Until the development of global positioning systems in the 1970s, navigating the earth required a highly technical skillset. Throughout history, humans have made long, dangerous journeys with nothing more than a raft and the stars above.

Even today, with all our technology, adventurers still rely heavily on manual navigation tools and skills to help them explore and make it home safely.

While short-term traders don’t brave uncharted seas or rough terrains, they still face complex risks and unpredictable markets. They may not worry about getting marooned, but they worry about being trampled by bulls or eaten by bears (markets).

That’s why risk management in trading is indispensable.

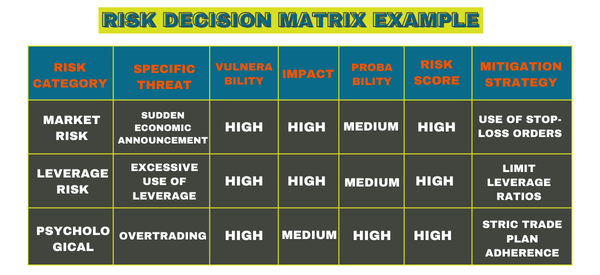

To that end, a risk decision matrix is one of the most useful tools that you can build. It’s a simple system with powerful implications for assessing risk and navigating today’s unpredictable market.

In this article, we’ll show you how to build a risk decision matrix and what each component means for your short-term trading strategy.

What Is a Risk Decision Matrix?

In its simplest form, a decision matrix is just two scales forming an intersecting axis, like a graph, but usually using qualitative and quantitative information. For example, you could create a decision matrix for growing and eating chili peppers.

On one axis, you might plot several pepper characteristics, including the Scoville Heat Units, flavor profile, and size.

Something like this:

| Chili Pepper Decision Matrix | Pimiento | Jalapeno | Thai | Habanero | Ghost |

|---|---|---|---|---|---|

| Scoville Heat Units | 100-500 | 2500-8000 | 50k-100k | 100k-350k | 855k-1,040k |

| Flavor profile | Sweet, mild | Vegetal, spicy | Sweet, citrusy | Fruity, sweet | Earthy, smokey |

| Available locally | No | Yes | No | Yes | No |

| Outdoor growing temp | 60-95 °F | 60-85 °F | 70-85 °F | 55-80 °F | 75-90 °F |

| Size | Small | Medium | Very small | Very small | Small |

This chart allows you to quickly cross-reference multiple criteria across similar categories. For example, maybe you want to make a recipe using Thai chiles, but they’re not available to purchase locally. So, you check if they’re compatible with growing in your climate.

Let’s move away from chilis to examine short-term trading risk. For any given asset, there are a range of risk factors:

- market

- leverage

- psychology

- interest rate

- politics

- industry

- climate

- legal risks

The amount of risk and probability of a negative outcome also vary widely.

In short-term trading, you can use a risk decision matrix to quickly see how each risk factor might affect the price direction of the asset you’re considering. With this information, you can plan your trading strategy based on a few likely scenarios.

The above is just an example. We have also created a Google Sheet version of the matrix that you can use at your leisure (create a copy, first).

The Value of a Risk Decision Matrix

Every trader’s psychology exists on a spectrum of optimism and pessimism, as well as risk tolerance (high to low).

A decision matrix keeps you—and each individual trader—in touch with reality and helps you design a strategy that works for your way of trading. In this sense, there’s no perfect version of a risk matrix.

However, keep in mind that a risk decision matrix is a tool, meaning that its efficacy is based entirely on how you use it.

The goal is to represent reality using your best estimate. If two traders build a risk matrix for the same asset, the varying results will reflect their unique trading styles—a combination of their mindset and how they value an asset’s risks.

Ultimately, a risk decision matrix gives short-term traders the ability to learn about themselves and the assets they trade over time. This knowledge allows them to build and execute detailed risk management in trading, which translates into more consistent trading performance.

As you get better at building risk decision matrices, you’ll also get better at pivoting when chaos strikes. You’re not trying to predict the future, but to mentally rehearse the best response to likely scenarios.

10 Steps to Building a Risk Decision Matrix

Because a risk decision matrix is a highly customizable—and personal—tool, there are an infinite number of ways that you could build it. The goal is to separate noise from signal.

Risk varies widely by asset, so you want to identify the most relevant factors and focus on improving the accuracy of your assessment in those areas.

1. Define Risk Categories

Generally speaking, risk is the level of uncertainty in a given investment decision and the amount of money you stand to lose if it goes poorly. Specific risks include:

- Volatility

- Liquidity

- Leverage

- Personal

- Market

- Climate

You’ll discover other risk categories as you study individual assets and markets. Add them to your notes and practice assessing and mitigating them.

