Sell the Rip is a relatively common concept in day trading. It is the opposite of buying the dip, another popular strategy.

In this article, we will explain why dips happen and when to sell the rip or buy the dip.

Table of Contents

Definition

A dip in the financial market refers to a period when a stock, commodity, cryptocurrency or any other asset declines sharply. It can refer to a period where it declines sharply in a single day or when it declines within a long period of time.

When the asset declines that much, traders have three options:

- They can decide to come back in and buy the asset. This is known as buying the dip.

- They can decide to short the asset and benefit as its price declines. This is known as selling the rip.

- Finally, they can understand the risks involved in buying the dip or selling the rip and stay away from the asset.

Therefore, sell the rip is defined as a period when a trader or investor decides to short an asset that has declined sharply.

For starters, shorting is a concept where you borrow shares, convert them into cash, and then sell them back when the price falls. Most brokers have it as a simple option, where you can sell the rip instantly without going through that process.

Causes of dips

There are several key causes of dips in the market. First, a stock could decline sharply if a company publishes weak quarterly results.

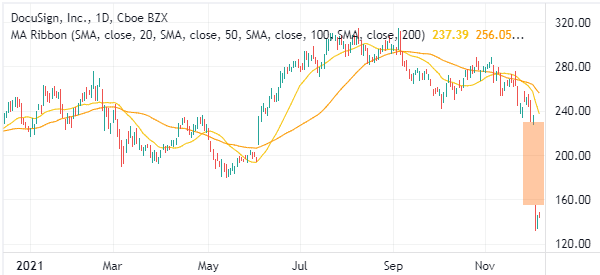

A good example is shown in the DocuSign stock below. The stock declined by more than 40% in a single session in December 2021. This happened even though the company’s results were better than expected. However, the stock crashed because the company’s guidance was relatively weak.

Fed Decision

Second, a dip can happen because of a major policy change by the Federal Reserve. For example, the Dow Jones has declined several times when the Fed turns hawkish.

A good example of this is the so-called taper tantrum. In it, the index declined sharply when the Fed started ending its quantitative easing program.

Geopolitical issues

Third, a major geopolitical issue can lead to a dip in an asset. For example, stocks used to decline sharply when Trump started his trade war with China.

Regulatory change

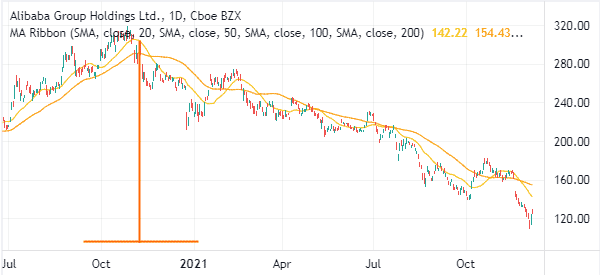

Fourth, a dip can happen because of regulatory changes. A good example of this is when the Alibaba share price declined sharply as China intensified its crackdown on technology companies. The stock tumbled by more than 65% from its highest level in 2020.

In addition, a dip can happen when there is a major news event surrounding a company or an asset. For example, it is not uncommon for the price of crude oil to decline sharply after OPEC meets.

Sell the rip vs buy the dip

As mentioned above, selling the rip refers to a situation where you short an asset that has already crashed. You do this if you believe that the price will continue dropping in your predicted period.

For example, in the example above, a seller can short the DocuSign stock if they believe that it will continue dropping in the foreseeable future.

Buying the dip, on the other hand, is when you believe that the dip is temporary. In this case, you can decide to buy a stock that has fallen sharply with the expectation that the price will bounce back. If it works out, buying the dip can be a highly profitable situation.

How to sell the rip

First, you need to know about the concept known as short sale restriction (SSR). This is a regulatory situation that happened after the dot com bubble. It simply restricts traders from shorting a stock that has dropped by 10% within a single session. This rule was implemented to prevent traders from pushing a stock sharply lower.

Second, in most cases, you will miss an immediate dip since it happens within microseconds. Therefore, the question is on whether to buy or sell the rip.

Third, you need to understand the cause of a dip. In most cases, the causes of a dip are those mentioned above. When you understand the cause of a dip, you will be at a good position to understand what to expect in the future. This is important since some dips are short-lived while others take time.

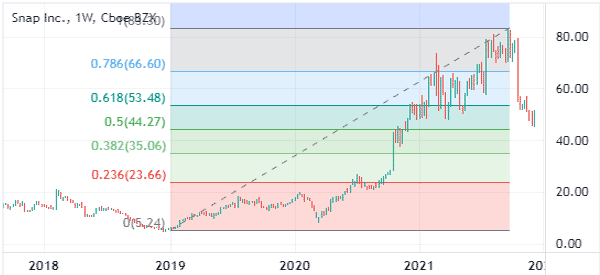

You should use some tools to know whether to buy the dip or sell the rip. We prefer using the Fibonacci retracement. For example, in the chart below, we see that the SNAP share price declined sharply after earnings. On the weekly chart, the stock tumbled close to the 38.2% Fibonacci retracement level.

Therefore, in this case, you could sell the rip and add a take-profit at the 50% retracement level.

Risks for selling the rip

There are several important risks that emerge when you decide to sell the rip. In our experience, investors tend to overreact when something happens. For example, in 2021, major stock indices declined when Jerome Powell hinted that the bank will accelerate tapering.

This was an overreaction since economic data then showed that the bank would accelerate. Shortly after the dip happened, stocks bounced back.

The other risk for selling the rip is a short squeeze. A short squeeze is a period when a stock price makes a parabolic rally. This, in turn, leads to significant losses for short-sellers. This means that selling the rip is riskier than buying the dip.

Final thoughts: Should you sell the rip or not?

Selling the rip is a common strategy when significant sell-offs happen. As you could see, this can be caused by more than one factor, and each of them must be carefully evaluated.

This is because the trigger has a great influence on the strategies to be adopted and the risks that sell the rip carries, a bit like all short selling tactics.

External Useful Resources

- You bought the dip. But should you sell the rip? – Chainex