-off is spread across a sector or a geographical location. For example, the chart below shows that a shakeout happened in Chinese stocks like Alibaba and TAL Education in 2021.

When they happen?

A shakeout happens when most investors push a stock or asset lower sharply. This is usually because of several factors. For example, a company may be going through internal challenges. Also, a previous strong stock can have a shakeout as many traders take a profit.

Chipotle makes a good example because of Bill Ackman, one of the best-known hedge fund managers. As the stock declined, he continued to invest in the company.

And as a result, he has doubled his returns in the new money in the past few months.

If you want to avoid shakeouts, we suggest to watch this video from our partners.

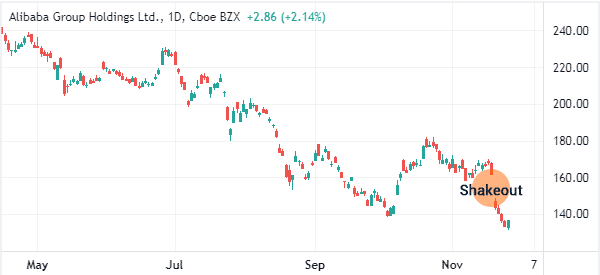

Alibaba is another good example of a shakeout. As shown below, the stock collapsed in 2021 as China intensified its crackdown on the tech sector. This drop can be viewed as a shakeout.

Key traits of shakeouts

Shakeouts are not always the same. However, a closer look at some of the top shakeouts shows that they have several similarities.

- Volume – One common characteristic of a shakeout is that it has a high volume. This volume tends to come from many inexperienced traders who rush to sell their holdings fearing more downside. You can see the high red volume in the chart below.

- A significant move – A shakeout is characterized by a substantial price movement. In most cases, the difference between the close and open should be the biggest within a certain period.

- Dip is short-lived – A shakeout is similar to a flash crash. In this case, the sharp decline should be short-lived. In some cases, it can take a few days before the price moves back to the original high.

Bullish and bearish shakeouts

The most common description of a shakeout is the one we have described above. This is where a stock crashes and then bounces back within a day or so. As such, since this type of shakeout is usually positive, it can be described as a bullish shakeout.

In some cases, a shakeout can also happen when an asset is in a downtrend. This is where a declining stock suddenly goes parabolic.

When this happens, it usually attracts bulls who believe that the price has bottomed.

How to trade shakeouts

There are several ways you can use to trade shakeouts in the market.

Shakeout Strategy #1 – Buy the Dip

A relatively common strategy is to buy the dips, which happen after a financial asset generates a major rally.

A dip happens when an asset in a major rally starts to decline. As they drop, most retail traders start fearing and sell them. As they sell, it reaches a point where the smart money starts to buy them back.

A good example of this happened recently, when traders started to sell Facebook shares because of an ad boycott. As the stock dropped, many retail traders who were afraid of the situation sold their Facebook shares.

As they did this, the smart money, which figured out that the boycott would have minor impacts on Facebook shares started to buy. As we write this, Facebook stock is trading near its all-time highs.

Shakeout Strategy #2 – Earnings

A shake out may also happen after a company releases its earnings. If a firm releases weak quarterly earnings, the stock price may drop as traders react to this.

As it starts to drop, many inexperienced traders will sell the stock. And as they do it, the big money will be scooping it in the cheap.

Related » How to trade During the Earning Season?

Shakeout Strategy #3 – Fibonacci Retracement

Another strategy to trade shakeouts is using the Fibonacci retracement. This is a tool that you draw by connecting the lowest and highest points of an asset.

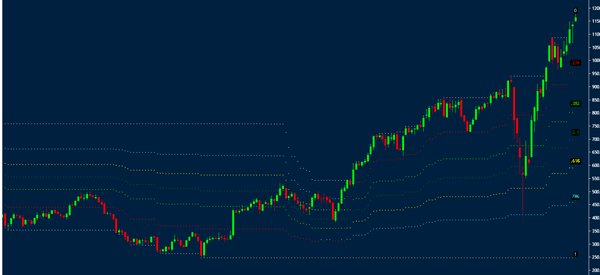

In the chart below, we have drawn the Fibonacci retracement tool in the Chipotle stock. As the stock dropped, it moved below the 23.6% retracement, then below the 38.2%, 50%, 61.8%, and 78.6% retracements.

Therefore, your goal is to identify a strong entry point based on these retracements.

Shakeout Strategy #4 – Trailing Stops

Finally, another strategy to trade shakeouts is to use trailing stops. These are stops, similar to other popular stop losses, with the main difference being that they move up with the price.

As a result, even with a pull back, you will still retain the profits you made earlier on.

Final thoughts

A shakeout is a strategy that happens regularly. The main foundation of the strategy is that not all pullbacks are usually bad. Instead, these pullbacks create a good entry point for traders and investors.

We recommend that you always take time to study the reasons why the price of an asset has dropped and its long-term implications.

External useful Resources

- How To Invest In Top Stocks: What Is A Stock Shakeout? – Investors.com