2. Identify Unique Threats

Within each category of risk there are unique threats and probability of them happening. Below we’ve listed some of the most common unique threats for each category.

- Volatility: usually measured on a scale from high to low. While some assets have a tendency to be more volatile than others, by definition, volatility is a moving target and not a static value.

- Liquidity: a measure of how easy it is to buy or sell an asset. Low liquidity makes it difficult to sell an asset at any given price.

- Leverage: one of the few risk factors that traders have full control over. Some traders avoid leverage completely, while others use it to magnify their gains.

- Personal: this includes confidence, reputation, resilience to loss, win-loss ratio, and profit goals, all of which figure into your personal risk calculation.

- Market: earnings reports, economic news, geopolitical changes, regulatory announcements, mergers, acquisitions, and litigation—all variables that influence the movement of any asset.

- Climate: seasonal weather, storms, droughts, and regional weather changes can significantly affect prices, especially for commodities and export/import industries.

Make sure to write all of these down, and carefully feed them into your personal risk decision matrix.

3. Assess Vulnerabilities

For each risk factor that you include, you should rate your exposure to it—i.e., how vulnerable you are to those risks.

The simplest way is to decide on a numerical scale, such as 1-5 or 1-10, going from low to high.

Another way to measure exposure is by determining the percentage a given trade represents as part of your portfolio. However, this is usually a separate category since it applies to your position with an asset, not a unique risk factor.

4. Evaluate the Impact

Rate the level of impact that each risk factor would have on your trading position if it were to happen. This can be expressed as a percentage of price and direction of movement, as well as the impact it might have on your psychological state.

5. Probability Assessment

This is one of the most important factors to study and refine your measuring ability.

Usually expressed as a percentage, you can also use a scale from low to high. Probability can be measured as a precise statistical function, but many short-term traders use more approximate values for the sake of time and simplicity.

6. Create the Matrix

We recommend that you start by listing the threats on the vertical axis as row headings and the following categories as column headings:

- Vulnerability: how susceptible you are to the threat.

- Impact: the potential consequence of the threat.

- Probability: the likelihood the threat will happen.

- Risk score: a combination of impact and probability. For example, high impact + high probability = highest risk score.

While you should always keep your risk decision matrix in print (either by hand or digitally), you can modify it as you evolve as a short-term trader.

7. Develop Mitigation Strategies

For any threats that achieve a medium to high-risk score, define the actions you can take to mitigate a negative outcome. Incorporate strategies such as:

- Stop-loss orders: automatically sell or buy an asset when it reaches a certain price that you determine.

- Reducing leverage (if applicable): determine a lower ratio for the amount of funds that you borrow from a broker.

- Diversification: trade in more assets at a time, from different asset classes. It’s one of many types of hedging.

- Reducing the size of your position: sell and keep a lower stake in an asset, so you have less to lose.

All of these details should be a part of your risk management strategy.

8. Implement and Record Results

A risk decision matrix won’t do you much good if you don’t adhere to it.

Lay out your plan and then follow it as closely as possible. Then, write down what happened in your trading journal. Your notes and performance data will be invaluable for improving both your risk decision matrix and risk management strategy.

As you grow and learn, you’ll become better at short-term trading.

9. Review and Analyze Efficacy

Depending on your trading frequency and success rate, you may need to evaluate your decision matrix on a daily basis. As your competence and comfort level increases, you may increase the cadence to weekly or monthly.

If you’re trading as part of a team, this review process should happen with the group so that you can learn from other traders and refine your risk decision matrices together.

10. Update the Matrix

Expert traders may not build a new risk matrix for every trade, but that’s because they’ve internalized the guiding principles and measurements the matrix provides.

New traders need to review and refine their risk decision matrices more frequently.

You may discover that some factors aren’t as relevant as others or that certain calculations are too time-consuming for the benefit they offer. Talk with other traders about their approach to risk management and learn from their mistakes whenever possible.

Trade Better With a Risk Decision Matrix

If you meet a trader who insists they don’t need guides or matrices—they’re intuitive and skilled enough to trade on feel alone—don’t buy it. Risk is an inescapable part of short-term trading, and smart traders use every advantage they can to manage it.

Even the best traders expect to lose more than 40% of their trades, and still make a great living. The goal of a risk decision matrix is to minimize losses and create a framework to plan successful trades.

Whether you’re an experienced trader or just getting started, if you’ve never built a risk decision matrix, now is the best time to start.

This is just one of the tools that you need to become a successful trader. There are many more of them, and we provide all of them at Real Trading—join today, and begin your short-term.